Blackstone (BX): Assessing Valuation After Landmark Synthetic Risk Transfer and First Lien Mortgage Deal

Blackstone (BX) just helped Sumitomo Mitsui complete a landmark $3.2 billion synthetic risk transfer while also striking a forward flow deal for first lien commercial mortgages, moves that quietly deepen its influence across global credit markets.

See our latest analysis for Blackstone.

These deals land at a moment when Blackstone’s 30 day share price return of 7.53 percent contrasts with a softer 90 day share price return of negative 17.17 percent. At the same time, its five year total shareholder return of 178.76 percent shows the long term growth story and momentum are still very much intact.

If you are tracking how major credit players are positioning for the next cycle, this is also a good time to explore fast growing stocks with high insider ownership for other potential opportunities.

With shares still trading at a meaningful discount to Wall Street targets despite solid multi year returns and double digit earnings growth, is Blackstone quietly undervalued here, or are markets already pricing in its next phase of expansion?

Most Popular Narrative Narrative: 15.4% Undervalued

With Blackstone last closing at $152.09 against a narrative fair value near $179.78, the framing leans toward upside as long term assumptions stack up.

The firm is well positioned to benefit from market dislocation with $177 billion of dry powder available for opportunistic investments, potentially increasing future earnings as capital is deployed in undervalued assets. Blackstone's strategic alliance with Wellington and Vanguard aims to develop integrated public private investment solutions, potentially expanding revenue channels by tapping into the private wealth market.

Want to see what kind of revenue surge and margin expansion those capital flows are meant to support? The full narrative spells out a bold profitability curve and a valuation multiple that assumes Blackstone can compound far faster than the broader US market, without needing tech style hype to get there.

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and delayed investment deployments could slow realizations and earnings growth, challenging the upbeat long term valuation story around Blackstone.

Find out about the key risks to this Blackstone narrative.

Another Lens On Valuation

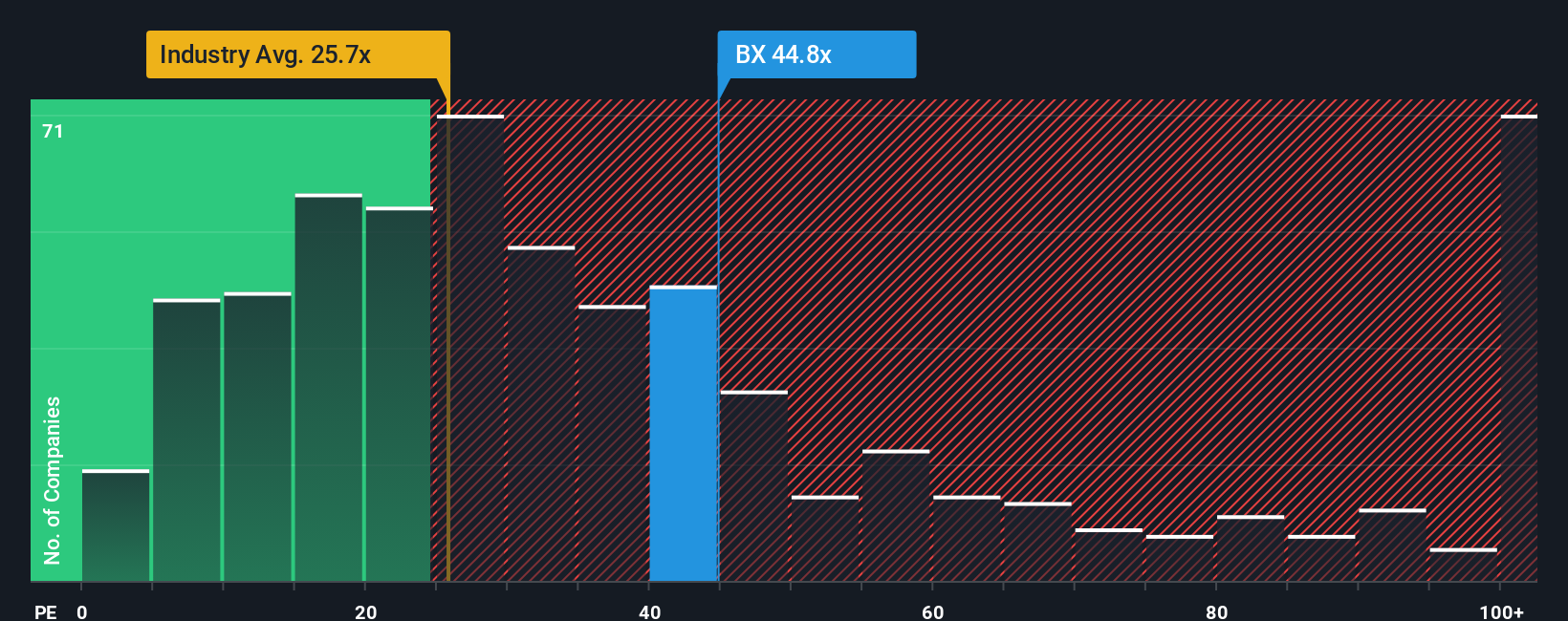

While the narrative fair value points to 15.4 percent upside, a simple earnings multiple paints a tougher picture. Blackstone trades at about 44 times earnings, versus 25 times for the US capital markets industry and a fair ratio closer to 24.4 times, which implies valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If the numbers here do not quite match your view, or you prefer to dig into the data yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with Blackstone, you could miss out on other powerful opportunities, so let Simply Wall Street's screener find your next smart move.

- Capture early stage potential by scanning these 3625 penny stocks with strong financials that already back strong balance sheets and improving fundamentals before the crowd catches on.

- Capitalize on structural shifts in medicine by targeting these 30 healthcare AI stocks reshaping diagnostics, drug discovery, and hospital efficiency with scalable data driven models.

- Lock in income focused strategies through these 13 dividend stocks with yields > 3% that pair reliable cash yields above 3 percent with businesses built to withstand tougher markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报