Has Hudbay’s 112% Rally in 2024 Outpaced Its Fundamentals?

- Wondering if Hudbay Minerals is still a smart buy after its recent run, or if you are turning up late to the party? This breakdown will walk through what the current price actually implies about its value.

- The stock has climbed 6.6% over the last week, 17.4% over the past month and an eye catching 111.7% year to date. That adds up to a 117.2% gain over 1 year and 267.5% over 3 years, which naturally raises the question of whether it has run too far or is simply catching up to fundamentals.

- Behind those moves, investors have been reacting to a stronger copper price backdrop and growing optimism around long term demand from electrification and green infrastructure. Both of these trends tend to boost sentiment for diversified miners like Hudbay. At the same time, the market has been digesting project updates and balance sheet improvements that together paint a picture of a business shifting from heavy investment toward harvesting cash flows.

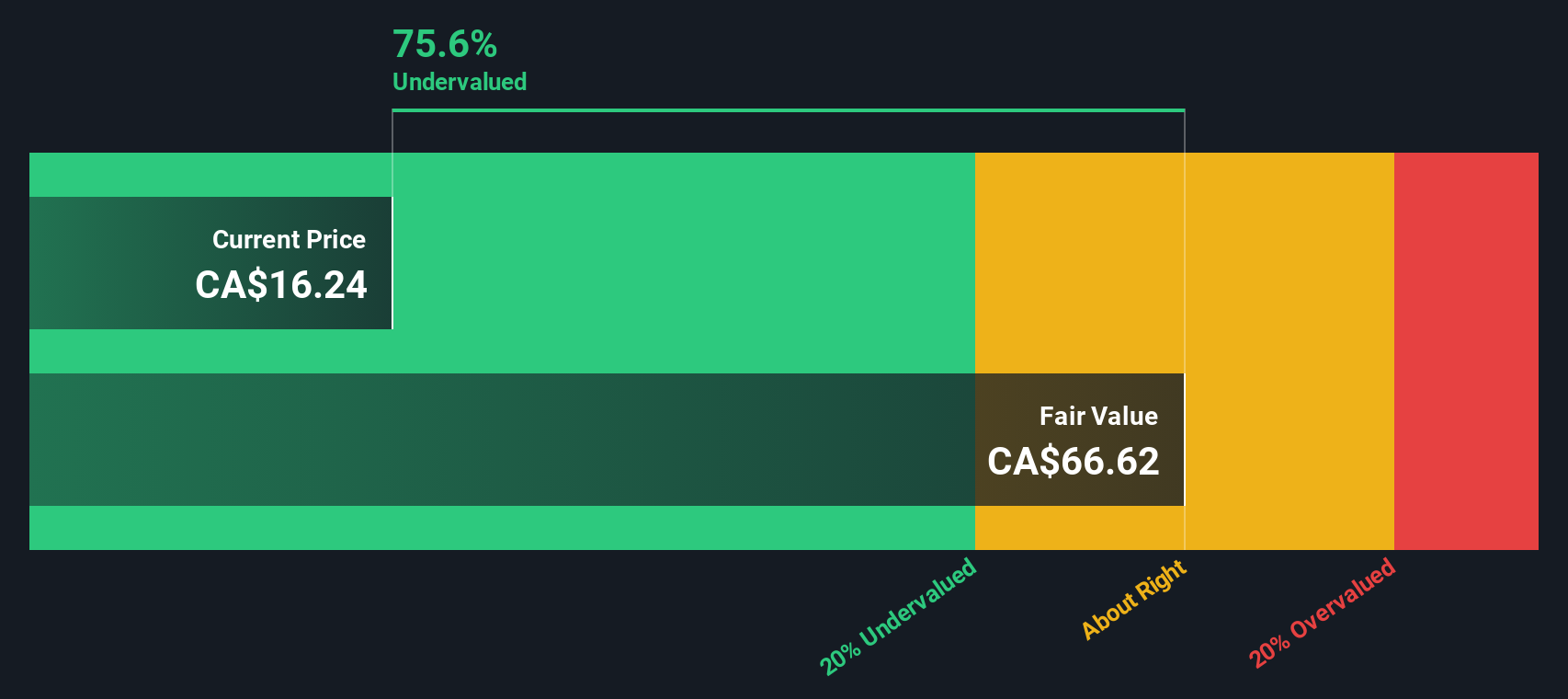

- On our framework, Hudbay scores a solid 5 out of 6 on valuation checks, suggesting the shares still screen as undervalued on most metrics. In the next sections we will unpack what each valuation approach is saying about the stock today and outline a more nuanced way to think about value that ties it all together at the end.

Approach 1: Hudbay Minerals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back into today’s dollars.

For Hudbay Minerals, the latest twelve month Free Cash Flow is about $341.3 Million. Analysts expect this to rise meaningfully, with projections stepping up to around $453.3 Million in 2026 and $572.1 Million in 2027, before further extrapolated growth takes over. Simply Wall St extends these analyst estimates, with projected Free Cash Flow reaching roughly $919.8 Million by 2035 based on a 2 Stage Free Cash Flow to Equity model.

