Top Asian Dividend Stocks To Consider In December 2025

As global markets navigate a complex landscape marked by interest rate adjustments and economic uncertainties, Asian markets have shown resilience with mixed performances across key indices. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.82% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| NCD (TSE:4783) | 4.10% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.78% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.29% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Click here to see the full list of 1056 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

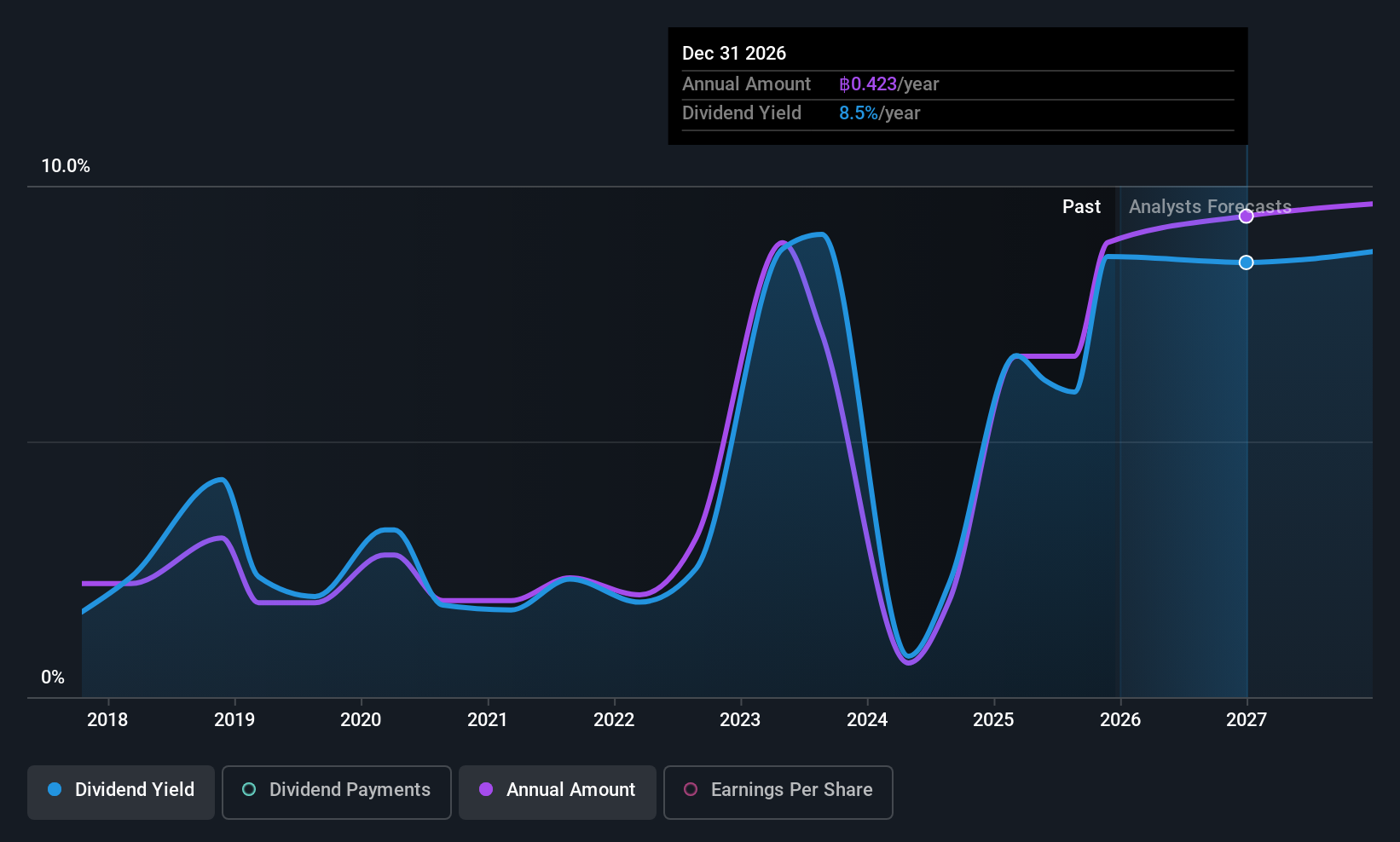

Thaifoods Group (SET:TFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thaifoods Group Public Company Limited, with a market cap of ฿28.07 billion, operates in Thailand through the production and distribution of chicken and swine products.

Operations: Thaifoods Group's revenue segments include Swine at ฿31.53 billion, Retail at ฿26.50 billion, Poultry at ฿46.32 billion, and Feed Mill at ฿30.26 billion.

Dividend Yield: 8.3%

Thaifoods Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 50.7% and cash payout ratio of 20.7%. Despite offering a high yield in the Thai market, its dividends have been volatile over eight years. Recent earnings show growth, with Q3 revenue at THB 18.38 billion and net income at THB 1.70 billion, yet future earnings are expected to decline by an average of 13% annually over three years.

- Unlock comprehensive insights into our analysis of Thaifoods Group stock in this dividend report.

