DroneShield (ASX:DRO) Valuation Check After New €2.8m Belgian Counter-Drone Contract and Rising Investor Optimism

DroneShield (ASX:DRO) just landed a €2.8 million contract with Belgium for handheld drone jammers, a deal that neatly captures how fast European demand for counter drone tech is moving from trials to real deployment.

See our latest analysis for DroneShield.

The contract lands as DroneShield’s A$2.3 share price rides powerful momentum, with a 1 day share price return of 10.6 percent and year to date share price return above 200 percent. Its 1 year total shareholder return of roughly 274 percent and 5 year total shareholder return above 1,200 percent show how enthusiasm has steadily built despite bouts of shorter term volatility.

If this kind of defense tech story interests you, it is worth seeing what else is emerging across Europe and beyond by exploring aerospace and defense stocks.

With revenue and earnings surging, a deep sales pipeline and analyst targets still sitting far above the current A$2.30 share price, is DroneShield an overlooked growth story, or are investors already paying up for tomorrow’s wins?

Most Popular Narrative: 55.3% Undervalued

Against DroneShield's last close at A$2.30, the most followed narrative anchors fair value at more than double that level, implying substantial upside if its growth path holds.

Substantial ongoing investment in proprietary AI driven detection, sensor fusion, and subscription based (SaaS) offerings fortifies DroneShield's margin profile and earnings quality. This enables premium pricing and recurring revenue streams as the business pivots beyond hardware only sales. Expanded global manufacturing capacity across Australia, Europe, and the U.S., combined with a diversified and growing international sales pipeline, positions the company to deliver on larger deal sizes and scale operations efficiently, supporting earnings leverage and margin improvement through economies of scale.

Want to see the math behind that ambitious valuation? The narrative leans on rapid revenue expansion, sharp margin lift, and a future earnings multiple usually reserved for market darlings. Curious which specific growth and profitability assumptions need to land for that upside to materialize? Dive in to uncover the projections driving this fair value.

Result: Fair Value of A$5.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched valuations and lumpy defense contracts mean that any delayed orders or missed growth targets could quickly unwind expectations for DroneShield’s bullish narrative.

Find out about the key risks to this DroneShield narrative.

Another View: Market Ratios Flash Caution

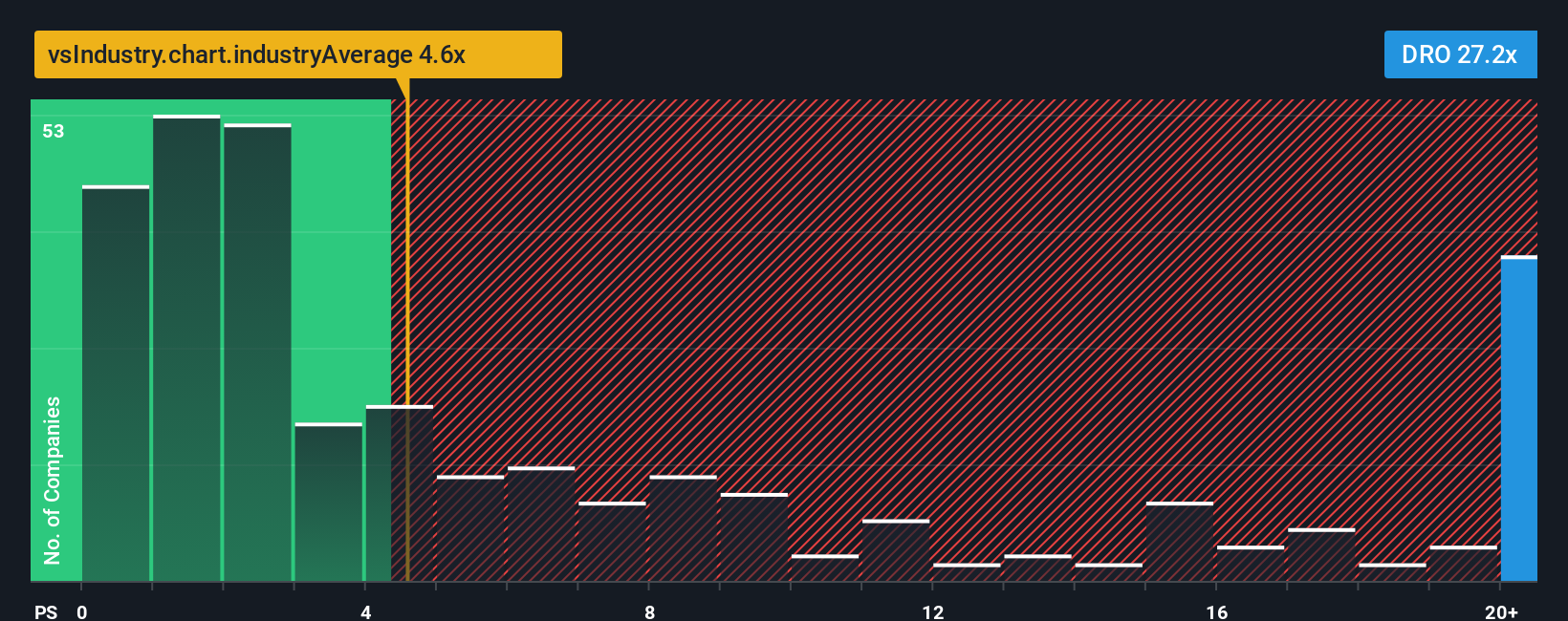

While our fair value work suggests upside, DroneShield’s share price already bakes in a lot of optimism when you look at simple sales based ratios. It trades on a rich 19.6 times sales versus 4.2 times for the global Aerospace and Defense industry and 3.8 times for peers, and even above a 16.9 times fair ratio that the market could eventually gravitate toward.

That kind of gap can work both ways, amplifying gains if growth delivers, but also leaving little room for disappointment. How comfortable are you with paying tomorrow’s growth price today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

If the story so far clashes with your own view, or you would rather trust your own digging, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one compelling story. Use the Simply Wall St Screener to uncover fresh opportunities that keep your portfolio one step ahead.

- Capture potential market mispricing early by scanning these 908 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations before sentiment catches up.

- Ride digital trends by targeting these 80 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and next generation financial infrastructure.

- Tap into innovation by focusing on these 27 quantum computing stocks pushing the limits of computing power and real world problem solving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报