Rocket Lab (RKLB) Valuation Check After Neutron ‘Hungry Hippo’ Milestone and JAXA RAISE-4 Mission Success

Rocket Lab (RKLB) just checked two big boxes for investors, qualifying its world first reusable Neutron fairing and successfully flying JAXA’s dedicated RAISE And Shine mission, together strengthening its case for higher margin, repeat business.

See our latest analysis for Rocket Lab.

The latest pullback, with a roughly 9.9% one day share price return decline after the JAXA success, looks more like profit taking than a change in thesis. This is especially the case given Rocket Lab’s triple digit year to date share price return and huge multi year total shareholder return, which suggests momentum is still broadly building rather than fading.

If this kind of space momentum has you rethinking your portfolio, it could be a good time to explore aerospace and defense stocks for other potential beneficiaries of the sector’s tailwinds.

With shares up more than 120% this year and trading only modestly below analyst targets despite ongoing losses, the key question now is simple: is Rocket Lab still an underappreciated growth story, or has the market already priced in liftoff?

Most Popular Narrative Narrative: 43.4% Undervalued

KiwiInvest’s narrative points to a fair value far above Rocket Lab’s last close, framing today’s price as a steep discount on long term potential.

These estimates produce a current fair value of ~$98 per share. The main determinant of daily stock prices over the next 10 years will be the PE ratio the market ascribes to Rocket Labs. This will fluctuate massively over time as an amplified measure of current investor confidence in the spaceflight business, the space economy, the global economy and global markets in general. Throughout Rocket Lab will continue to innovate and grow. Periods of lower PEs will offer good buying opportunities. Only extremely high PEs represent true overvalued status, given the long term prospects of this company.

Want to see how ambitious revenue expansion, rich margins and a premium future earnings multiple combine into that price target? The underlying forecasts might surprise you.

Result: Fair Value of $98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses, Neutron setbacks, or fiercer price competition from SpaceX could quickly erode the bullish long term valuation narrative around Rocket Lab.

Find out about the key risks to this Rocket Lab narrative.

Another Lens on Valuation

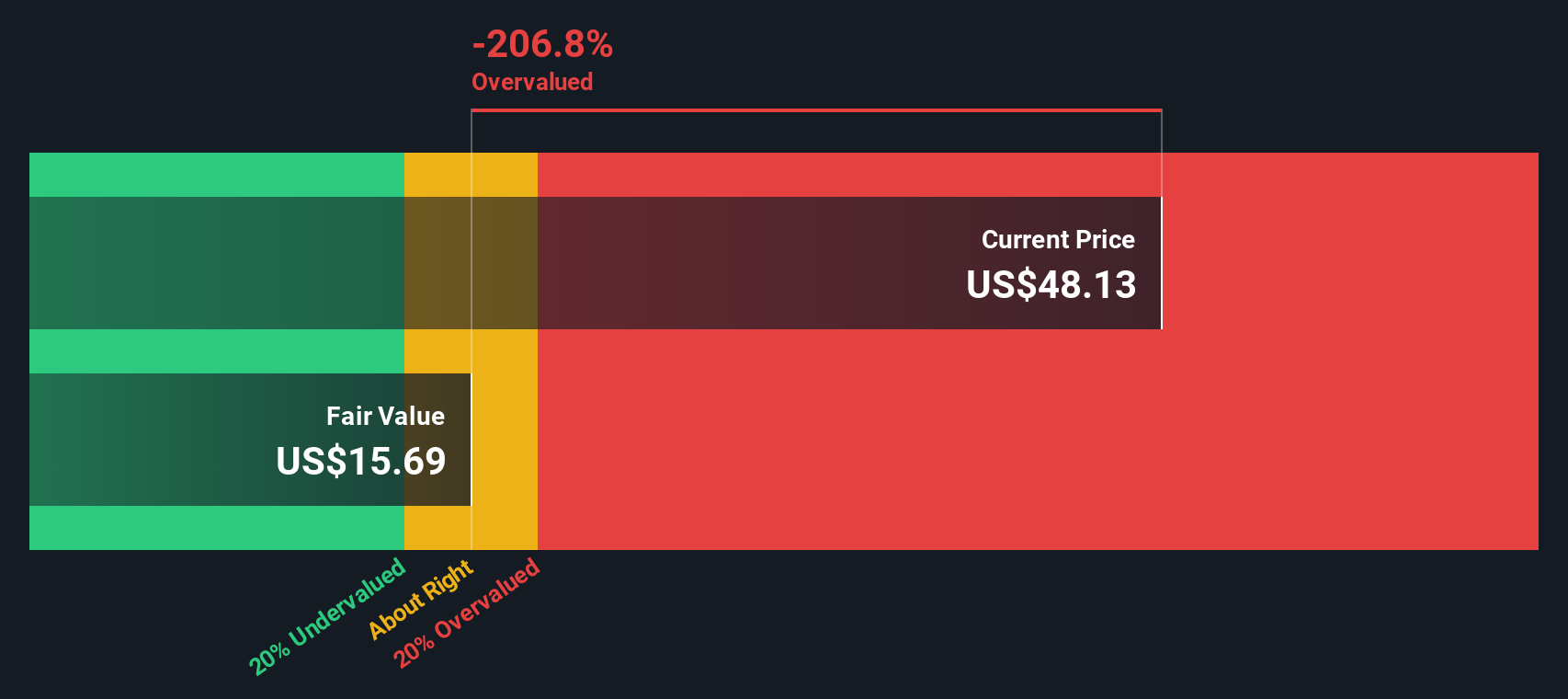

While KiwiInvest sees Rocket Lab as deeply undervalued, our SWS DCF model paints a cooler picture, with fair value at $37.84 versus a $55.41 share price, implying the stock is overvalued on this view. Is the market already paying up for future Neutron wins?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rocket Lab Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using our screeners to explore stocks the market has not fully appreciated yet.

- Review these 3627 penny stocks with strong financials to find companies that combine speculative upside with improving fundamentals and stronger balance sheets.

- Explore these 25 AI penny stocks at the intersection of innovation and earnings power, highlighting companies involved in intelligent software and automation.

- Evaluate these 13 dividend stocks with yields > 3% that offer a mix of income potential, sustainable payout ratios, and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报