ASML (ENXTAM:ASML) Valuation Check After China Export Scrutiny and Ongoing AI-Driven Optimism

ASML Holding (ENXTAM:ASML) is back in the spotlight after Dutch media reports alleged sales of equipment to Chinese entities linked to SMIC and the military, putting export controls and geopolitical risk firmly on investors' radar.

See our latest analysis for ASML Holding.

The headlines have added some short term noise, with a recent pullback contributing to a 7 day share price return of minus 3.3 percent, but the 90 day share price return of 27 percent and five year total shareholder return of roughly 156 percent still signal strong, if increasingly scrutinised, momentum around ASML’s AI exposed growth story.

If the ASML news has sharpened your focus on the semiconductor value chain, it could be a good moment to explore other chip exposed opportunities through high growth tech and AI stocks.

With shares up strongly over the past year and trading only modestly below consensus targets, the key question now is whether recent geopolitical jitters create a genuine entry point or if the market already reflects ASML’s next decade of AI driven growth.

Most Popular Narrative Narrative: 6.9% Undervalued

With ASML Holding closing at €931 against a narrative fair value of €1,000, the valuation debate centers on how durable its growth runway really is.

ASML delivered a solid quarter, with:

• Net sales of €7.7 billion

• Gross margin of 53.7%

• Net income of €2.3 billion (29.8% margin)

• €5.5 billion in net bookings, including €2.3 billion in EUV orders

• €2.1 billion in Installed Base Management (IBM) sales

In addition, ASML successfully shipped its first TWINSCAN EXE:5200B, a next-generation EUV machine built for even smaller and more powerful chips.

According to Investingwilly, the case for upside hangs on a powerful mix of accelerating earnings, premium margins and a future valuation multiple usually reserved for market defining chip giants.

Result: Fair Value of $1000.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening export controls or a prolonged 2026 slowdown in equipment demand could compress ASML’s growth expectations and challenge the undervaluation thesis.

Find out about the key risks to this ASML Holding narrative.

Another View: DCF Flags a Very Different Story

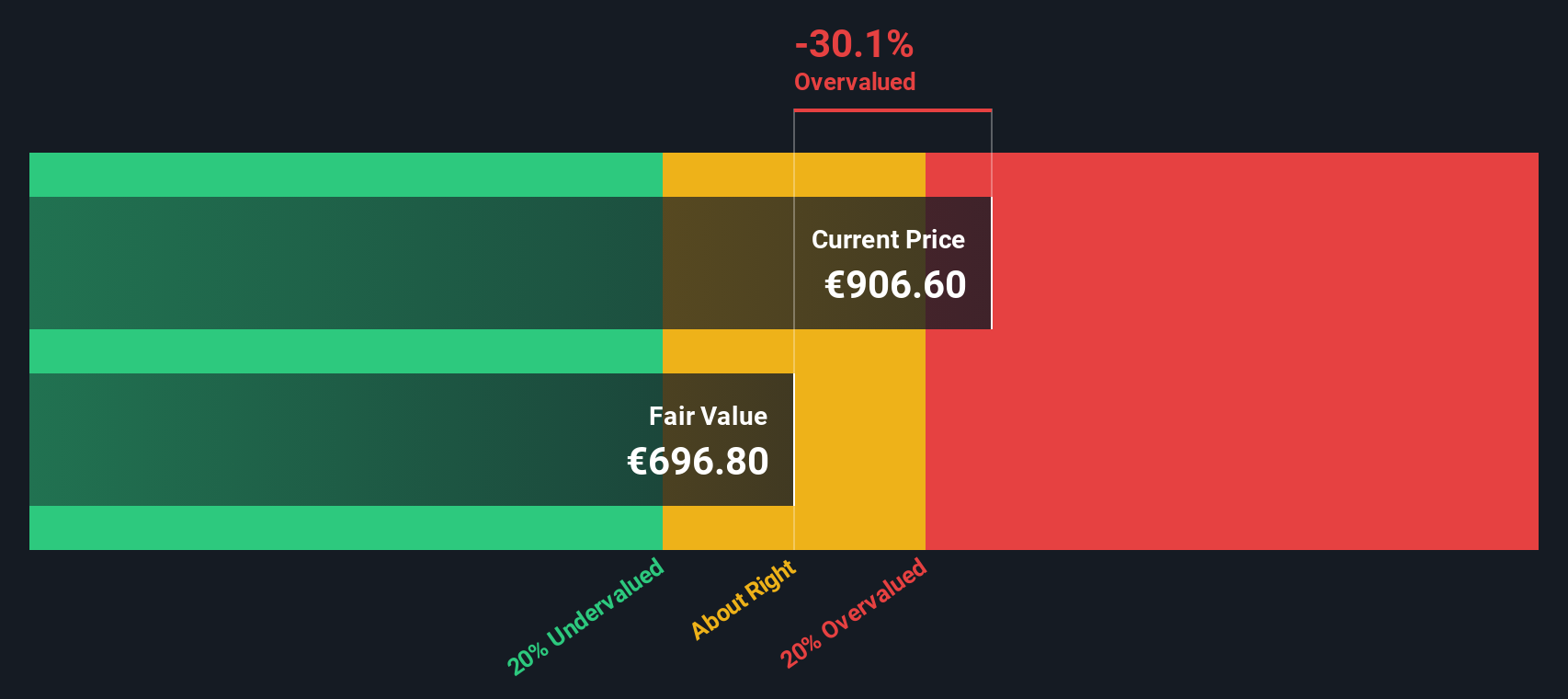

While the popular narrative sees ASML as 6.9 percent undervalued, our DCF model presents a different view of optimism already reflected in the price, with fair value closer to €701 versus the €931 share price. Is the market overestimating how far this AI cycle can stretch?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASML Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASML Holding Narrative

If you see the story differently or prefer to test your own assumptions against the numbers, you can build a complete view in minutes: Do it your way.

A great starting point for your ASML Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, identify your next watchlist candidates with focused screens on quality, growth and income opportunities that other investors may be overlooking.

- Turn small positions into potential breakouts by targeting these 3612 penny stocks with strong financials that already support their low prices with solid fundamentals.

- Participate in the structural shift to intelligent automation with these 26 AI penny stocks that focus on companies related to AI acceleration.

- Strengthen your margin of safety by filtering for these 910 undervalued stocks based on cash flows where current prices reflect a discount to the companies’ cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报