- The valuation report we've compiled suggests that Thaifoods Group's current price could be quite moderate.

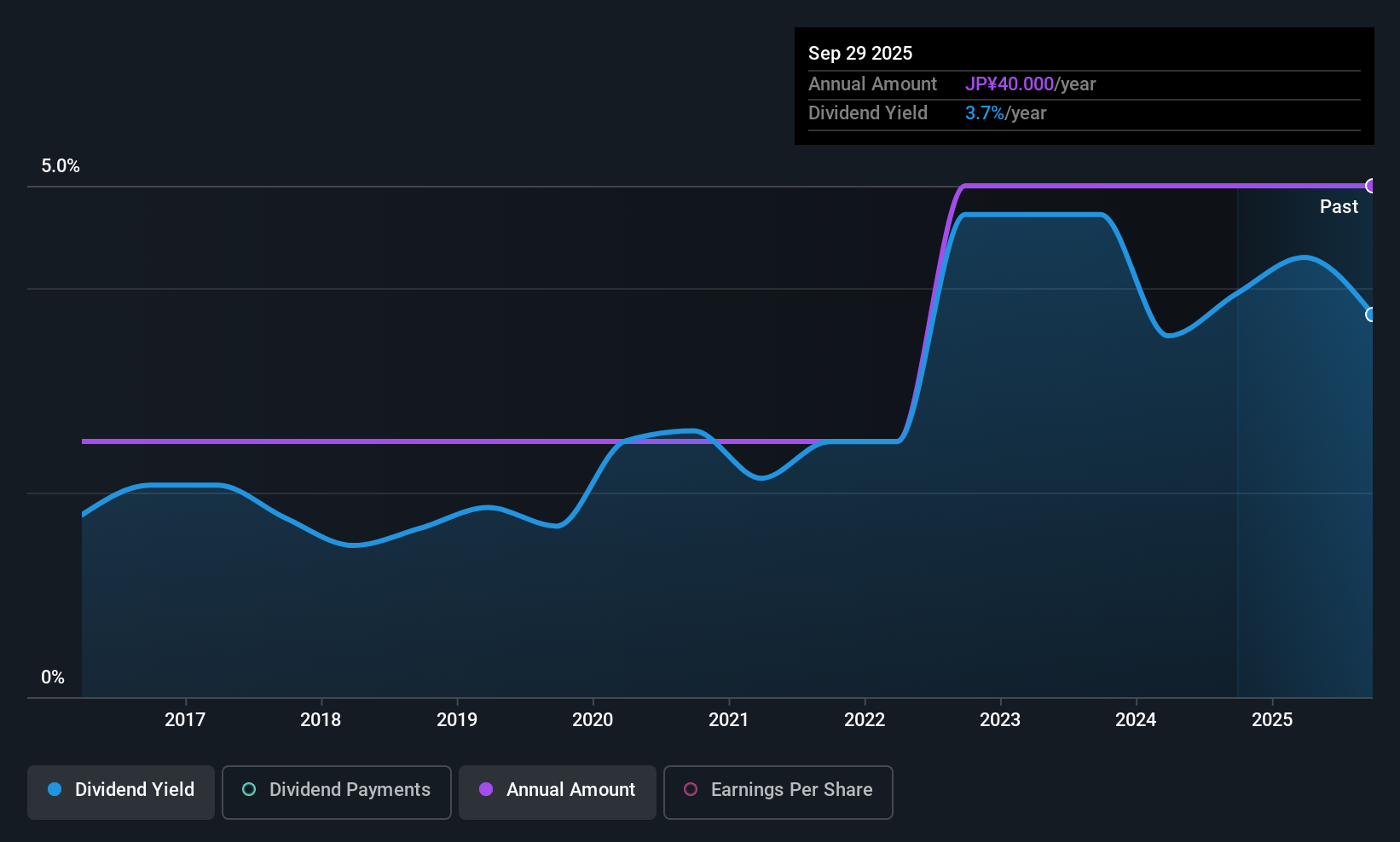

TOA (TSE:6809)

Simply Wall St Dividend Rating: ★★★★★★

Overview: TOA Corporation manufactures and sells broadcasting, communications, and transmission equipment in Japan with a market cap of ¥49.51 billion.

Operations: TOA Corporation generates revenue from various regions, including ¥34.81 billion in Japan, ¥2.78 billion in the U.S.A., ¥10.13 billion in Asia-Pacific, ¥2.01 billion in China & East Asia, and ¥7.01 billion in Europe/Middle East/Africa.

Dividend Yield: 5.5%

TOA Corporation's dividends are well-supported by earnings and cash flows, with payout ratios of 59% and 66%, respectively. The dividend yield of 5.47% ranks it among the top in Japan, enhanced by a decade of stable and increasing payouts. Despite recent share price volatility, TOA is trading below its estimated fair value. Recent board meetings focused on enhancing shareholder returns through policy adjustments and dividend increases, reflecting a commitment to financial soundness and long-term value maximization.

- Delve into the full analysis dividend report here for a deeper understanding of TOA.

