Assessing Jyske Bank (CPSE:JYSK)’s Valuation After Its Strong Recent Share Price Rally

Jyske Bank (CPSE:JYSK) has quietly delivered a strong run for shareholders, with the stock up about 7% over the past month and roughly 18% in the past 3 months. That outperformance raises a clear question: does the current price still make sense?

See our latest analysis for Jyske Bank.

Zooming out, that recent momentum sits on top of a powerful trend, with a year to date share price return above 60% and a five year total shareholder return near 300%. This suggests sentiment has steadily improved as investors reassess the bank's earnings power and risk profile.

If Jyske Bank's run has you rethinking your banking exposure, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With the shares now trading above analyst targets but still showing a hefty implied discount to intrinsic value, the key question is simple: is Jyske Bank still a mispriced compounder, or has the market fully baked in future growth?

Most Popular Narrative: 4.6% Overvalued

Jyske Bank's last close at DKK 830 sits modestly above the most followed fair value estimate of DKK 793.5, setting up a nuanced valuation debate.

The share price appears to reflect a best-case scenario for sector consolidation and regulatory stability in Denmark and broader Europe, with ongoing high capital ratios supporting shareholder distributions. Any tightening in regulatory capital requirements, higher compliance costs, or delayed capital returns would constrain buyback potential and future EPS growth.

Want to see what really powers that valuation call? The narrative leans on stubbornly high margins, shrinking top line forecasts, and a future earnings multiple that might surprise you. Curious which numbers matter most, and how they combine to justify today’s fair value?

Result: Fair Value of DKK 793.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained top tier customer satisfaction and resilient credit quality could keep earnings firmer for longer, challenging assumptions of shrinking margins and declining revenue.

Find out about the key risks to this Jyske Bank narrative.

Another View, Multiples Say Cheap

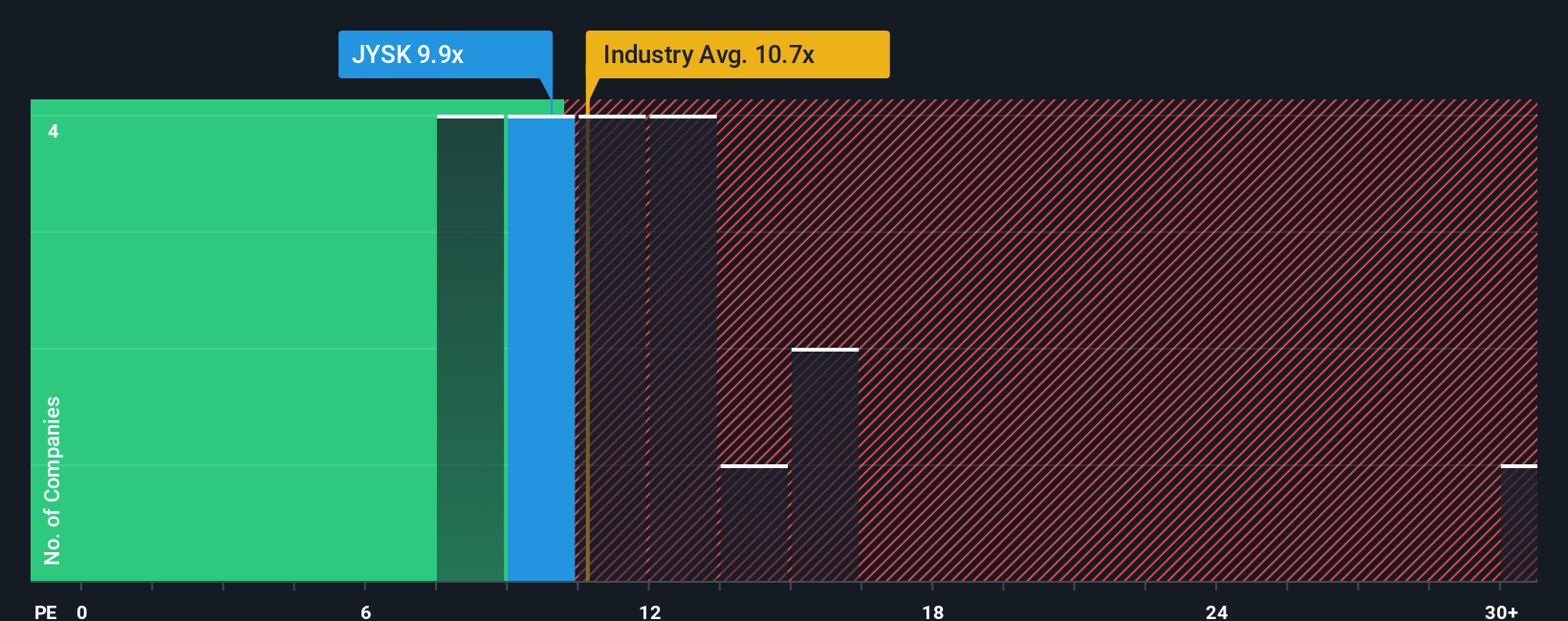

While the most popular narrative sees Jyske Bank as 4.6% overvalued versus fair value of DKK 793.5, the price to earnings picture looks very different. At 9.8x earnings, the stock trades below peers at 10.6x, the wider European banks at 10.5x, and even below a fair ratio of 11x, which hints at a valuation cushion rather than froth. Which lens do you trust when the signals conflict?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jyske Bank Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes with Do it your way.

A great starting point for your Jyske Bank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready For More High Conviction Ideas?

Before you move on, lock in your next opportunities with hand picked stock ideas that match clear themes, solid data, and your investing style.

- Secure potential bargains by targeting companies trading below intrinsic value through these 906 undervalued stocks based on cash flows, where cash flow strength meets attractive pricing.

- Ride innovation trends by focusing on real businesses driving AI breakthroughs with these 26 AI penny stocks, rather than chasing the latest headline hype.

- Strengthen your income stream by zeroing in on reliable payers using these 13 dividend stocks with yields > 3% and avoid missing yields that could compound for years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报