Is Nuvation Bio’s 228.6% 2025 Surge Still Supported by Valuation?

- If you are wondering whether Nuvation Bio's explosive run means you are late to the party or looking at a genuine opportunity, let's break down what the current price might really be worth.

- The stock has been on a tear recently, with a 75.1% gain over the last month and a 228.6% jump year to date, even after a small 0.8% pullback over the past week.

- That surge has been fueled by growing optimism around Nuvation Bio's oncology pipeline and increasing investor attention on small cap biotech names, as risk appetite has crept back into the market. At the same time, sentiment has been shifting as traders reassess the balance between clinical progress, cash runway and takeover potential.

- On our valuation checks, Nuvation Bio scores a 3 out of 6, which suggests some areas of undervaluation but also a few flags that need unpacking. Next, we will walk through different valuation approaches to see how the current price stacks up, before finishing with a more holistic way to think about what Nuvation Bio might really be worth.

Approach 1: Nuvation Bio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Nuvation Bio, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections from analysts and then extended further out by Simply Wall St.

The company currently generates negative free cash flow of about $190.5 Million, reflecting its heavy investment phase in oncology research. Analysts expect this to improve over time, with free cash flow projected to reach roughly $219.7 Million by 2029 and continue growing thereafter based on extrapolated assumptions.

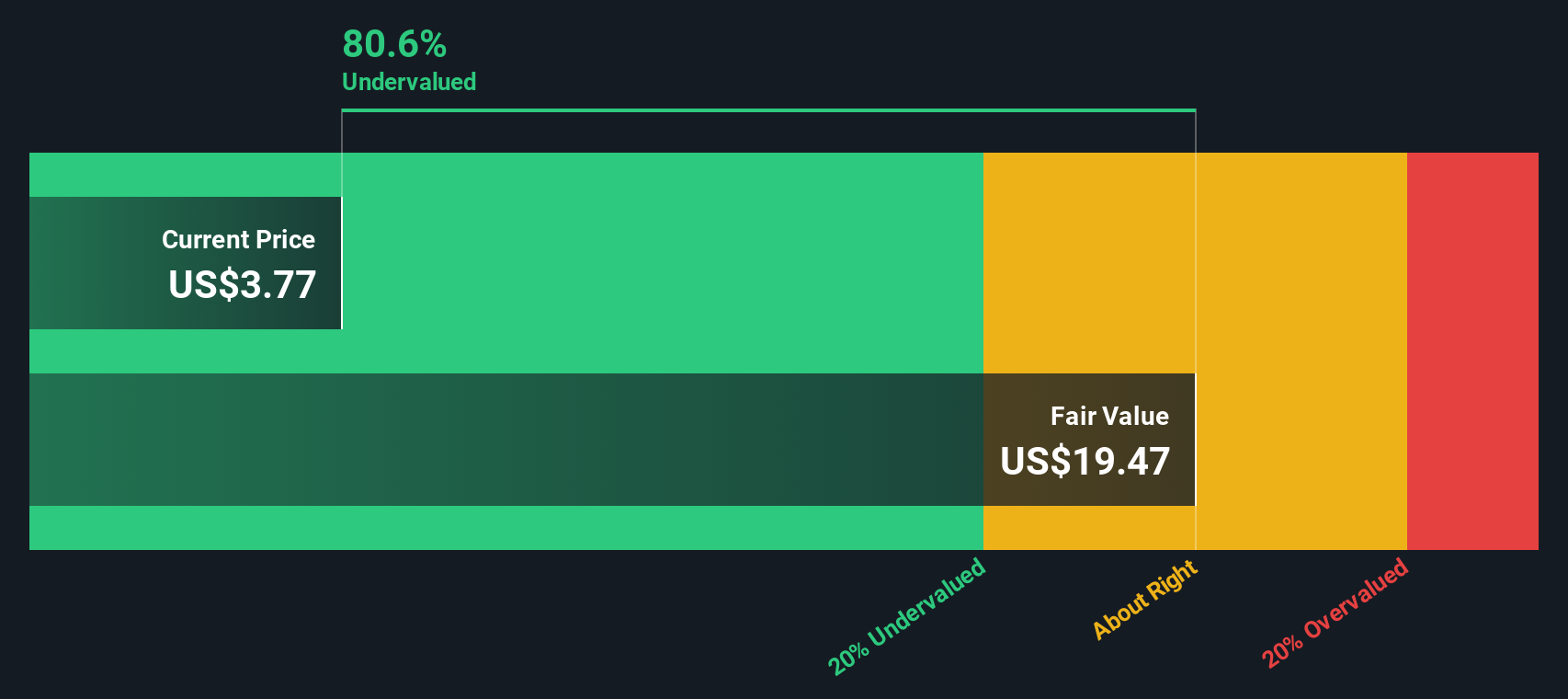

Aggregating and discounting these future cash flows results in an estimated intrinsic value of about $32 per share. Compared with the current market price, this implies the stock is trading at a 73.4% discount to its DCF based fair value, suggesting investors are paying far less than the modelled value of future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nuvation Bio is undervalued by 73.4%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Nuvation Bio Price vs Book

