All for One Group (XTRA:A1OS) Q3 EPS Volatility Tests Bullish Margin Expansion Narrative

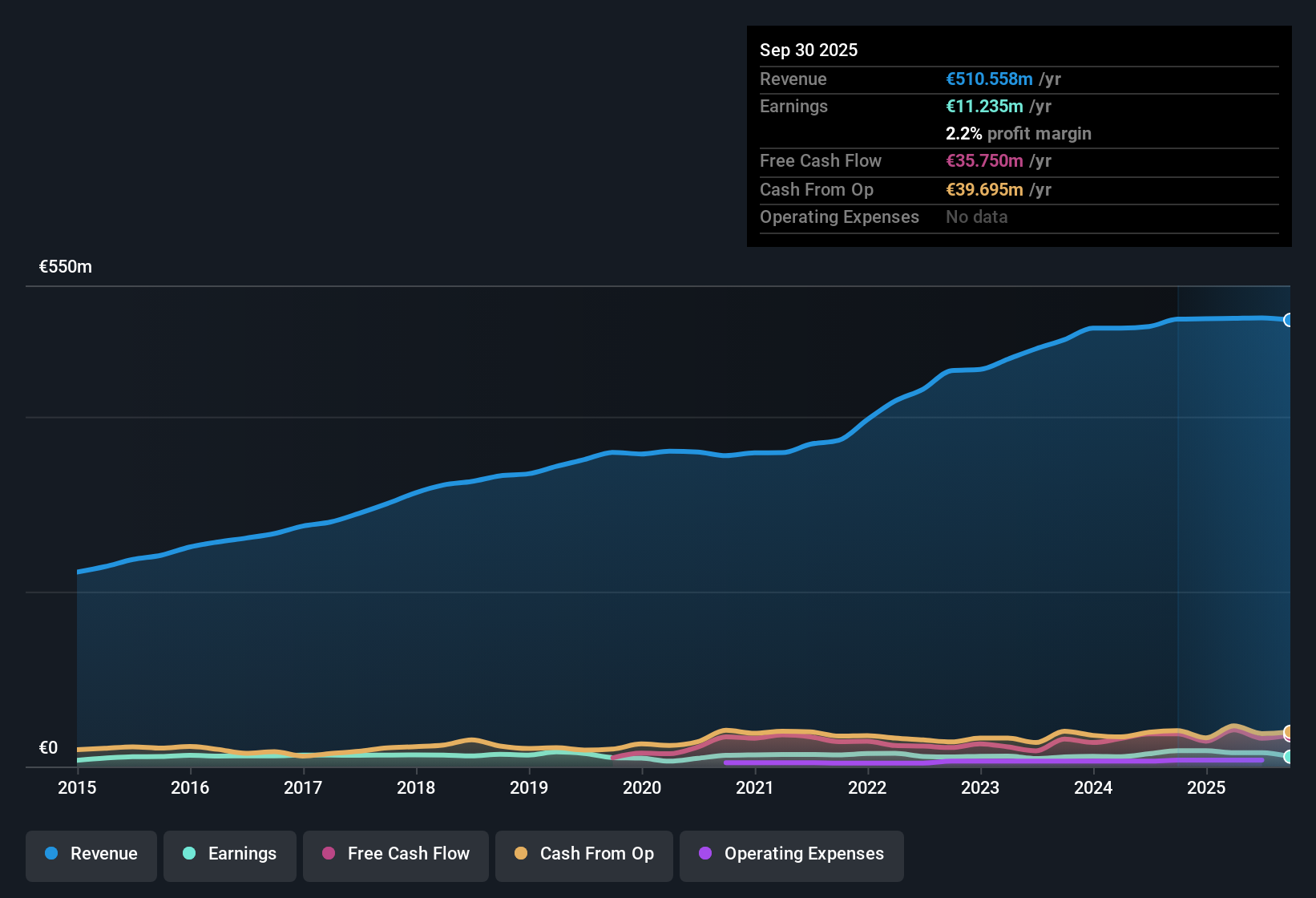

All for One Group (XTRA:A1OS) has just posted its FY 2025 Q3 numbers, with revenue at €122.8 million and EPS of €0.14, marking another quarter of modest profitability following last year’s improvement in earnings. The company has seen revenue hover around the €122 million to €134 million range over recent quarters, while EPS has swung from €0.11 in FY 2024 Q3 to €1.33 in FY 2025 Q1 and now €0.14 in Q3. This pattern places greater emphasis on how consistently those profits can translate into sturdier margins ahead.

See our full analysis for All for One Group.With the latest figures on the table, the next step is to weigh these results against the dominant market narratives around All for One Group and assess which stories about its growth, resilience, and profitability are supported by the data.

See what the community is saying about All for One Group

Net Margin Still Thin at 3.1%

- Over the last 12 months, net profit margin sat at 3.1%, only slightly higher than the prior year’s 2.9% even though earnings grew 8.9% year on year.

- Analysts' consensus view expects margins to move meaningfully higher, and the current numbers give a mixed backdrop for that:

- The consensus narrative sees the shift to cloud subscriptions and more managed services eventually lifting margins. This fits with margins edging up to 3.1%, but that increase is still modest versus the longer term target of 5.7% in three years.

- At the same time, the move from one off licenses to cloud and consulting work is linked to revenue recognition challenges and weaker organic growth. This is consistent with EPS in FY 2025 dropping from 1.33 euros in Q1 to 0.14 euros in Q3 even as full year margins improve only slowly.

Revenue Steady, Earnings Choppy

- Quarterly revenue has stayed in a narrow band between about 122 million and 134 million euros over the last six reported quarters, while basic EPS jumped from 0.11 euros in FY 2024 Q3 to 1.613465 euros in FY 2024 Q4 and then down to 0.14 euros in FY 2025 Q3.

- Consensus narrative links a big part of this pattern to the business model shift, and the figures help show both the promise and the bumpiness:

- Supportive of the bullish angle, recurring style revenue from subscriptions and S or 4HANA related consulting is expected to bring more predictable earnings over time, while trailing 12 month earnings have already grown 8.9% to net income of 15.883 million euros.

- Challenging that same bullish angle in the near term, the transition is associated with lower immediate revenues per deal and consulting pauses. This is reflected in Q1 FY 2025 net income of 6.49 million euros dropping to 0.686 million euros by Q3 even though revenue stayed above 122 million euros each quarter.

Cheap on 12.6x P/E With DCF Upside

- The stock trades on a trailing P or E of 12.6 times at a share price of 41.7 euros, below the European IT industry at 18.9 times and peers at 26.1 times, and also well under a DCF fair value of about 172.50 euros.

- For more cautious investors, these valuation gaps sit alongside operational frictions from the cloud transition that the consensus narrative also flags:

- On one side, the combination of 8.9% trailing earnings growth, a 3.84% dividend yield, and P or E below sector averages strongly backs a value oriented bullish case if the forecast move to 5.7% margins and earnings of 33.9 million euros by around 2028 is met.

- On the other, bears could point out that achieving an analyst style price target of 81.70 euros still relies on solid execution in Europe where some customers are delaying digital projects, something that is already visible in relatively low net margins of 3.1% despite the revenue base of 512.943 million euros over the last 12 months.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for All for One Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on the latest results, shape a concise view in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding All for One Group.

Explore Alternatives

All for One Group's thin margins, choppy quarterly earnings, and execution risks around its cloud transition highlight how uneven its current growth profile still looks.

If this volatility makes you uneasy, use our stable growth stocks screener (2101 results) to shift your focus toward companies delivering steadier revenue and earnings progress that can compound more predictably over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报