Spotlighting Bridgewater Bancshares And 2 Other Growth Stocks With Strong Insider Ownership

As the U.S. stock market navigates a challenging landscape marked by AI bubble concerns and fluctuating major indexes, investors are keenly observing key economic indicators like employment data and retail sales to gauge future trends. In this environment, growth companies with strong insider ownership can offer a unique appeal, as high insider stakes often signal confidence in the company's long-term prospects despite broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 133.2% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Bridgewater Bancshares (BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering a range of banking products and services in the United States with a market cap of $517.49 million.

Operations: The company's revenue is primarily derived from its banking segment, which generated $127.24 million.

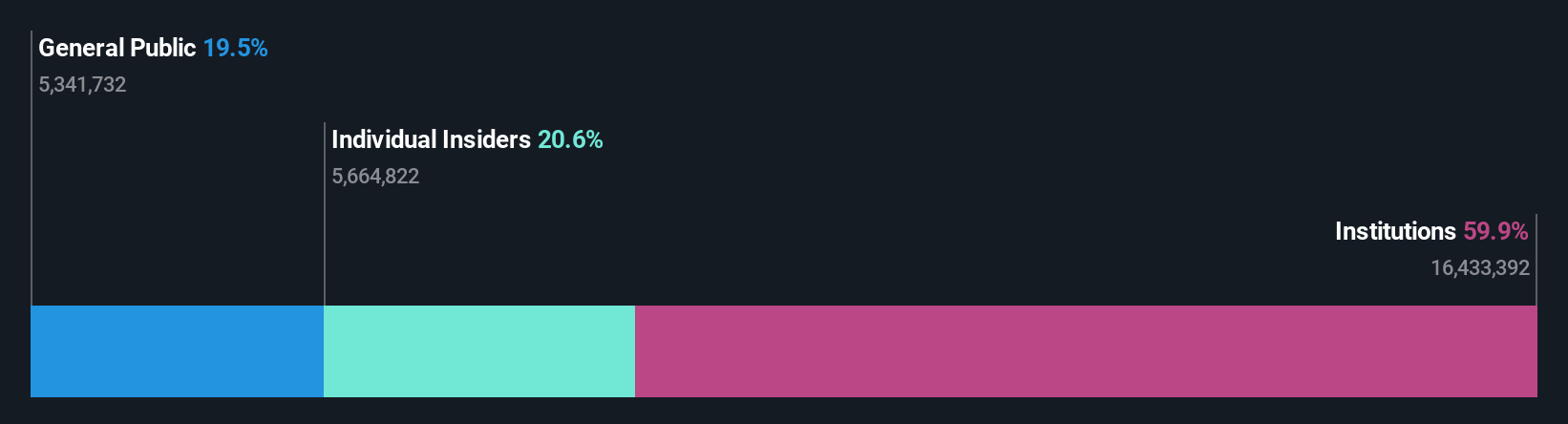

Insider Ownership: 20.5%

Earnings Growth Forecast: 22% p.a.

Bridgewater Bancshares demonstrates growth potential with its earnings forecast to grow 22% annually, surpassing the US market's average. However, insider ownership dynamics show more shares were bought than sold recently, indicating confidence despite no substantial buying in the past quarter. The company trades at a significant discount to estimated fair value and expects revenue growth of 14.4% annually. Recent leadership changes could bolster credit strategies and support further expansion in commercial lending sectors.

- Take a closer look at Bridgewater Bancshares' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Bridgewater Bancshares shares in the market.

Aebi Schmidt Holding (AEBI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aebi Schmidt Holding AG develops and manufactures special-purpose vehicles and attachments, with a market cap of $1.04 billion.

Operations: The company's revenue is primarily derived from North America, contributing $781.05 million, and Europe and the Rest of the World, accounting for $515.43 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 148.1% p.a.

Aebi Schmidt Holding is experiencing significant growth with earnings forecast to rise 148.1% annually, outpacing the US market. Insider activity shows substantial buying over the past three months, signaling confidence in its trajectory. Despite trading at 62% below estimated fair value and strong revenue growth projections of 29.3%, recent financials reveal declining profit margins and net income compared to last year, suggesting challenges in maintaining profitability amidst rapid expansion efforts.

- Click here to discover the nuances of Aebi Schmidt Holding with our detailed analytical future growth report.

- Our expertly prepared valuation report Aebi Schmidt Holding implies its share price may be too high.

Precigen (PGEN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Precigen, Inc. is a discovery and clinical-stage biopharmaceutical company focused on developing gene and cell therapies for immuno-oncology, autoimmune disorders, and infectious diseases, with a market cap of $1.35 billion.

