Undiscovered European Gems for December 2025

As the European markets navigate a landscape marked by mixed performance in major indices and cautious economic outlooks, investors are keenly observing the potential impacts of interest rate shifts and economic resilience. In this context, identifying promising small-cap stocks that demonstrate strong fundamentals and adaptability to changing conditions can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

IDI (ENXTPA:IDIP)

Simply Wall St Value Rating: ★★★★★★

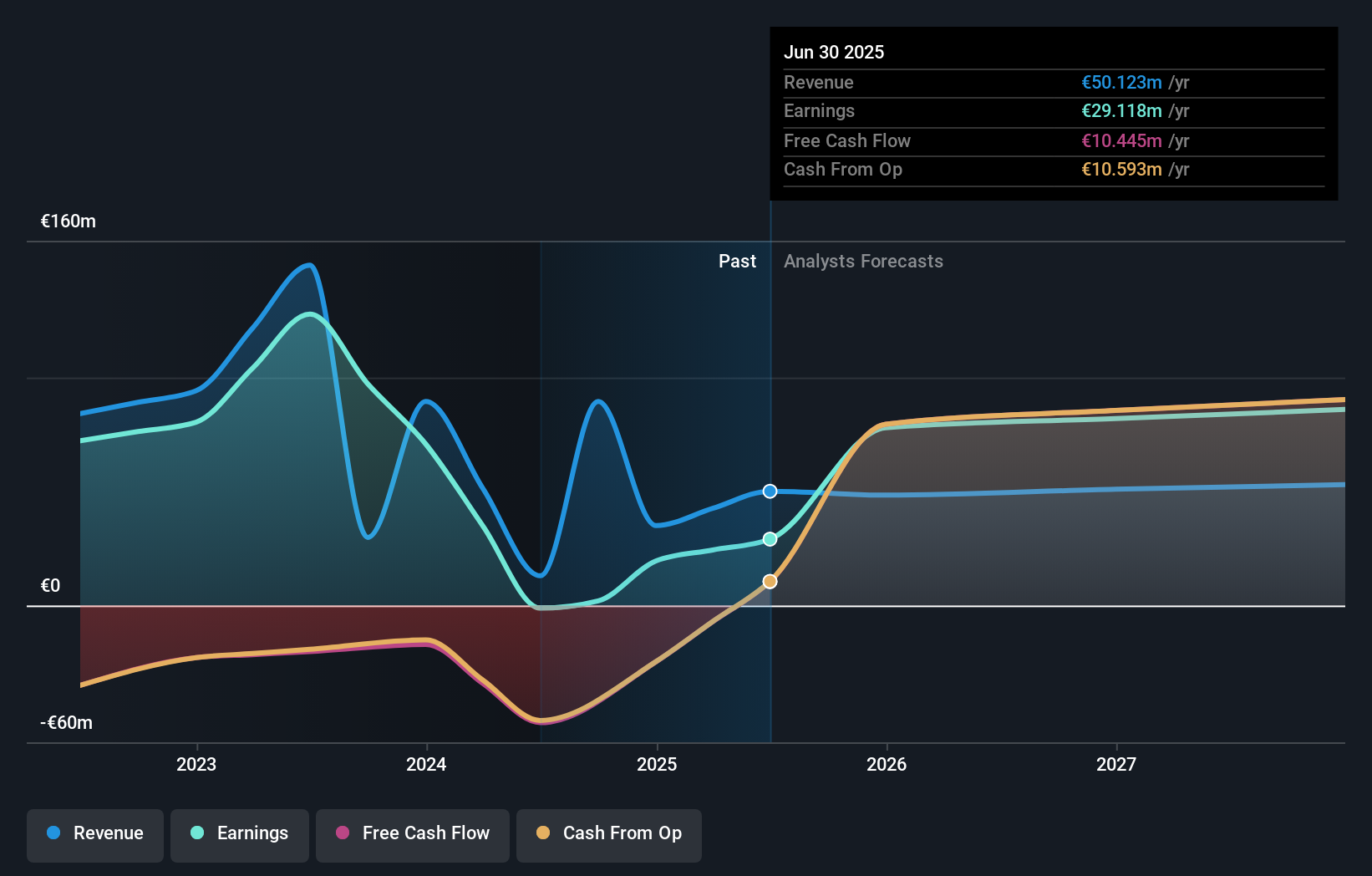

Overview: IDI is a private equity firm that focuses on leveraged buyouts, expansion and growth capital, acquisitions of significant holdings in listed small and medium companies, mezzanine financing, and other investment strategies with a market cap of €496.55 million.

Operations: IDI generates revenue primarily through its private equity investments, focusing on leveraged buyouts and growth capital. The firm's strategic financial activities include acquisitions of significant holdings in listed small and medium companies and mezzanine financing.

IDI, a smaller player in the European market, has shown notable financial improvements. Its debt to equity ratio impressively decreased from 27.3% to 7.1% over five years, reflecting stronger financial health. With interest payments well covered by EBIT at 17.1 times, IDI's earnings quality stands out as high. The company recently reported a net income of €15 million for the first half of 2025, up from €5 million the previous year, showcasing significant growth potential with earnings forecasted to grow annually by about 26%. Trading at nearly half its estimated fair value suggests room for upward movement in valuation.

- Navigate through the intricacies of IDI with our comprehensive health report here.

Evaluate IDI's historical performance by accessing our past performance report.

Arendals Fossekompani (OB:AFK)

