Will GTT’s New CEO Shape a Credible Diversification Path for Gaztransport & Technigaz (ENXTPA:GTT)?

- GTT Group has announced that François Michel will become Chief Executive Officer on January 5, 2026, restoring a dissociated governance structure after a demanding selection process by the Board on December 13, 2025.

- Michel’s mix of high-level public policy experience and international industrial leadership is set to influence GTT’s technology roadmap and diversification push.

- We’ll now examine how Michel’s appointment as CEO could influence GTT’s investment narrative, particularly its innovation agenda and diversification efforts.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gaztransport & Technigaz Investment Narrative Recap

To own GTT, you need to believe its LNG containment franchise can stay profitable long enough to fund a credible shift into adjacent technologies, despite energy transition and diversification risks. François Michel’s appointment does not materially change the near term dependency on LNG carrier orders, but it does matter for execution on innovation and diversification, where missteps at Elogen and in new segments remain a key risk.

Among recent announcements, the raised 2025 revenue guidance to €790m to €820m stands out, as it reinforces how much the current investment case is still anchored in the existing LNG order book and royalty model rather than any yet to be proven diversification benefits.

Yet even with higher near term revenue guidance, investors should be aware of the execution risk around GTT’s diversification into...

Read the full narrative on Gaztransport & Technigaz (it's free!)

Gaztransport & Technigaz's narrative projects €830.8 million revenue and €387.8 million earnings by 2028. This requires 4.2% yearly revenue growth and about a €30.4 million earnings increase from €357.4 million today.

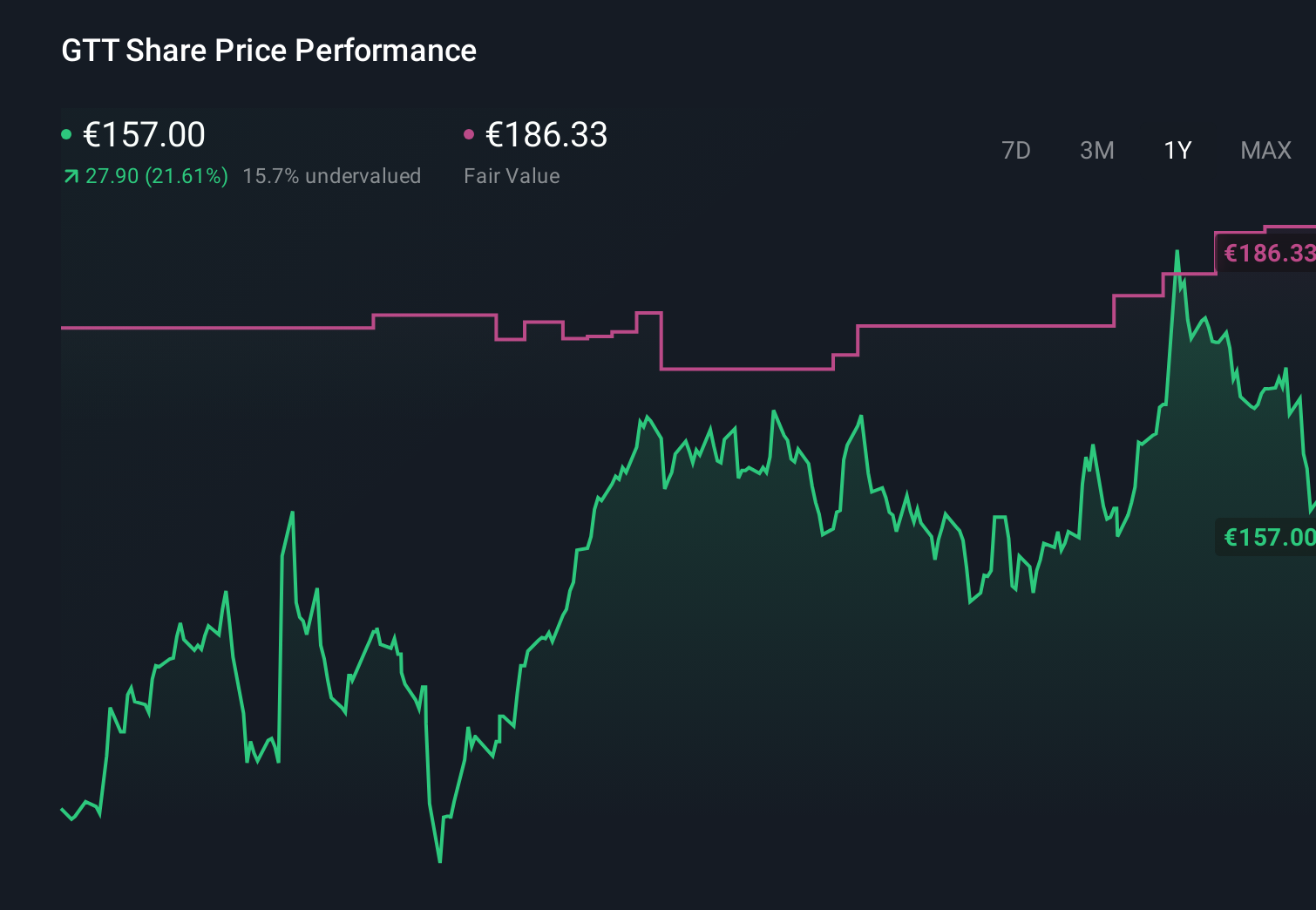

Uncover how Gaztransport & Technigaz's forecasts yield a €186.33 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place GTT’s fair value between €186.33 and €236.37, which shows how far opinions can spread. Set this against GTT’s reliance on LNG demand in a world tightening carbon rules, and it becomes worth weighing several different views on how resilient the current business model really is.

Explore 4 other fair value estimates on Gaztransport & Technigaz - why the stock might be worth just €186.33!

Build Your Own Gaztransport & Technigaz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaztransport & Technigaz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gaztransport & Technigaz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaztransport & Technigaz's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报