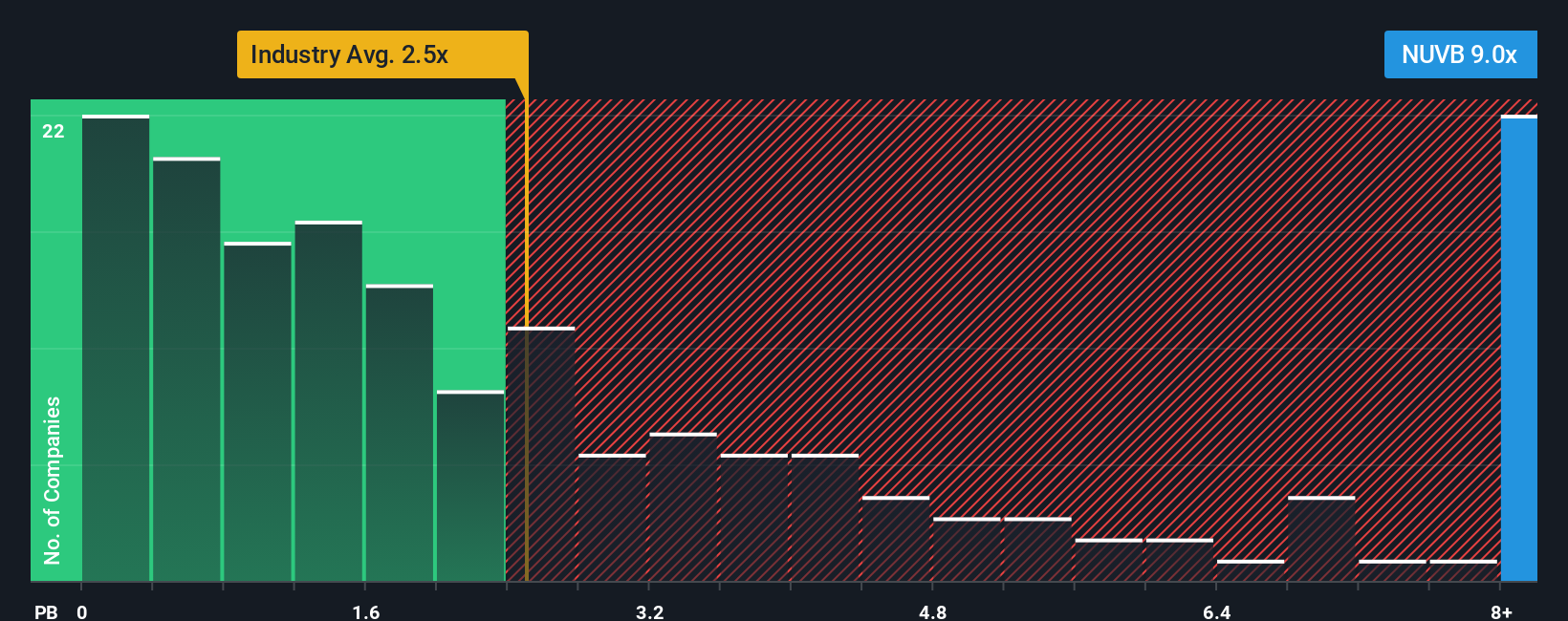

For early stage or unprofitable biotechs like Nuvation Bio, the price to book ratio is often more useful than earnings based measures, as it anchors valuation to the net assets backing the business rather than profits that are still years away.

In practice, investors are willing to pay a higher or lower price to book multiple depending on how fast a company is expected to grow, how risky its pipeline appears and how likely it is to raise dilutive capital. Nuvation Bio currently trades on a price to book ratio of about 9.0x, well above the broader Pharmaceuticals industry average of roughly 2.5x but somewhat below a peer group average of around 10.8x. To move beyond blunt comparisons, Simply Wall St also uses a proprietary Fair Ratio, which estimates what a reasonable multiple should be given Nuvation Bio's growth outlook, risk profile, profitability, industry and size. Because this Fair Ratio is tailored to the company, it provides a more nuanced check than simply lining it up against peers or the sector. On this basis, Nuvation Bio screens as modestly undervalued relative to its Fair Ratio.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nuvation Bio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story about a company to the numbers behind its fair value, including your assumptions for future revenue, earnings and margins. A Narrative connects three pieces: what you believe about a company’s business, how that belief translates into a financial forecast and what that forecast implies for fair value compared to today’s share price. On Simply Wall St, Narratives are an easy, accessible tool available on the Community page, where millions of investors share and refine their views. Each Narrative continuously updates as new information like news or earnings is released. This can make it easier to decide when to buy or sell, because you can see at a glance whether your Narrative’s Fair Value still sits above or below the current Price. For example, one Nuvation Bio Narrative might assume rapid trial success and a high fair value, while another bakes in slower approvals and a much lower fair value, showing how different perspectives can coexist.

Do you think there's more to the story for Nuvation Bio? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报