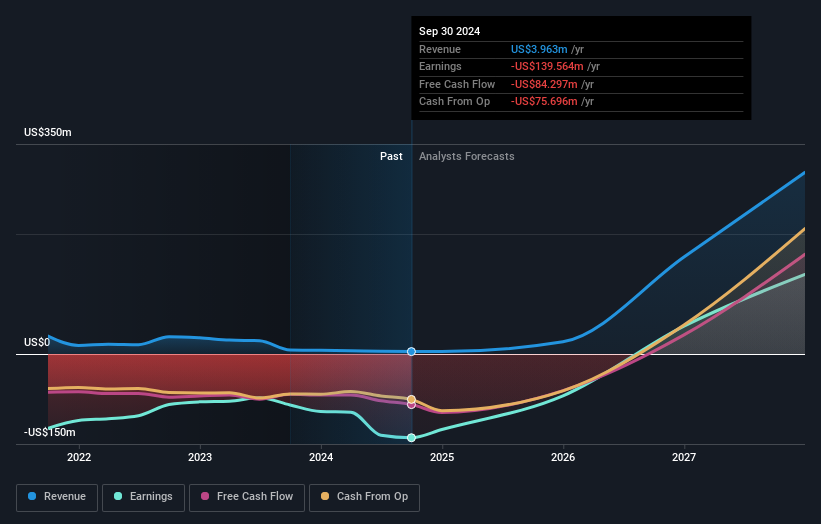

Operations: The company's revenue segments focus on developing advanced gene and cell therapies aimed at treating conditions in immuno-oncology, autoimmune disorders, and infectious diseases.

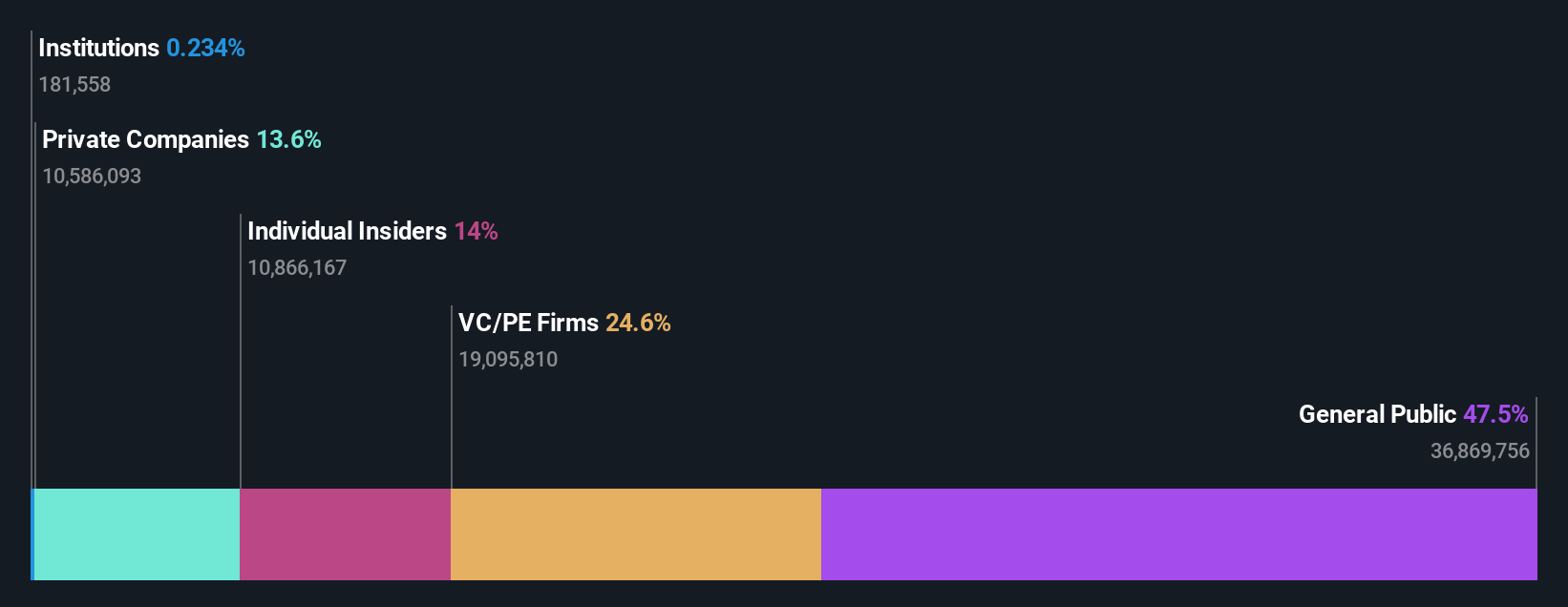

Insider Ownership: 12.3%

Earnings Growth Forecast: 79.7% p.a.

Precigen's revenue is forecast to grow 55.8% annually, significantly outpacing the US market, while it aims for profitability within three years. Despite recent insider selling and high share price volatility, the FDA approval of PAPZIMEOS™ marks a pivotal advancement in treating recurrent respiratory papillomatosis. However, recent financials show increased net losses despite revenue growth, highlighting ongoing challenges in achieving profitability amidst its expansion and innovation efforts.

- Get an in-depth perspective on Precigen's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Precigen's share price might be too optimistic.

Summing It All Up

- Explore the 204 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报