When all of these future cash flows are discounted back, the model arrives at an intrinsic value of about $49.20 per share. Compared with the current share price, this implies the stock is trading at a 47.2% discount. This indicates the market is still pricing Hudbay well below its modeled cash flow potential according to this DCF approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hudbay Minerals is undervalued by 47.2%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Hudbay Minerals Price vs Earnings

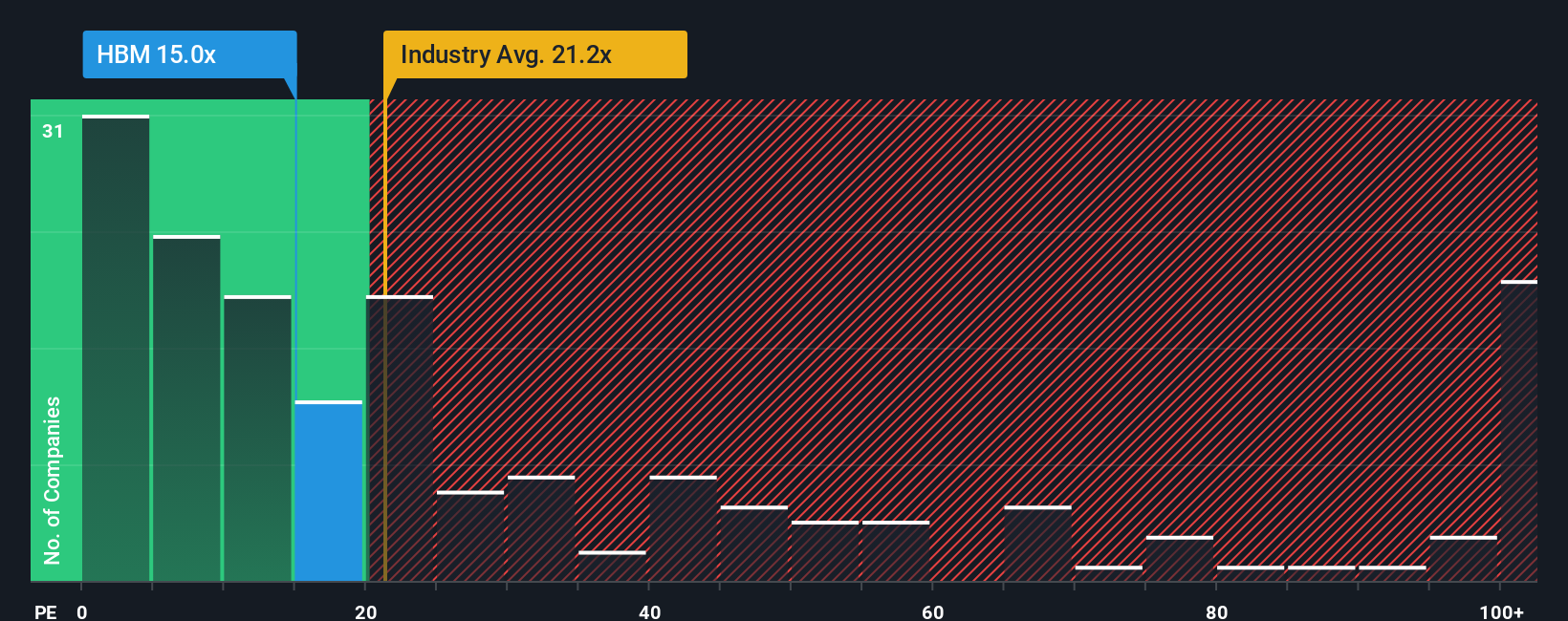

For a profitable company like Hudbay, the Price to Earnings (PE) ratio is a useful way to gauge value because it links what investors are paying directly to the profits the business is generating today. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually mean the multiple should sit closer to, or below, the market and industry norms.

Hudbay currently trades on a PE of about 16.2x, which is below both the Metals and Mining industry average of roughly 21.4x and the broader peer group average of around 27.7x. Simply Wall St also calculates a proprietary Fair Ratio of 18.6x for Hudbay, which reflects what investors might reasonably pay given its earnings growth profile, margins, industry, market cap and risk characteristics.

This Fair Ratio is more informative than a simple comparison with peers or the industry because it adjusts for Hudbay’s specific fundamentals rather than assuming all miners deserve the same multiple. Comparing the current 16.2x PE with the 18.6x Fair Ratio suggests the stock is trading at a discount on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hudbay Minerals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page where you describe your story for Hudbay Minerals, translate that into expectations for future revenue, earnings and margins, and instantly see the Fair Value that falls out of those assumptions.

You can then compare this Fair Value to today’s price and decide whether to buy, hold or sell, with the Narrative automatically updating whenever new information like news or earnings is released. For example, one investor might build a bullish Hudbay Narrative around strong copper demand, successful Copper World execution and premium margins that supports a Fair Value close to CA$26.90. A more cautious investor could create a Narrative that assumes slower growth, cost pressures and project delays that justifies a Fair Value nearer CA$16.00. This shows how the same company can look attractively undervalued or close to fully priced depending on the story and numbers you believe are most realistic.

Do you think there's more to the story for Hudbay Minerals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报