Hangzhou Fortune Gas Cryogenic Group Leads 3 Undiscovered Asian Gems

As global markets experience fluctuations driven by interest rate adjustments and concerns over technology stock valuations, the small-cap sector, particularly in Asia, is garnering attention for its potential resilience and growth opportunities. With the Federal Reserve's recent rate cuts impacting market dynamics, investors are increasingly looking towards lesser-known companies that demonstrate strong fundamentals and adaptability. In this context, identifying stocks with robust business models and a capacity to thrive amidst economic shifts becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chudenko | NA | 4.70% | 23.23% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Creative & Innovative System | 0.72% | 37.76% | 64.55% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| ShenZhen Click TechnologyLTD | 2.65% | 28.95% | 21.45% | ★★★★★☆ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Suzhou Fengbei Biotech Stock | 42.33% | 18.50% | 13.12% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hangzhou Fortune Gas Cryogenic Group (SHSE:603173)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Fortune Gas Cryogenic Group Co., Ltd. operates in the cryogenic equipment industry and has a market capitalization of CN¥6.75 billion.

Operations: The company's revenue streams are derived from its operations in the cryogenic equipment sector. The market capitalization stands at CN¥6.75 billion, reflecting its scale within the industry.

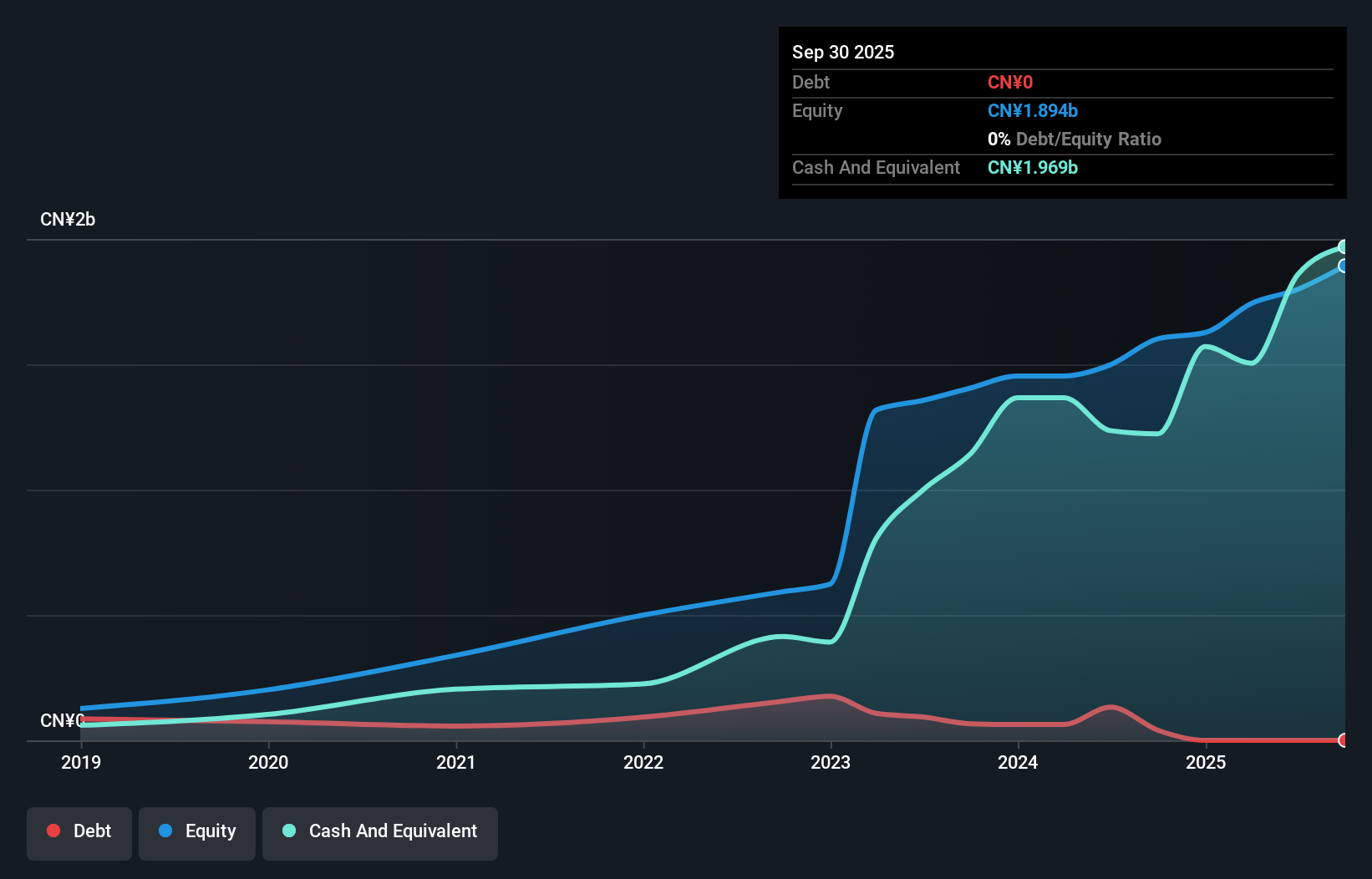

Hangzhou Fortune Gas Cryogenic Group, a nimble player in the machinery sector, is showing impressive growth. With earnings surging 56% over the past year, it outpaces the industry's 6.1% growth. The company reported sales of CNY 2.14 billion for nine months ending September 2025, up from CNY 1.65 billion last year, while net income rose to CNY 344.82 million from CNY 207.58 million previously. Trading at a substantial discount of nearly 93% below its estimated fair value adds appeal for potential investors seeking undervalued opportunities in Asia's dynamic market landscape.