- Our comprehensive valuation report raises the possibility that TOA is priced higher than what may be justified by its financials.

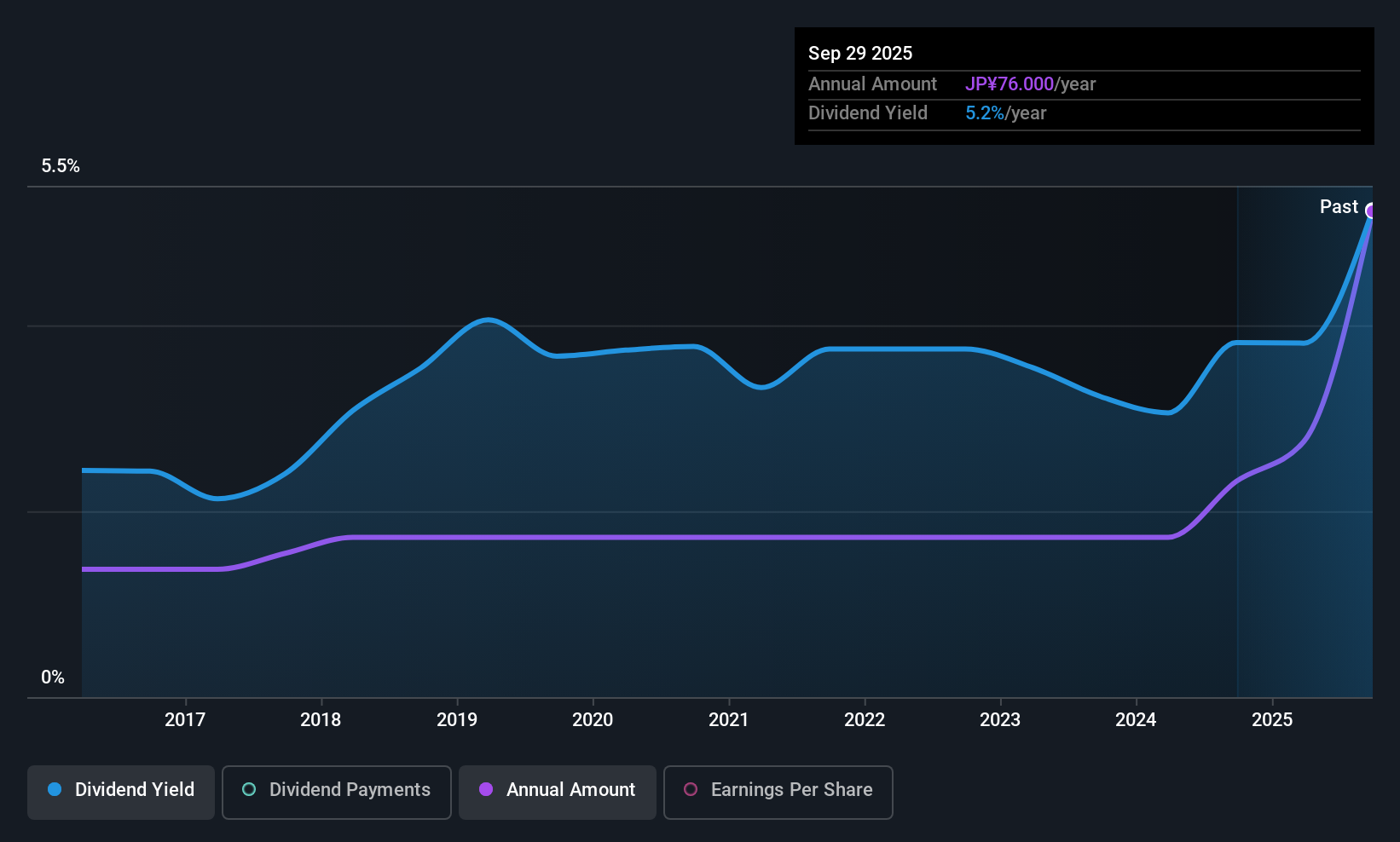

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyodo Printing Co., Ltd. and its subsidiaries operate in the prepress, printing, bookbinding, and related ancillary sectors in Japan with a market capitalization of ¥42.83 billion.

Operations: Kyodo Printing Co., Ltd. generates revenue primarily from its Information Communication segment at ¥34.89 billion, the Lifestyle and Industrial Materials Division at ¥32.98 billion, and Information Security at ¥31.14 billion.

Dividend Yield: 5%

Kyodo Printing's dividend yield of 5.01% places it in the top quartile of Japanese dividend payers, supported by a stable decade-long payout history. However, the recent decrease to ¥38 per share from ¥55 highlights potential concerns. Despite a low earnings payout ratio of 44.2%, dividends are not well-covered by cash flow, with a high cash payout ratio of 114.2%. Recent buyback and equity offering announcements may impact future shareholder returns and capital allocation strategies.

- Click here to discover the nuances of Kyodo Printing with our detailed analytical dividend report.

- The analysis detailed in our Kyodo Printing valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Gain an insight into the universe of 1056 Top Asian Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报