Revenues Working Against AS Pro Kapital Grupp's (TAL:PKG1T) Share Price

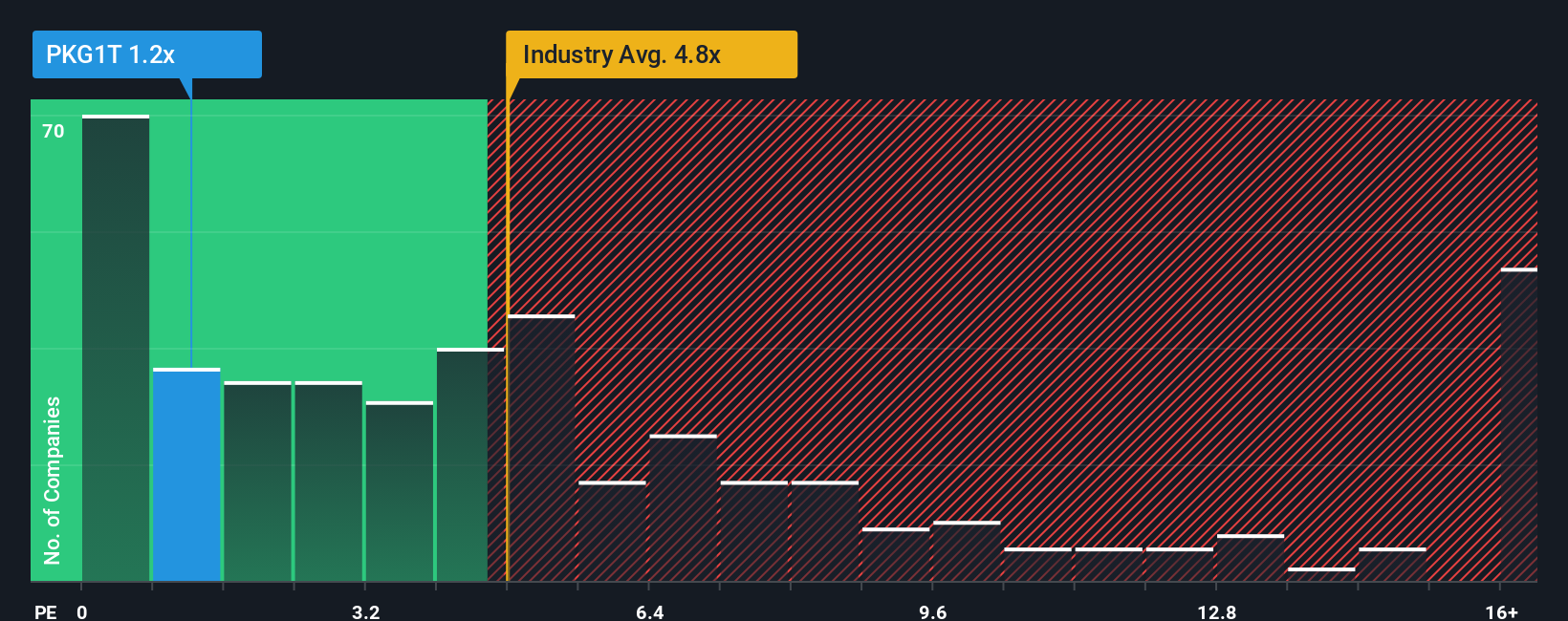

AS Pro Kapital Grupp's (TAL:PKG1T) price-to-sales (or "P/S") ratio of 1.2x might make it look like a strong buy right now compared to the Real Estate industry in Estonia, where around half of the companies have P/S ratios above 4.8x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AS Pro Kapital Grupp

What Does AS Pro Kapital Grupp's P/S Mean For Shareholders?

AS Pro Kapital Grupp certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on AS Pro Kapital Grupp will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AS Pro Kapital Grupp's earnings, revenue and cash flow.How Is AS Pro Kapital Grupp's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like AS Pro Kapital Grupp's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 206% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 51% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 2.6% shows it's an unpleasant look.

With this information, we are not surprised that AS Pro Kapital Grupp is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of AS Pro Kapital Grupp revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for AS Pro Kapital Grupp (of which 2 are concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报