Pamica Technology (SZSE:001359)

Simply Wall St Value Rating: ★★★★★★

Overview: Pamica Technology Corporation focuses on the R&D, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials with a market cap of CN¥11.69 billion.

Operations: Pamica Technology generates revenue primarily from the sale of mica insulation materials, glass fiber cloth, and new energy insulation materials. The company's financial performance is highlighted by its net profit margin trends, which offer insight into its profitability dynamics over time.

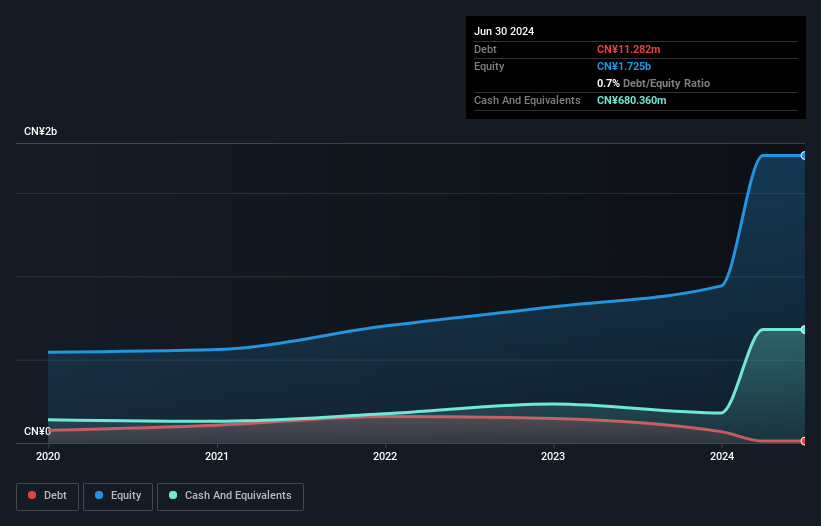

Pamica Technology stands out with its impressive financial performance, boasting a net income of CNY 200.91 million for the first nine months of 2025, up from CNY 163.72 million the previous year. Its earnings per share also increased to CNY 1.08 from CNY 0.96, indicating solid profitability growth. The company has more cash than total debt and is enjoying a favorable price-to-earnings ratio of 45.9x, below the industry average of 50.8x, suggesting it might be undervalued in its sector. With earnings growing at a rate surpassing industry norms and high-quality past earnings, Pamica seems poised for continued success in the electrical space.

- Unlock comprehensive insights into our analysis of Pamica Technology stock in this health report.

Evaluate Pamica Technology's historical performance by accessing our past performance report.

Elitegroup Computer SystemsLtd (TWSE:2331)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elitegroup Computer Systems Co., Ltd., along with its subsidiaries, engages in the design, development, manufacturing, and sale of computer equipment across Asia, America, Europe, and other international markets with a market cap of approximately NT$14.55 billion.

