Whitehaven Coal (ASX:WHC): Assessing Valuation After New A$72 Million Share Buyback Announcement

Whitehaven Coal (ASX:WHC) has just doubled down on shareholder returns, unveiling a new A$72 million buyback for up to 4.48% of its shares, alongside an update on its earlier repurchase progress.

See our latest analysis for Whitehaven Coal.

The fresh A$72 million buyback lands on top of a strong run, with a 30 day share price return of 10.68% and a 90 day gain of 22.56%. The 5 year total shareholder return of 495.19% shows how powerful capital returns and cash generation have been over a longer cycle.

If this buyback has you rethinking where the next big moves could come from, it might be worth scanning fast growing stocks with high insider ownership for other fast growing, high conviction ideas.

Yet with the share price already near analyst targets, but trading at a steep discount to some intrinsic value estimates, investors face a key question: Is Whitehaven still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 3.9% Overvalued

With the narrative fair value sitting just below Whitehaven Coal's last close of A$7.77, the story pivots on how durable future margins really are.

Analysts are assuming Whitehaven Coal's revenue will decrease by 0.3% annually over the next 3 years. Analysts assume that profit margins will shrink from 11.1% today to 7.6% in 3 years time.

Want to see why a shrinking top line and thinner margins still justify a premium future earnings multiple, above the sector benchmark? The narrative walks through tightly calibrated forecasts for revenues, profits, and valuation rerating that challenge simple coal bear or bull labels. Curious which specific earnings path needs to play out for this price to hold up? Dive in to uncover the full set of assumptions behind that fair value.

Result: Fair Value of A$7.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust long term Asian coal demand and a persistent global supply gap could keep prices firmer and margins healthier than current forecasts assume.

Find out about the key risks to this Whitehaven Coal narrative.

Another Lens on Value

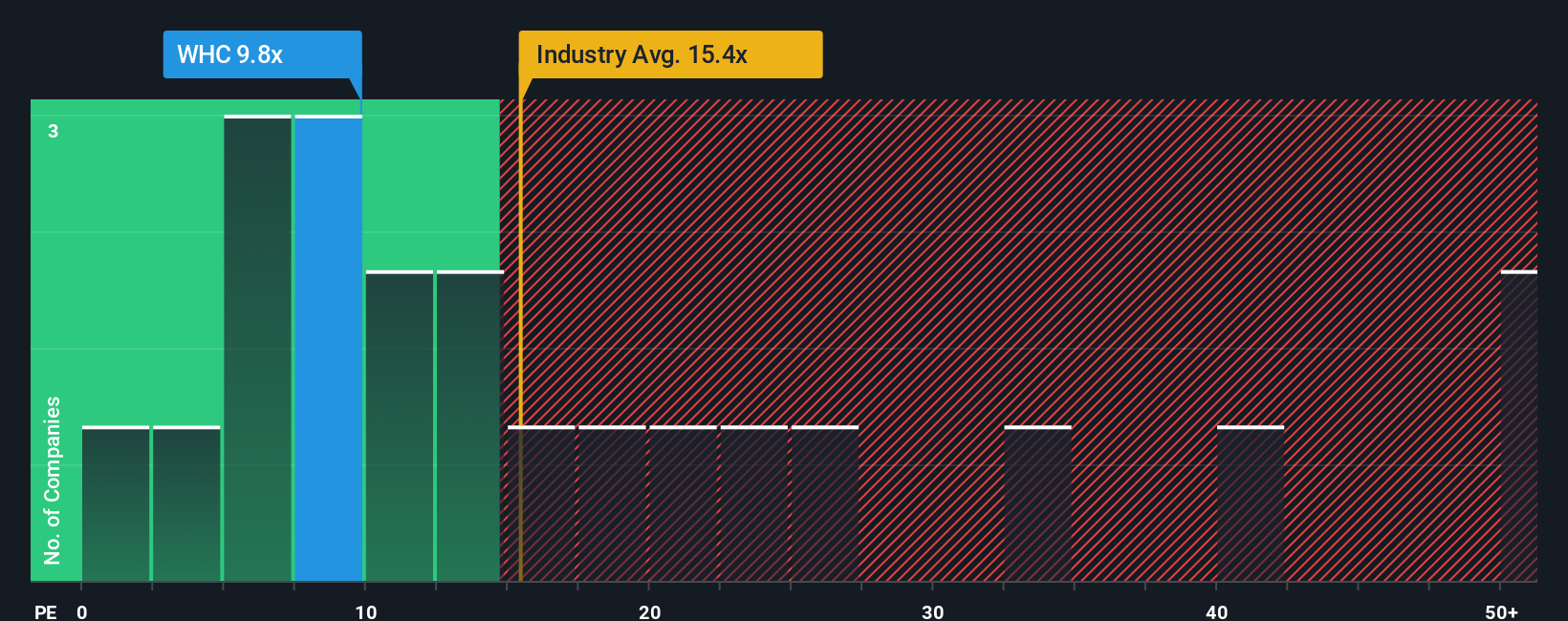

Analysts calling Whitehaven 3.9% overvalued are leaning on forward earnings and a richer future P E. But the fair ratio suggests a P E of 12.6x versus the current 9.9x, with the industry on 15.5x. If sentiment shifts, could the share price close that gap, or is this discount deserved?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Whitehaven Coal Narrative

If you see the story differently or want to stress test your own assumptions using the latest data, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Whitehaven Coal research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by scanning a few focused stock lists tailored to very different approaches in this market.

- Explore these 3625 penny stocks with strong financials that combine lower share prices with relatively strong financial foundations.

- Review these 26 AI penny stocks that are contributing to the next wave of machine powered innovation.

- Evaluate these 13 dividend stocks with yields > 3% that may help support total returns through regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报