Powerhouse Ventures Limited's (ASX:PVL) Shares Bounce 26% But Its Business Still Trails The Market

Powerhouse Ventures Limited (ASX:PVL) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last month tops off a massive increase of 105% in the last year.

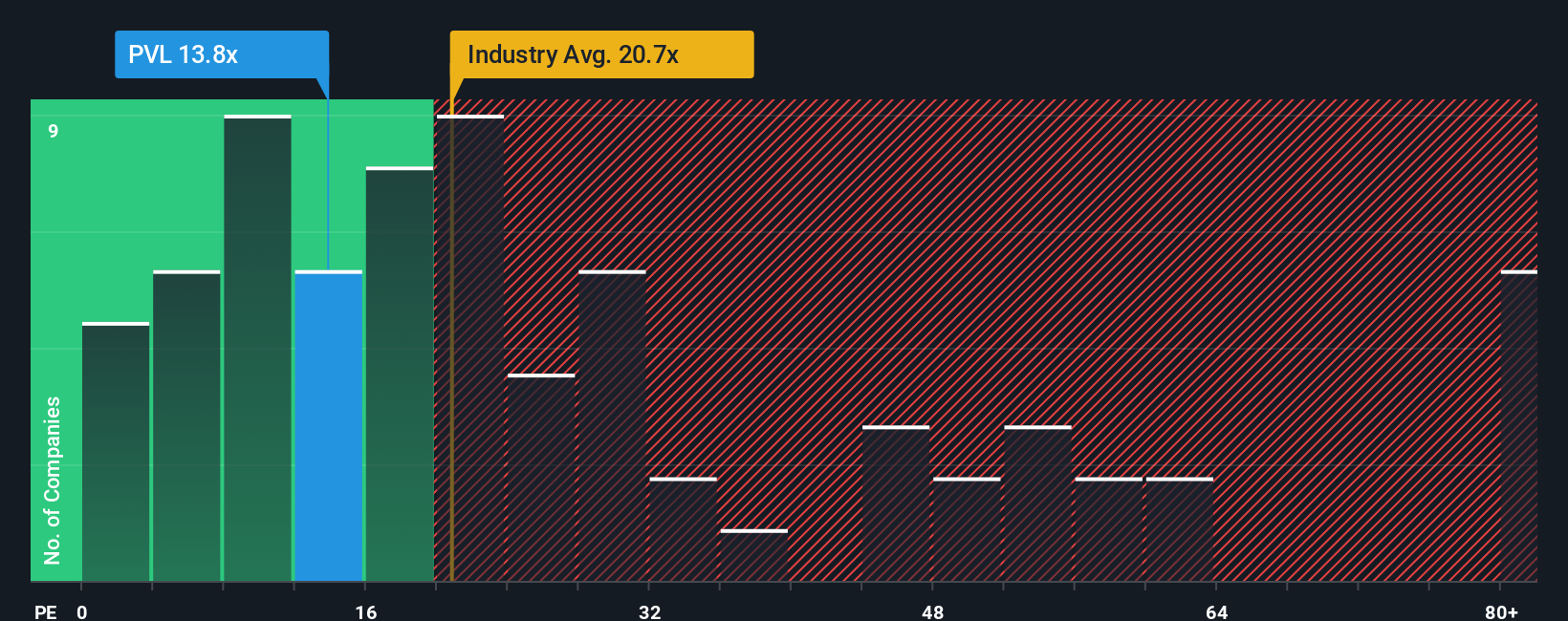

Although its price has surged higher, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 22x, you may still consider Powerhouse Ventures as an attractive investment with its 13.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Powerhouse Ventures as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Powerhouse Ventures

What Are Growth Metrics Telling Us About The Low P/E?

Powerhouse Ventures' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 297% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 22% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Powerhouse Ventures' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Powerhouse Ventures' P/E?

Powerhouse Ventures' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Powerhouse Ventures revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Powerhouse Ventures (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Powerhouse Ventures' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报