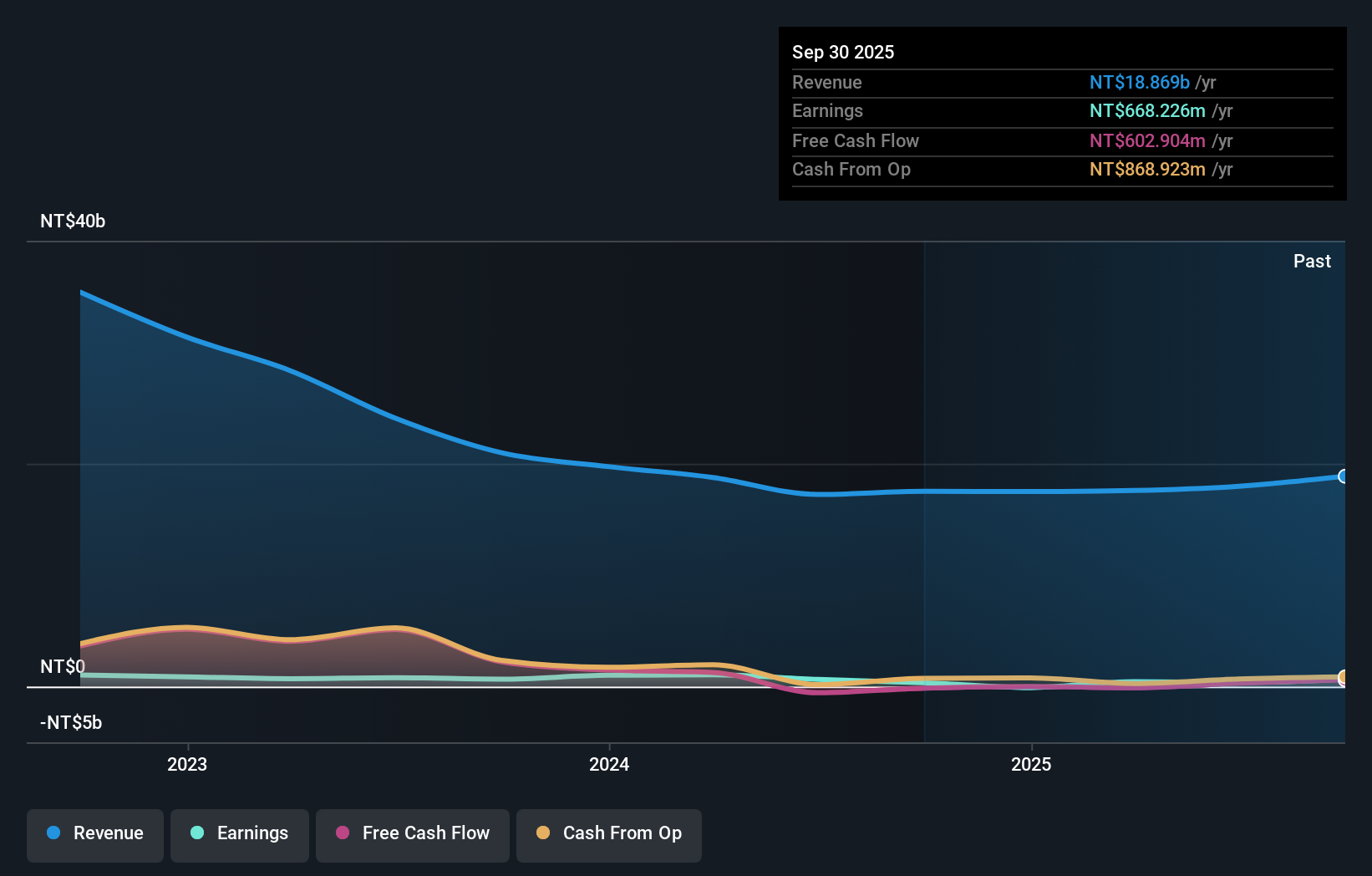

Operations: The company generates revenue primarily from the production and sales of computer equipment, amounting to NT$18.87 billion.

Elitegroup Computer Systems, a tech company with a knack for surprising growth, has seen its earnings skyrocket by 97% over the past year, outpacing the tech industry's modest 0.6%. This growth was bolstered by a significant one-off gain of NT$696 million in its recent financial results. The company's debt to equity ratio improved from 11.5% to 8.5% over five years, indicating better financial health. In the third quarter of 2025 alone, sales rose to TWD 5.63 billion from TWD 4.74 billion last year, while net income flipped from a loss to TWD 286 million profit, showcasing robust performance improvements across key metrics.

Where To Now?

- Click here to access our complete index of 2500 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报