AGL Energy (ASX:AGL) Valuation Check as It Seeks Private Capital for Renewable and Grid Assets

AGL Energy (ASX:AGL) has joined Origin in courting private capital for its green energy and utility assets, marking a strategic shift that could reshape how investors think about funding Australia’s energy transition.

See our latest analysis for AGL Energy.

The latest push to bring private capital into AGL’s renewables and grid assets comes after a choppy year, with a negative year to date share price return but a solid three year total shareholder return. This signals that longer term momentum in the story is still building.

If AGL’s repositioning has caught your attention, it might also be a good time to see what else is changing in the sector. You can explore aerospace and defense stocks as another pocket of the market where large, capital intensive transitions can create interesting opportunities.

With the share price down year to date but still trading at a discount to analyst targets, the key question now is whether AGL is undervalued ahead of its transition, or if the market is already pricing in that future growth?

Most Popular Narrative Narrative: 17.2% Undervalued

With AGL Energy last closing at A$9.51 against a narrative fair value of A$11.48, the valuation case hinges on how its long term cash flows evolve.

Industry tailwinds such as government investment in renewables, grid stability initiatives, and increasing electrification of broader industries are expanding the total addressable market and project opportunities for AGL, which, given its established position and strong funding, is likely to benefit from market consolidation and economies of scale, positively impacting future revenue and earnings growth.

Want to see what future margins, earnings growth, and valuation multiple this narrative is baking in for AGL, and how those assumptions transform today’s losses into tomorrow’s profits?

Result: Fair Value of A$11.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on large battery projects or sustained margin pressure in retail could quickly challenge the current undervalued narrative that investors are leaning on.

Find out about the key risks to this AGL Energy narrative.

Another Angle on Value

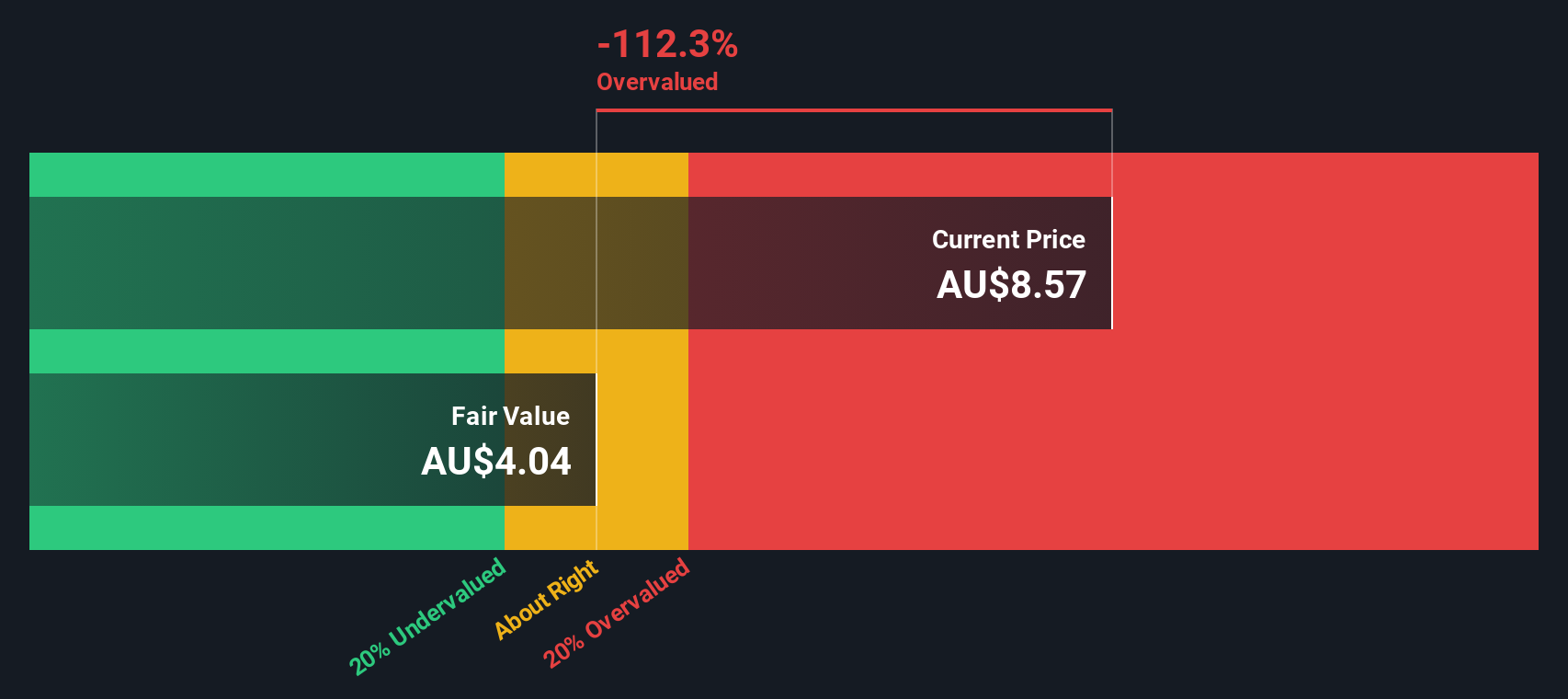

Our SWS DCF model paints a very different picture, suggesting AGL shares are actually overvalued at A$9.51 versus a fair value estimate of about A$0.44. If the cash flows do not live up to the bullish narrative, could today’s discount to analyst targets prove illusory?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AGL Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AGL Energy Narrative

If the conclusions above do not quite align with your own thinking, you can quickly dig into the numbers yourself and shape a custom view in minutes: Do it your way.

A great starting point for your AGL Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Put your research momentum to work now by scanning high potential opportunities on Simply Wall St’s screener, so you are not kicking yourself when the next leaders run.

- Explore long term compounding potential by targeting quality companies trading below estimated worth through these 910 undervalued stocks based on cash flows before any valuation gaps close.

- Focus on structural shifts in automation and data by identifying innovation standouts using these 26 AI penny stocks while adoption trends are still developing.

- Strengthen your income strategy by searching for robust payouts with these 14 dividend stocks with yields > 3% and compare yields across different interest rate environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报