Does Analyst Caution on Pricing Power Reveal a Deeper Competitive Strain in Conagra (CAG)?

- In recent days, analysts at Stifel Nicolaus and Goldman Sachs reiterated cautious views on Conagra Brands, keeping ratings at Hold or Sell while expressing concern over weakening fundamentals.

- Behind these ratings, analysts pointed to declining sales volumes, limited pricing power, and muted impact from new product launches in an intensely competitive packaged food market.

- Next, we’ll examine how this continued analyst caution around declining volumes and pricing power might reshape Conagra Brands’ existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Conagra Brands Investment Narrative Recap

To own Conagra Brands today, you need to believe its core packaged food portfolio can translate steady consumption into reliable cash flows, even as volumes soften and pricing power is tested. The latest Hold and Sell ratings, with lower price targets, reinforce that the key short term catalyst is management’s ability to stabilize volumes, while the biggest risk is that weakening demand and limited pricing responses undermine already modest growth expectations.

In that context, Conagra’s decision on 1 October 2025 to reaffirm its fiscal 2026 guidance for organic net sales growth of (1)% to 1% stands out. This guidance now sits against a backdrop of analyst concern about declining volumes, so any evidence that the company can still hit those targets has become central to how investors assess both the near term catalyst and the durability of its earnings base.

Yet even with this guidance, investors should be aware that weakening volumes and constrained pricing leave Conagra more exposed if...

Read the full narrative on Conagra Brands (it's free!)

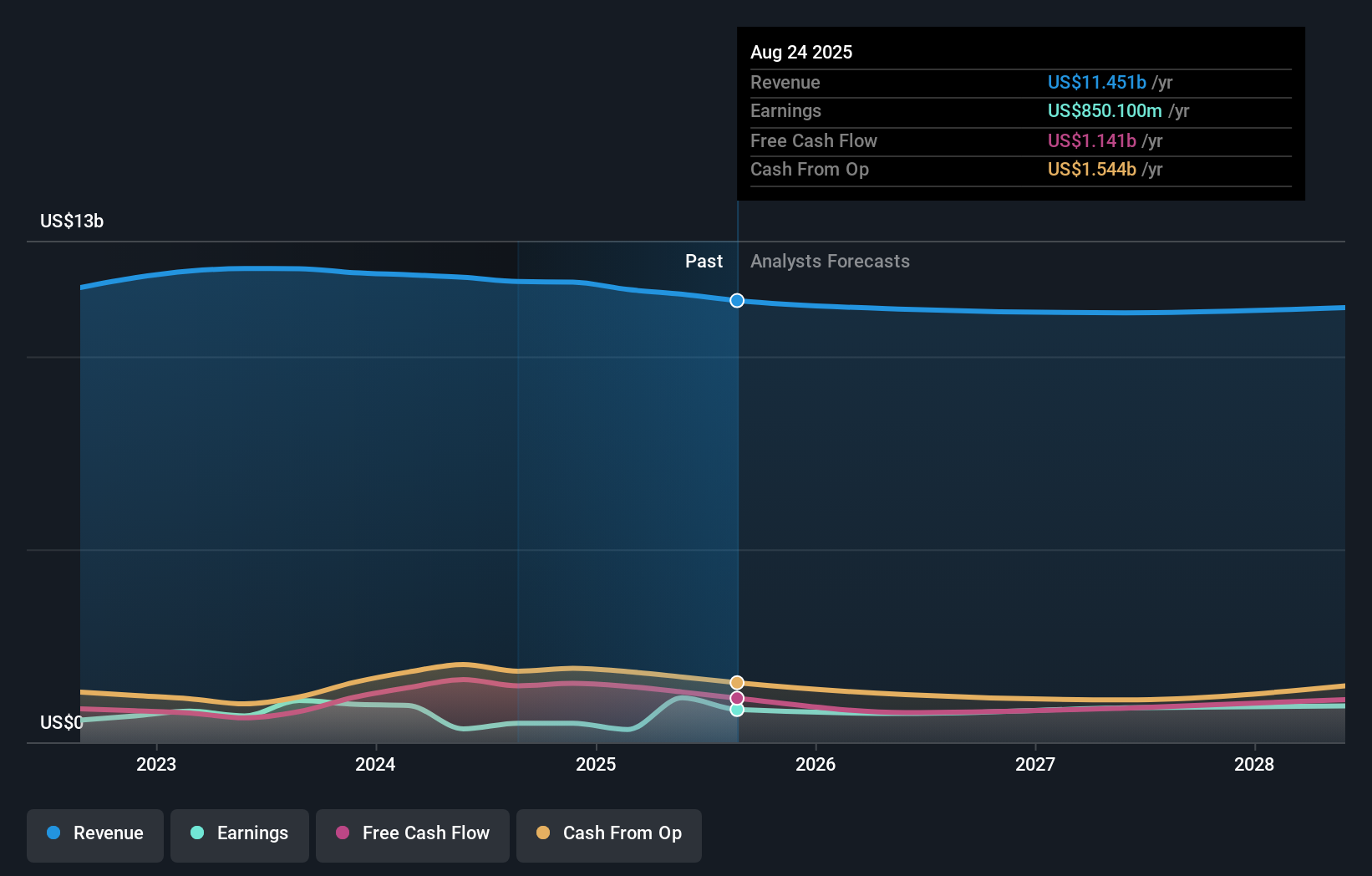

Conagra Brands' narrative projects $11.4 billion revenue and $905.9 million earnings by 2028. This assumes revenue declines by 0.5% per year and an earnings decrease of about $300 million from roughly $1.2 billion today.

Uncover how Conagra Brands' forecasts yield a $20.22 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span roughly US$17 to about US$73.65, showing just how far apart individual views on Conagra can be. You can weigh these against the risk that softening volumes and limited pricing power pressure margins and challenge the company’s ability to meet its reaffirmed guidance and longer term earnings goals.

Explore 10 other fair value estimates on Conagra Brands - why the stock might be worth over 4x more than the current price!

Build Your Own Conagra Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Conagra Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Conagra Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Conagra Brands' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报