Sekisui House Reit (TSE:3309) H1 Net Income Slide Tests Bullish Margin Narrative

H1 2026 Earnings Snapshot

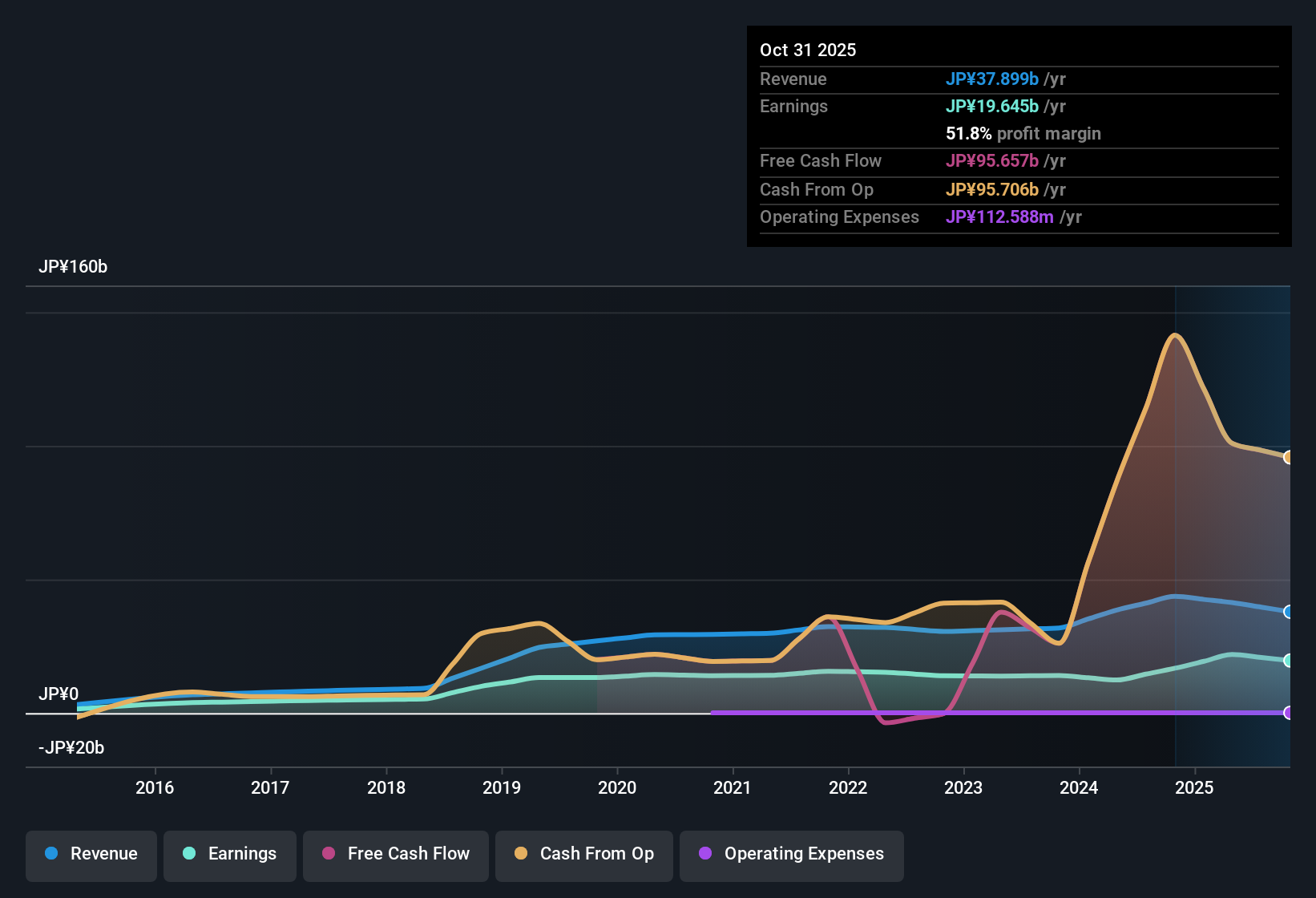

Sekisui House Reit (TSE:3309) has posted its H1 2026 numbers with revenue of ¥19.4 billion and basic EPS of ¥2,199.20, setting the stage for investors to reassess the story around this residential REIT. Over the last three half year periods, revenue has moved from ¥21.6 billion in H1 2025 to ¥19.7 billion in H2 2025 and now ¥19.4 billion in H1 2026, while basic EPS tracked from ¥2,698.69 to ¥2,320.43 and then ¥2,199.20. This frames a steady reset that puts the focus firmly on how sustainable today’s margins really are.

See our full analysis for Sekisui House Reit.With the latest half year results on the table, the next step is to line these numbers up against the dominant narratives around Sekisui House Reit to see which views hold up and which need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Hold Up At 50.2 percent

- On a trailing 12 month basis, net profit margin is 50.2 percent compared with 38.4 percent a year earlier, alongside 17.1 percent earnings growth and 6.6 percent annualized earnings growth over five years.

- What stands out for a bullish narrative is how these strong margins sit next to softer recent halves, as H1 2026 net income was ¥9,516 million versus ¥11,824 million in H1 2025 and ¥10,128 million in H2 2025.

- This combination of higher trailing margin and a three period net income step down raises the question of whether past profitability levels are sustainable or if they are already normalizing.

- Supporters who point to margin strength as the core of the bullish case need to factor in that the most recent half year is weaker than the earlier periods feeding into that 50.2 percent figure.

Revenue And Earnings Forecast To Shrink

- Forward looking figures in the analysis show revenue expected to decline about 7.2 percent per year and earnings by 12.4 percent per year over the next three years.

- Bears focus on these contraction forecasts as their main concern, especially when set against the trailing 17.1 percent earnings growth and 50.2 percent net margin.

- The contrast between backward looking growth and forward looking declines underpins the cautious view that recent strength may not repeat in the medium term.

- That same cautious view also flags the company’s high debt level as an added risk in a period when both revenue and earnings are projected to fall.

Valuation Stuck Between P E And DCF

- The units trade on a P E of 18.2 times, below the JP REITs average of 19.8 times and the peer average of 21.8 times, yet the DCF fair value of ¥30,157.47 is far below the current ¥83,000 price.

- For a bearish narrative, critics highlight that a 4.76 percent dividend yield and below peer P E multiple sit awkwardly beside a DCF fair value that is roughly one third of the current price.

- This gap between relative valuation support on P E and a much lower DCF fair value is exactly the kind of tension skeptics point to when questioning upside from here.

- Income oriented investors may still see appeal in the 4.76 percent yield, but bears would argue that any mispricing implied by the DCF matters more than the distribution in the longer run.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sekisui House Reit's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite resilient margins, Sekisui House Reit faces shrinking revenue and earnings forecasts, high leverage, and a wide gap between market price and DCF fair value.

If that combination of debt pressure and uncertain future cash flows feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1944 results) today to focus on financially stronger businesses built to better withstand tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报