Market Participants Recognise Allergy Therapeutics plc's (LON:AGY) Revenues Pushing Shares 30% Higher

Allergy Therapeutics plc (LON:AGY) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 70%.

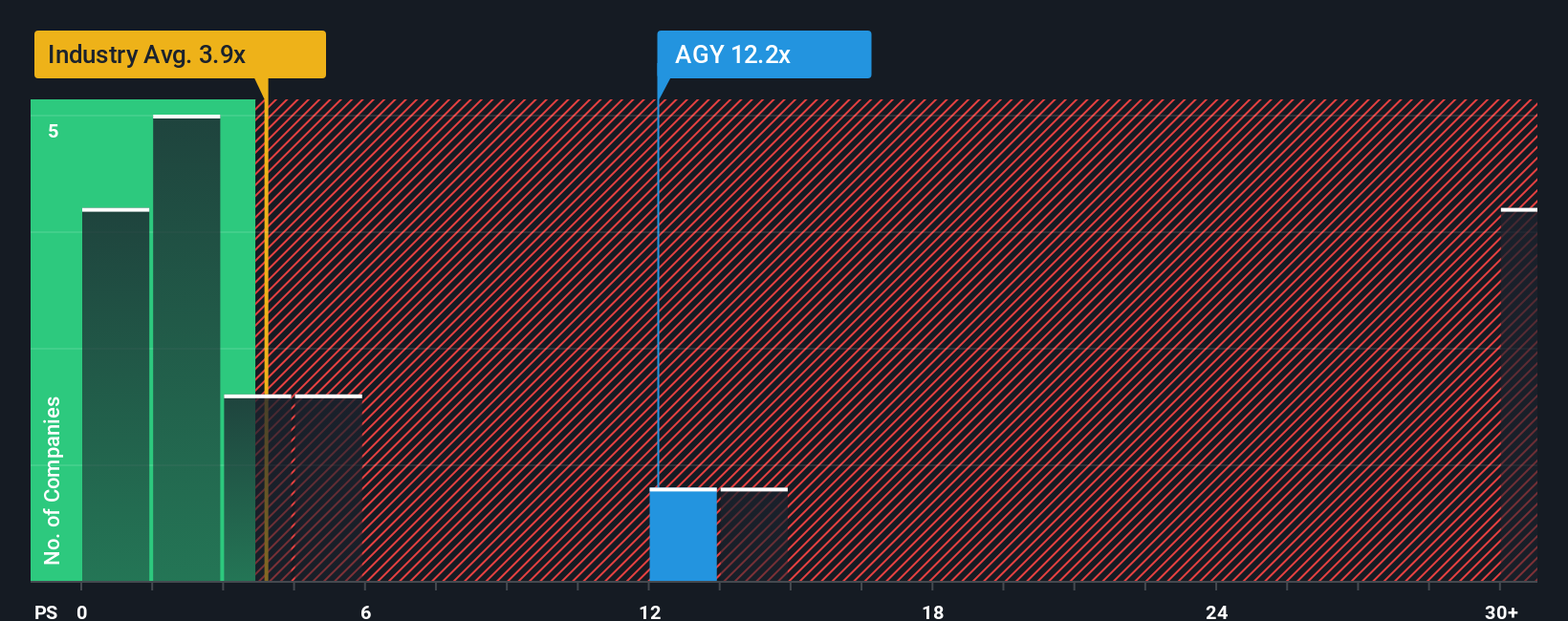

After such a large jump in price, given around half the companies in the United Kingdom's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3x, you may consider Allergy Therapeutics as a stock to avoid entirely with its 12.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Allergy Therapeutics

How Has Allergy Therapeutics Performed Recently?

Allergy Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Allergy Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Allergy Therapeutics' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 24% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 24% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 5.2%, which is noticeably less attractive.

In light of this, it's understandable that Allergy Therapeutics' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Allergy Therapeutics' P/S Mean For Investors?

Allergy Therapeutics' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Allergy Therapeutics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 5 warning signs for Allergy Therapeutics (3 are a bit concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报