Optimistic Investors Push Olaplex Holdings, Inc. (NASDAQ:OLPX) Shares Up 27% But Growth Is Lacking

Those holding Olaplex Holdings, Inc. (NASDAQ:OLPX) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

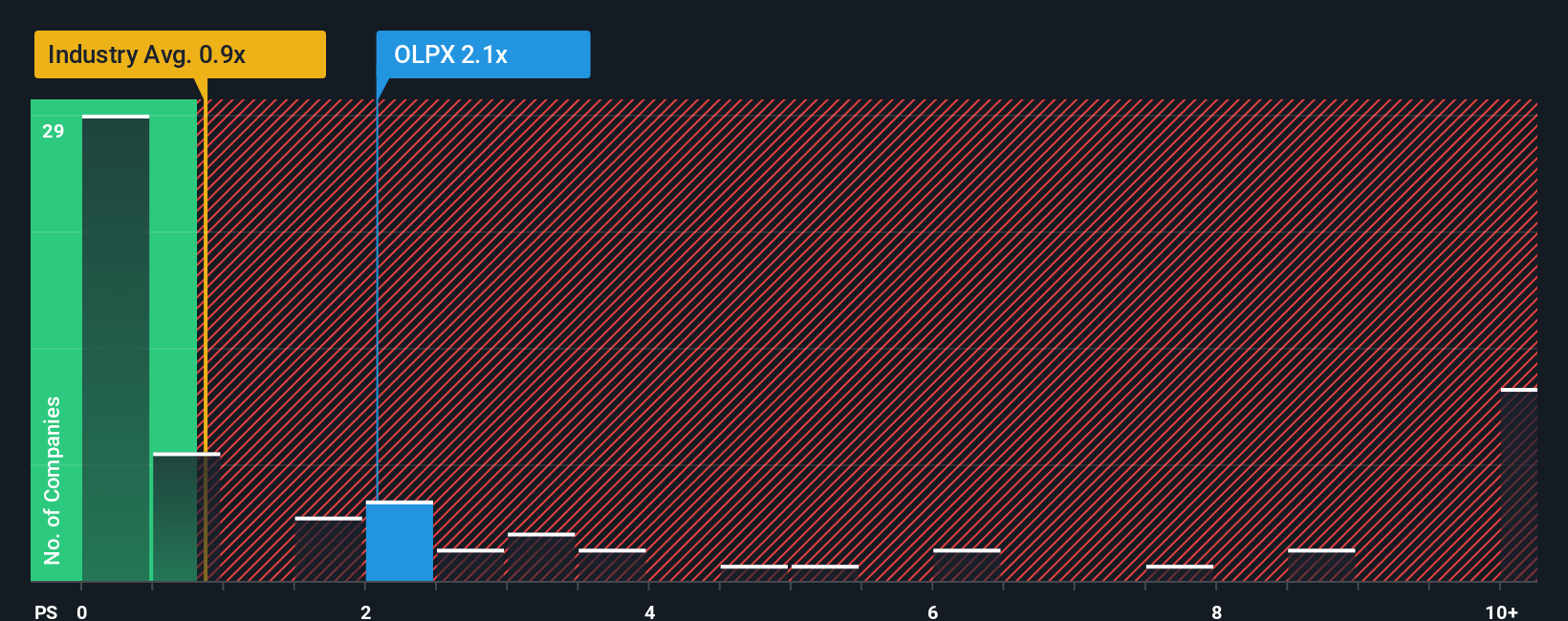

After such a large jump in price, you could be forgiven for thinking Olaplex Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in the United States' Personal Products industry have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Olaplex Holdings

How Olaplex Holdings Has Been Performing

Recent times haven't been great for Olaplex Holdings as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Olaplex Holdings will help you uncover what's on the horizon.How Is Olaplex Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Olaplex Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 43% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 2.8% over the next year. With the industry predicted to deliver 5.1% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Olaplex Holdings' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Olaplex Holdings' P/S?

Olaplex Holdings' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Olaplex Holdings, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Olaplex Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报