ASX Penny Stocks To Watch In December 2025

As the Australian market enters the final weeks of December 2025, shares remain largely unchanged amidst a cautious global economic landscape. Despite this subdued atmosphere, penny stocks—often overlooked and underestimated—continue to offer intriguing opportunities for investors seeking potential growth at lower price points. In this article, we explore several promising penny stocks that exhibit strong financial foundations and could present valuable prospects in today's market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$108.9M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.465 | A$70.76M | ✅ 2 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.05 | A$225.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$40.53M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.19B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$366M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.34B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.95 | A$133.86M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Hammer Metals (ASX:HMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hammer Metals Limited is an Australian company focused on the exploration and extraction of mineral resources, with a market cap of A$28.57 million.

Operations: The company generates its revenue primarily from operations in Australia, amounting to A$0.23 million.

Market Cap: A$28.57M

Hammer Metals Limited, with a market cap of A$28.57 million, is a pre-revenue company focused on mineral exploration in Australia. Despite being debt-free and having short-term assets (A$2.7M) that cover both short-term (A$964.7K) and long-term liabilities (A$52.1K), the company faces challenges such as recent auditor concerns about its ability to continue as a going concern following significant losses of A$2.92 million for the year ended June 2025. While it has reduced losses over five years, Hammer Metals remains unprofitable with negative return on equity (-8.76%) and minimal revenue generation (A$227K).

- Dive into the specifics of Hammer Metals here with our thorough balance sheet health report.

- Gain insights into Hammer Metals' past trends and performance with our report on the company's historical track record.

Tanami Gold (ASX:TAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tanami Gold NL is an Australian gold exploration company with a market cap of A$84.61 million.

Operations: Currently, there are no revenue segments reported for this Australian gold exploration company.

Market Cap: A$84.61M

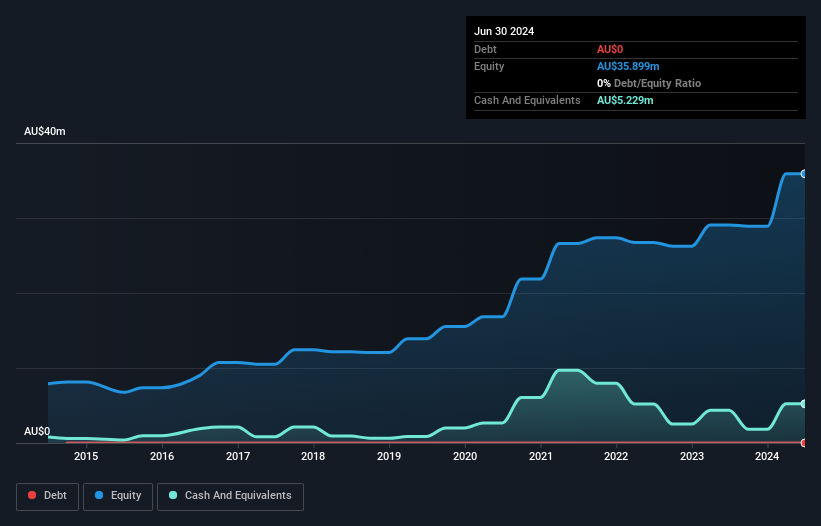

Tanami Gold NL, with a market cap of A$84.61 million, is a pre-revenue gold exploration company in Australia. Despite being unprofitable and experiencing significant earnings declines of 48.2% annually over the past five years, the company remains debt-free and has sufficient short-term assets (A$22.4M) to cover both its short-term (A$1.2M) and long-term liabilities (A$4.4M). The board's average tenure is 13.4 years, indicating experienced leadership amidst financial challenges like a net loss of A$5.84 million for the year ended June 2025, slightly improved from the previous year’s loss of A$6.15 million.

- Unlock comprehensive insights into our analysis of Tanami Gold stock in this financial health report.

- Learn about Tanami Gold's historical performance here.

Vita Life Sciences (ASX:VLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vita Life Sciences Limited is a healthcare company involved in the formulation, packaging, distribution, and sale of vitamins and supplements across Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China with a market cap of A$138.79 million.

Operations: Vita Life Sciences Limited has not reported any specific revenue segments.

Market Cap: A$138.79M

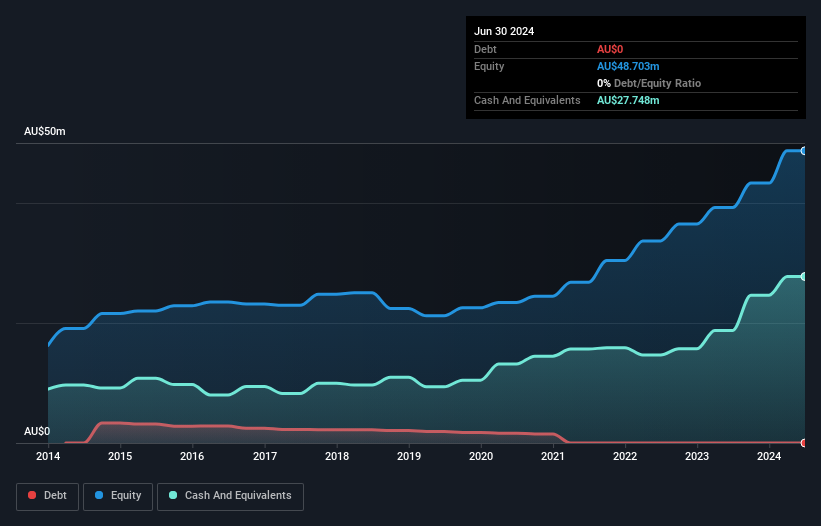

Vita Life Sciences Limited, with a market cap of A$138.79 million, operates in the healthcare sector focusing on vitamins and supplements across multiple Asian markets. The company is financially stable, being debt-free and having sufficient short-term assets (A$59.2M) to cover both its short-term (A$20.1M) and long-term liabilities (A$1.9M). Despite negative earnings growth over the past year and a low return on equity at 17.7%, Vita Life maintains high-quality earnings without shareholder dilution recently. Its experienced management team averages 8.8 years of tenure, supporting operational stability amidst challenges like declining profit margins from 12% to 10.9%.

- Take a closer look at Vita Life Sciences' potential here in our financial health report.

- Explore historical data to track Vita Life Sciences' performance over time in our past results report.

Make It Happen

- Investigate our full lineup of 432 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报