Simply Wall St Value Rating: ★★★★★★

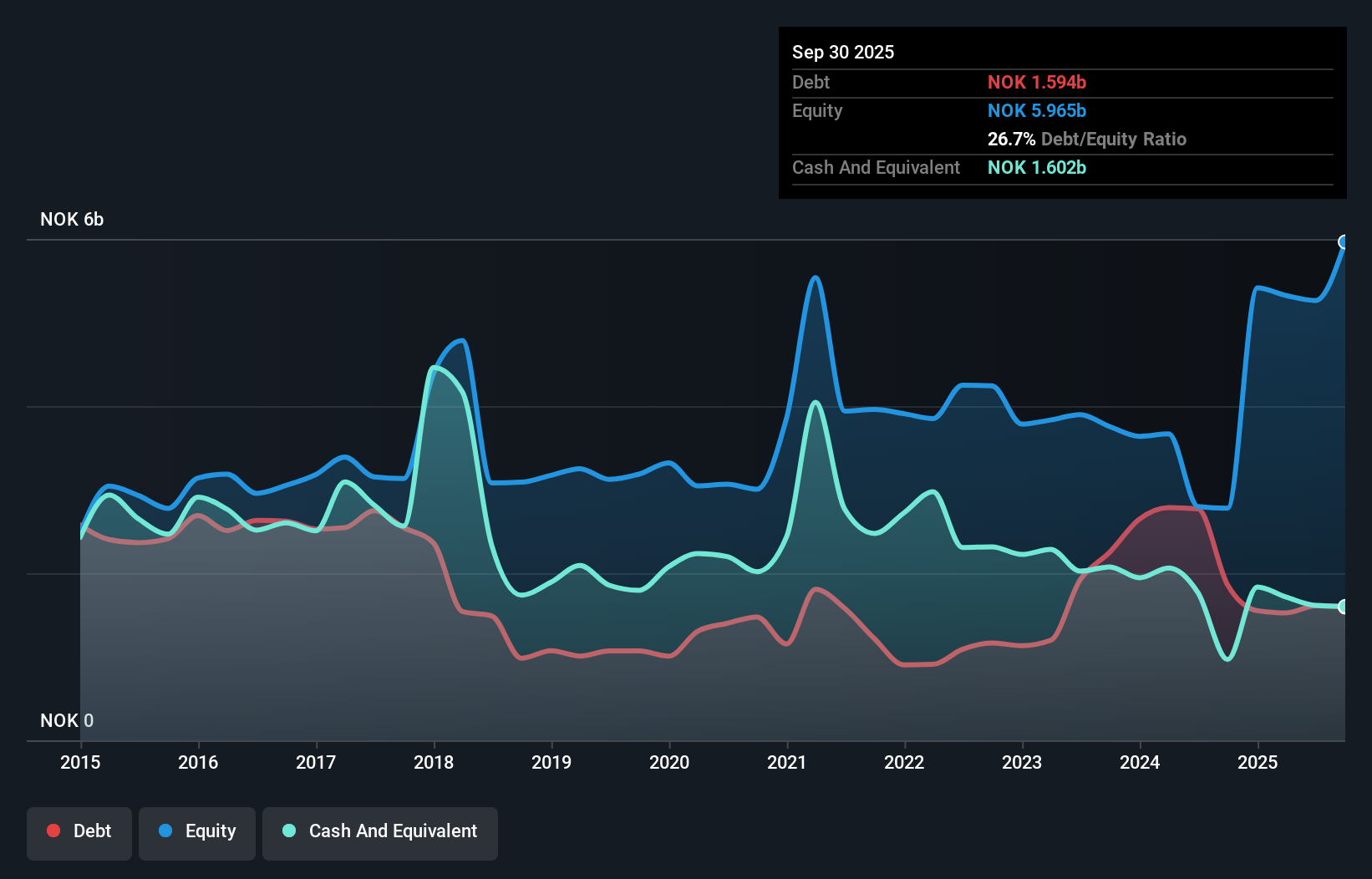

Overview: Arendals Fossekompani ASA is an industrial investment company that offers cyber secure satellite and mobile communications across Norway, Europe, Asia, and North America, with a market capitalization of NOK7.45 billion.

Operations: The primary revenue streams for Arendals Fossekompani ASA include ENRX with NOK1.78 billion and NSSL Global contributing NOK1.34 billion. Tekna and AFK Vannkraft add NOK269.35 million and NOK321 million, respectively, to the total revenue.

Arendals Fossekompani, a notable player in the Industrials sector, showcases promising financial health with a price-to-earnings ratio of 17.7x, undercutting the industry average of 20.5x. Over five years, its debt to equity ratio impressively dropped from 49.1% to 26.7%, indicating prudent financial management. Recent earnings growth at 26% outpaces the industry's modest 4.6%. Despite a dip in third-quarter sales to NOK 853 million from NOK 911 million last year, net income soared to NOK 734 million from just NOK 1 million previously, reflecting strong operational efficiency and high-quality earnings performance amidst challenges.

