Amdocs (DOX) Margin Improvement Supports Bullish Narrative Despite Modest Revenue Growth

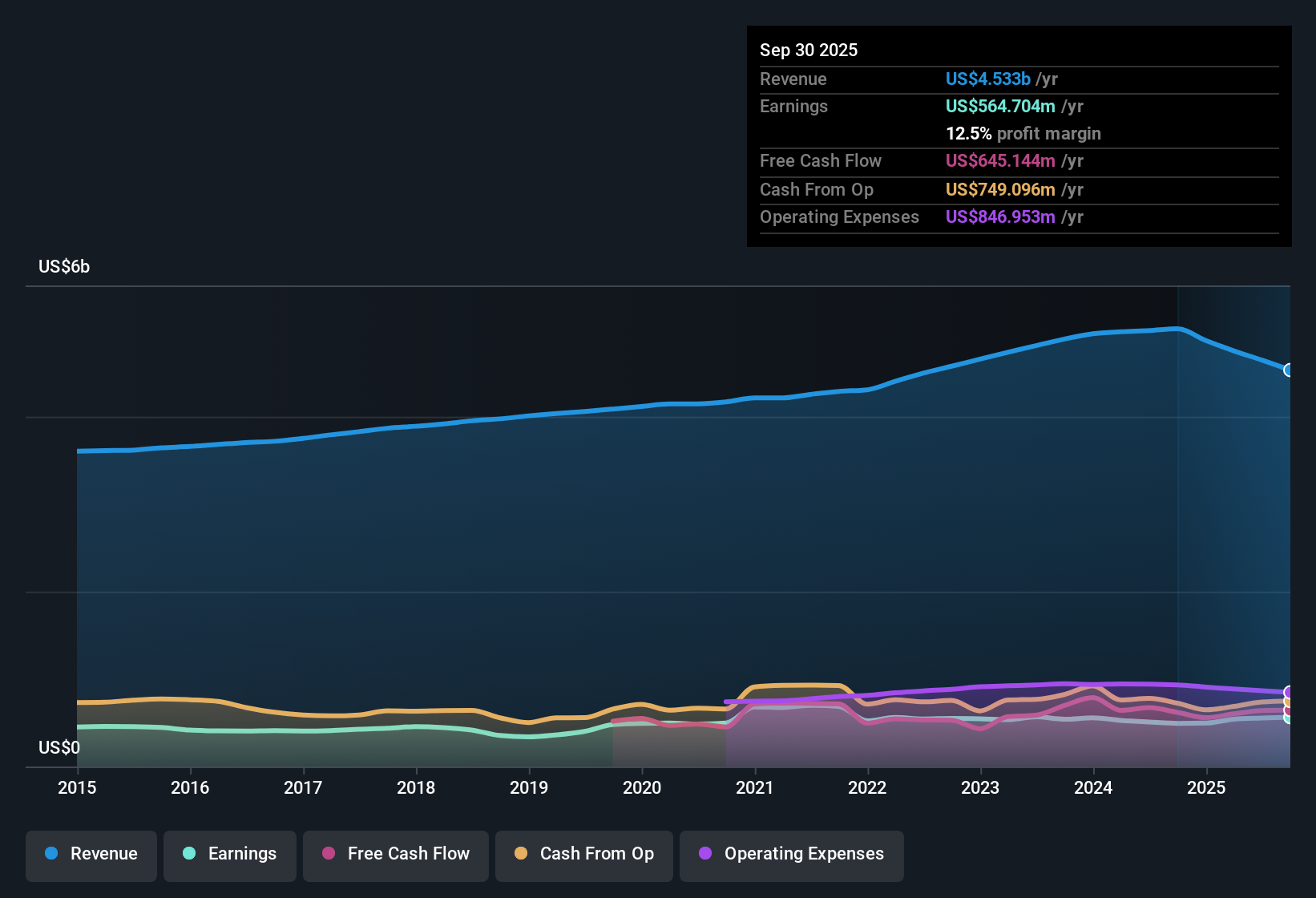

Amdocs (DOX) just wrapped up FY 2025 with fourth quarter revenue of about $1.2 billion and EPS of $0.88, setting the stage against a trailing twelve month backdrop of $4.5 billion in revenue and EPS of $5.08. Over the past year, the company has seen revenue move from roughly $5.0 billion to $4.5 billion on a trailing basis, while trailing EPS has edged up from $4.27 to $5.08. This reflects a business that is leaning more on profitability than top line expansion, with margins now doing more of the heavy lifting for investors.

See our full analysis for Amdocs.With the headline numbers on the table, the next step is to stack these results against the prevailing narratives around Amdocs and test where the story of cautious growth, margin work, and earnings resilience really holds up.

See what the community is saying about Amdocs

Margins Step Up To 12.5 Percent

- Net profit margin over the last 12 months improved to 12.5 percent from 9.9 percent, even though trailing revenue slipped from about $5.0 billion to $4.5 billion over the same period.

- Consensus narrative highlights Amdocs' push into higher margin areas like SaaS, automation, and AI driven BSS or OSS, and the stronger 12.5 percent margin suggests that

- recent cloud and automation wins are already showing in profitability, despite only 3.8 percent revenue growth, and

- the business is becoming less dependent on pure top line expansion as margins do more of the work for earnings per share growth.

EPS Rebounds Despite 5 Year Drag

- Trailing 12 month EPS of $5.08 is up 14.5 percent versus a year ago, while the longer 5 year trend still shows earnings declining by about 3.9 percent per year.

- Bulls point to strong adoption of cloud, AI, and next generation telecom projects as a driver of more stable, higher quality earnings, and the recent 14.5 percent EPS growth tests that view by showing that

- short term performance now runs ahead of the negative 5 year EPS trend, suggesting that modernization deals are starting to offset prior weakness, while

- dependence on a few large telecom customers means any slowdown or contract change could still pull EPS back toward that longer term decline path.

Stronger margins and a double digit EPS lift versus last year have bulls arguing that Amdocs is finally turning years of investment in cloud and AI into earnings power that they see as potentially compounding from here. 🐂 Amdocs Bull Case

Valuation On 15x P or E With DCF Upside

- The shares trade at a price to earnings multiple of 15.2 times versus peers at 18.2 times and the US IT sector at 29.8 times, and a DCF fair value of about $131.83 sits well above the current $79.63 share price.

- Bears worry that slower forecast growth, with revenue expected to rise around 2.8 to 3.8 percent annually and earnings growth at 0.9 percent versus 16.1 percent for the broader US market, means the low P or E is deserved, because

- client concentration and reliance on large multi year transformation projects could cap how quickly that valuation gap to the 131.83 dollar DCF fair value can close, and

- even with analysts seeing room for upside toward their 102.50 dollar target, the below market growth profile leaves less room for mistakes if large telecom customers trim budgets.

Slower forecast growth and heavy exposure to a handful of big telcos have skeptics asking whether Amdocs low multiple is a bargain or a warning sign. 🐻 Amdocs Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amdocs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that perspective to quickly shape your own take on Amdocs story in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Amdocs.

Explore Alternatives

Amdocs combination of slowing revenue growth, client concentration, and below market earnings outlook raises questions about how durable its long term growth story really is.

If that sluggish profile leaves you uneasy, use our stable growth stocks screener (2087 results) to quickly zero in on companies already delivering consistent revenue and earnings progress across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报