Franklin Electric (FELE): Reassessing Valuation After Insider Share Moves and Mixed Q3 2025 Earnings

Franklin Electric (FELE) has been in the spotlight after director Gregg C. Sengstack sold shares and moved stock into his family foundation, just as the company reported 9% third quarter sales growth but slightly softer adjusted earnings.

See our latest analysis for Franklin Electric.

Those moves come as Franklin Electric’s share price has quietly ground higher, with a 1 day share price return of 1.78 percent and solid multi year total shareholder returns suggesting long term momentum remains intact even if the recent 1 year total shareholder return of negative 4.92 percent shows some near term fatigue.

If this kind of steady compounder appeals to you, it might be worth exploring fast growing stocks with high insider ownership for other companies where insiders are meaningfully aligned with long term shareholders.

With sales still climbing, earnings growing and the share price sitting at a modest discount to analyst targets, is Franklin Electric slipping under the radar as a value opportunity, or has the market already priced in its next leg of growth?

Most Popular Narrative: 9.5% Undervalued

With Franklin Electric last closing at $97.76 versus a most popular narrative fair value of $108.00, the story leans toward underappreciated earnings power and gradual multiple compression.

Analysts are assuming Franklin Electric's revenue will grow by 5.4% annually over the next 3 years.

Analysts assume that profit margins will increase from 8.7% today to 10.7% in 3 years time.

Curious how modest revenue growth, rising margins and a lower future earnings multiple can still justify a higher price than today? The most followed narrative walks through a tightly calibrated path of expanding profitability, disciplined capital returns and a valuation reset that hinges on one crucial assumption about how long Franklin Electric can out-earn the broader machinery space.

Result: Fair Value of $108.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to cyclical dewatering markets and potential margin drag from future acquisitions could quickly challenge this underappreciated earnings story.

Find out about the key risks to this Franklin Electric narrative.

Another Lens on Valuation

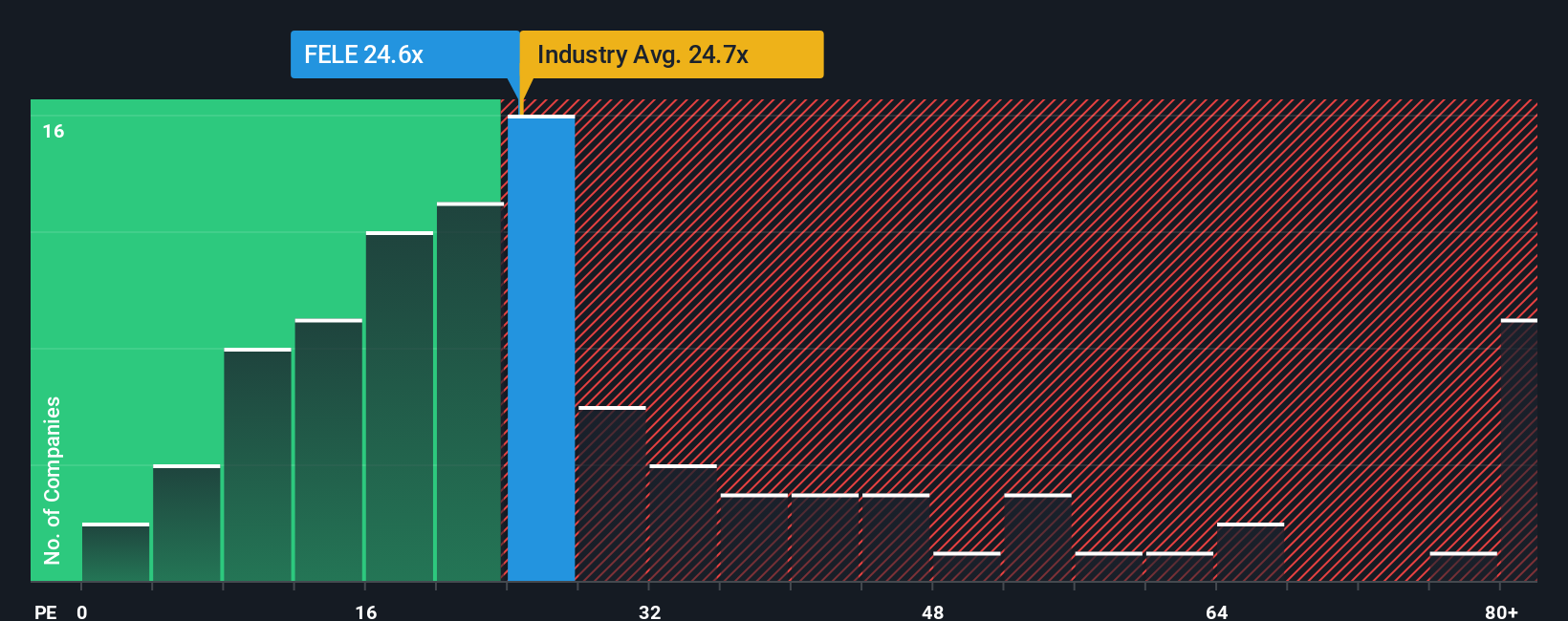

On earnings based multiples, Franklin Electric looks less forgiving. It trades on a 30.9x price to earnings ratio compared with a 28.2x fair ratio our work suggests the market could move toward, and 26.2x for the broader US machinery group, which tilts risk toward de rating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Electric Narrative

If you are skeptical of this view or simply want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your advantage by using the Simply Wall St screener to uncover fresh, data driven opportunities that most investors overlook.

- Capture potential market mispricing by targeting these 906 undervalued stocks based on cash flows that combine solid fundamentals with attractive discounts to intrinsic value.

- Tap into structural growth themes by focusing on these 26 AI penny stocks positioned to benefit from surging demand for intelligent automation and data driven decision making.

- Boost your income strategy with these 13 dividend stocks with yields > 3% that aim to deliver resilient cash yields alongside long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报