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

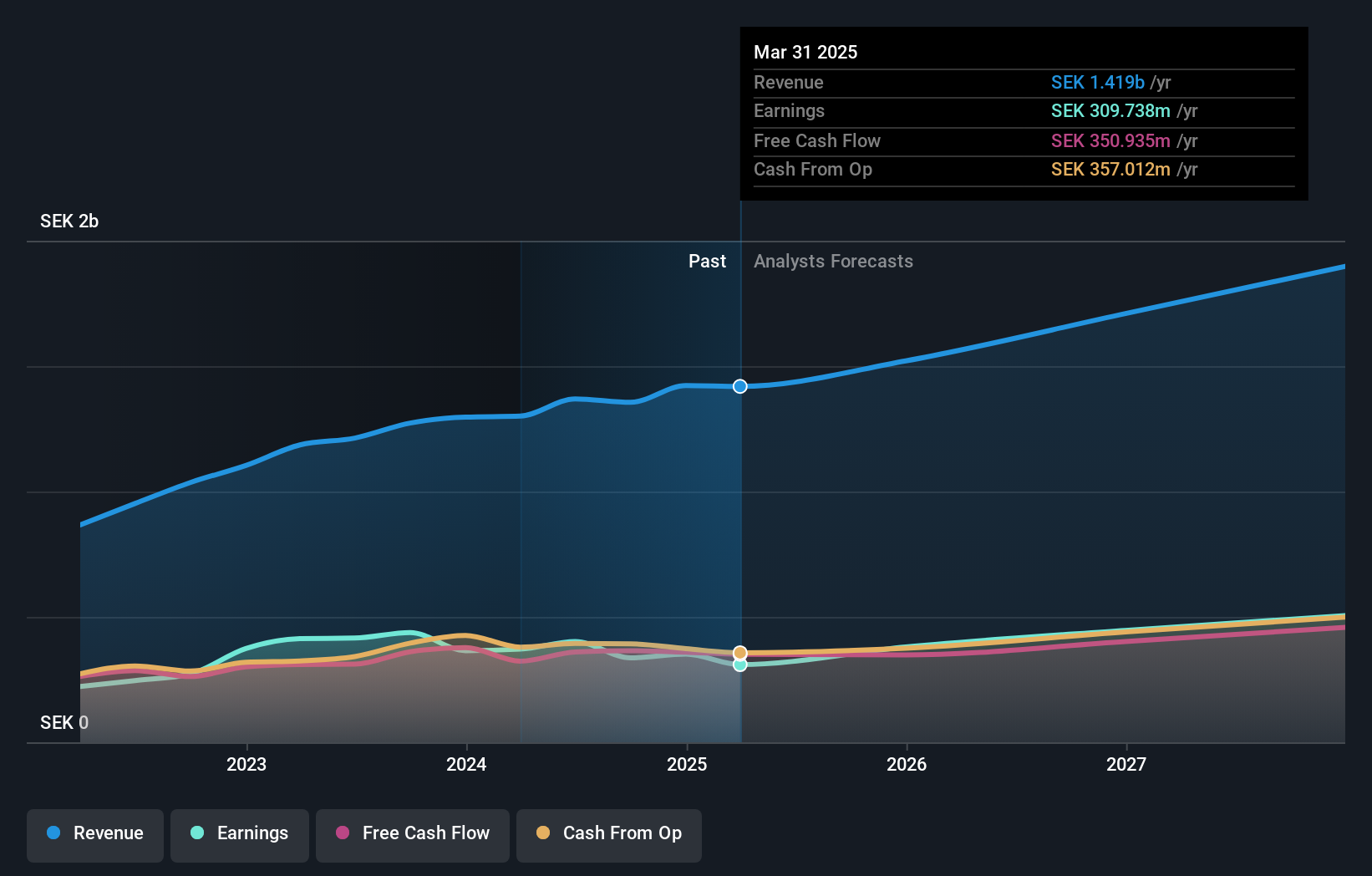

Overview: BioGaia AB (publ) is a healthcare company that focuses on developing, manufacturing, marketing, and selling probiotic products for gut, oral, and immune health across various global regions with a market capitalization of approximately SEK10.22 billion.

Operations: BioGaia generates revenue primarily through its Pediatrics segment, contributing SEK1.09 billion, followed by Adult Health at SEK357.59 million. The company's financial performance is characterized by a focus on these key segments within the probiotic market across diverse global regions.

BioGaia, a nimble player in the biotech space, recently reported third-quarter sales of SEK 326.64 million, up from SEK 303.97 million last year, while net income rose to SEK 65.88 million from SEK 36.6 million. Despite a challenging past year with earnings shrinking by 6.2%, BioGaia remains debt-free and boasts high-quality earnings alongside positive free cash flow of approximately US$365 million as of September 2025. The company's innovative strides include identifying gut bacteria that produce serotonin and launching microbiome-friendly dental probiotics, positioning it well for future growth with an expected annual earnings increase of nearly 22%.

- Click here and access our complete health analysis report to understand the dynamics of BioGaia.

Gain insights into BioGaia's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 306 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报