How Iberdrola’s €350 Million Portuguese Wind Farm Investment Will Impact Iberdrola (BME:IBE) Investors

- Iberdrola has already begun assembling wind turbines for Portugal’s largest wind farm, a €350 million project that marks a major expansion of its renewable energy footprint in the country.

- This milestone adds scale to Iberdrola’s clean energy portfolio and may reinforce its role as a key player in Iberian decarbonisation efforts.

- We’ll now examine how this €350 million Portuguese wind farm investment fits into Iberdrola’s existing growth narrative in regulated networks and renewables.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Iberdrola Investment Narrative Recap

To own Iberdrola, you need to believe that regulated networks and renewables can compound steadily, even with regulatory and financing pressures in the background. The €350 million Portuguese wind farm adds more clean generation to that story, but it does not materially change the near term focus on executing the €5 billion equity raise and managing regulatory risk in Spain and other core markets.

The Portuguese wind project sits alongside Iberdrola’s recently filed €5.016 billion follow on equity offering, which is intended to support a major step up in network and clean energy investment. Taken together, these moves highlight how dependent the investment case is on continued access to green capital and the company’s ability to channel that funding into regulated grids and contracted renewables without eroding returns.

However, against this backdrop, investors should also be aware of the growing tension between Iberdrola’s rising leverage and the risk that...

Read the full narrative on Iberdrola (it's free!)

Iberdrola's narrative projects €50.1 billion revenue and €7.0 billion earnings by 2028. This requires 3.7% yearly revenue growth and about €2.2 billion earnings increase from €4.8 billion today.

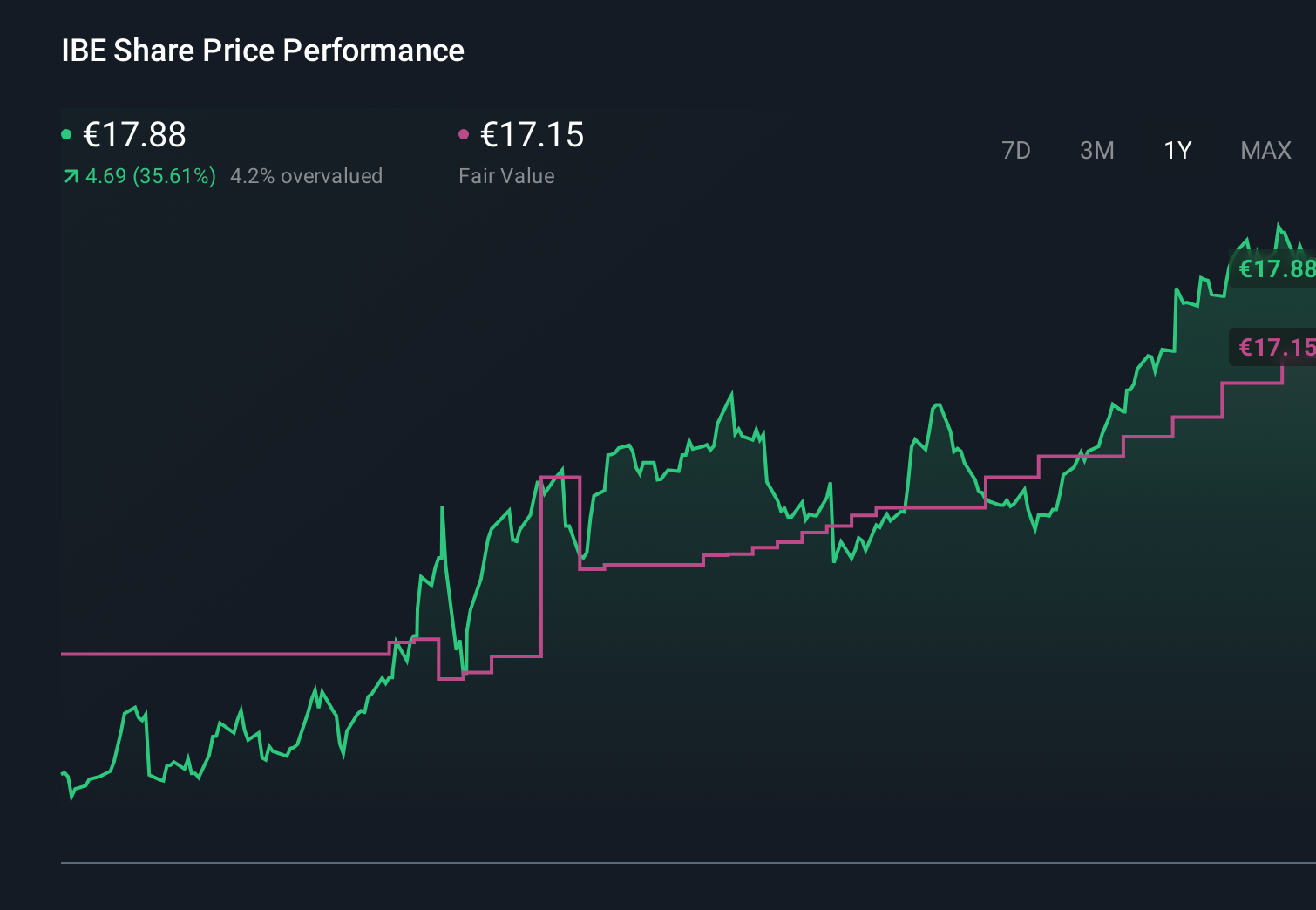

Uncover how Iberdrola's forecasts yield a €17.15 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community range from €0.37 to €17.15, underscoring how far apart individual views can be. Set this against Iberdrola’s heavy reliance on stable regulation and green financing, and it becomes even more important to compare several viewpoints before forming your own expectations for the business.

Explore 10 other fair value estimates on Iberdrola - why the stock might be worth as much as €17.15!

Build Your Own Iberdrola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iberdrola research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Iberdrola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iberdrola's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报