Peloton (PTON) Holiday Push and AI Pivot: What the New Strategy Could Mean for Its Valuation

Peloton Interactive (PTON) is kicking off its 2025 holiday sales event with discounts on its Bikes, Treads, and Rows, tying the promotion directly to a broader AI driven turnaround under new CEO Peter Stern.

See our latest analysis for Peloton Interactive.

Despite the fresh AI features and holiday push, sentiment has been weak, with a year to date share price return of minus 29 percent and a one year total shareholder return of about minus 41 percent, suggesting momentum is still fading.

If Peloton's rocky turnaround has you rethinking your options, this could be a good moment to scout high growth tech and AI stocks for other tech and AI names shaping the next growth wave.

With shares down sharply over one, three, and five years but still trading at a premium on forward earnings, has Peloton finally become a mispriced turnaround story, or is the market already discounting all realistic growth ahead?

Most Popular Narrative Narrative: 40.1% Undervalued

With Peloton Interactive’s fair value pegged around 10.43 dollars versus a 6.25 dollars last close, the most followed narrative sees clear upside from here.

The long term proliferation of connected devices and IoT, coupled with increased remote/hybrid work, creates continued tailwinds for at home and digitally connected fitness solutions, enhancing Peloton's total addressable market and supporting a return to sustainable revenue and earnings growth if the company executes effectively.

Curious how modest top line expectations can still justify a punchy future profit multiple and premium fair value? The real twist lies in the margin and earnings ramp baked into this storyline, and the bold assumption about what investors will pay for Peloton’s profits a few years from now.

Result: Fair Value of $10.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained hardware and subscription declines, alongside intensifying low cost and big tech competition, could quickly undermine the assumed margin recovery and premium valuation.

Find out about the key risks to this Peloton Interactive narrative.

Another Angle on Valuation

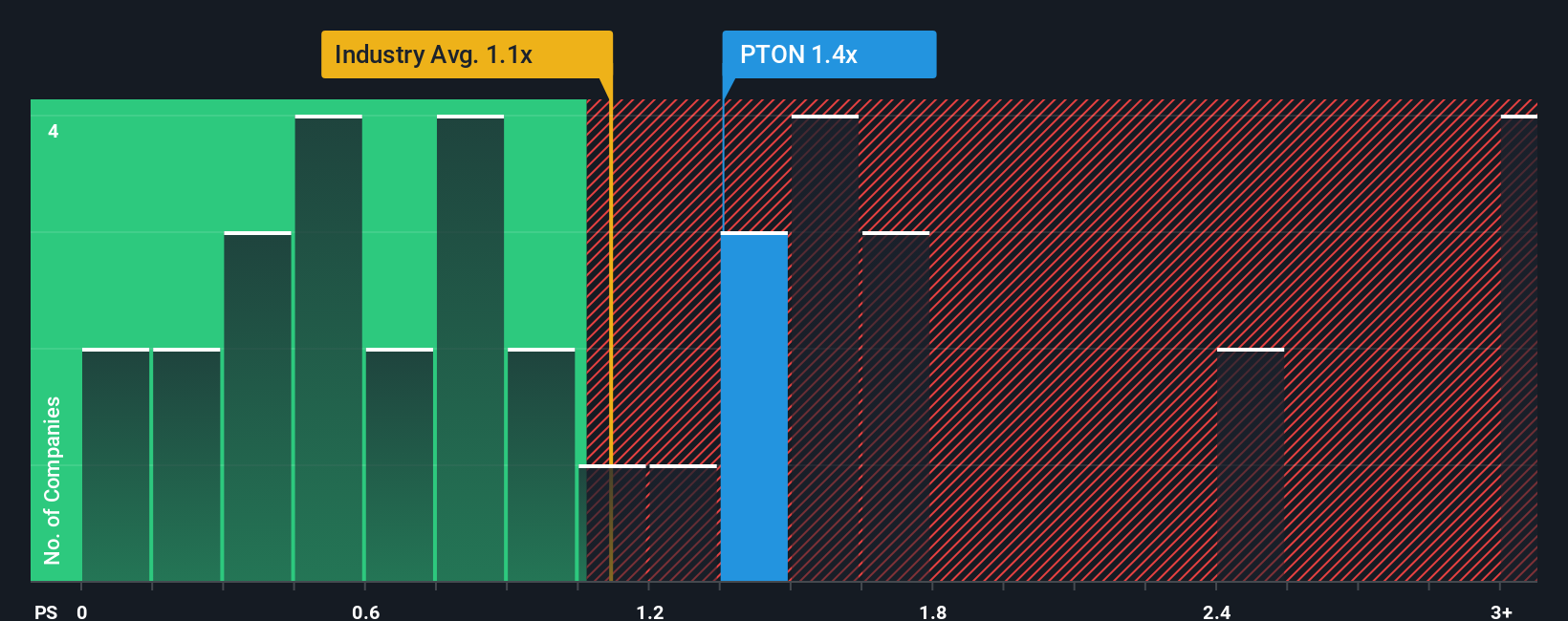

Peloton might screen cheap against our 10.43 dollars fair value estimate, but its 1.1 times price to sales ratio is still higher than both the US Leisure sector at 0.9 times and our fair ratio of 1 times. This hints that the market may be baking in more recovery than the story has earned so far, or just starting to re rate from depressed levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peloton Interactive Narrative

If you see Peloton’s story differently, or just want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before sentiment shifts again, put Simply Wall Street’s Screener to work to uncover fresh opportunities that can complement or even outshine your view on Peloton.

- Capture potential multi baggers early by scanning these 3620 penny stocks with strong financials that pair tiny market caps with solid balance sheets and credible growth trajectories.

- Ride structural tech tailwinds by focusing on these 26 AI penny stocks powering automation, data driven decisions, and next generation software platforms.

- Secure a margin of safety by targeting these 13 dividend stocks with yields > 3% that combine income with disciplined capital allocation and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报