Lotus HoldingsLtd And 2 Other Undiscovered Gems in Asia With Solid Potential

As global markets react to the Federal Reserve's interest rate cuts and mixed economic signals, small-cap stocks like those in the Russell 2000 Index have shown resilience, benefiting from their sensitivity to such monetary policy shifts. In this dynamic environment, identifying promising stocks requires a focus on companies with solid fundamentals and growth potential that can navigate these evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Namuga | 14.15% | -4.88% | 23.32% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Bonraybio | NA | 33.85% | 70.92% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| Zhongyeda Electric | 0.41% | -0.88% | -14.90% | ★★★★★☆ |

| KNJ | 65.48% | 8.93% | 40.98% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Sichuan Zigong Conveying Machine Group | 54.32% | 21.85% | 16.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Lotus HoldingsLtd (SHSE:600186)

Simply Wall St Value Rating: ★★★★★★

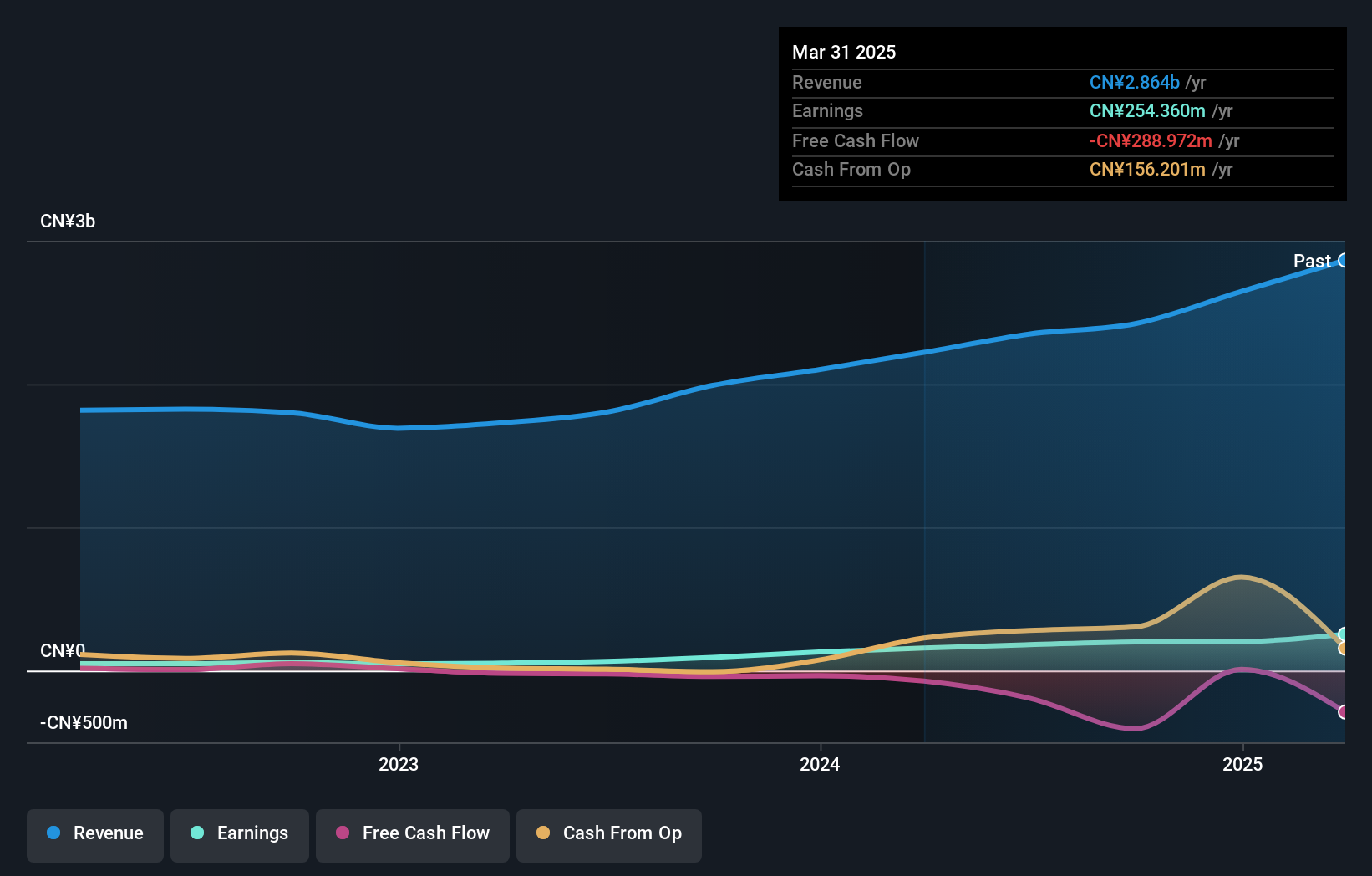

Overview: Lotus Holdings Co., Ltd. operates in China, focusing on the production and sale of condiments and health food, with a market capitalization of CN¥10.22 billion.

Operations: Lotus Holdings Ltd derives its revenue primarily from the sale of condiments and health food in China. The company's net profit margin stands at 15%, reflecting its profitability within this sector.

Lotus Holdings Ltd. is making waves with its recent performance, showcasing a robust earnings growth of 44.8% over the past year, significantly outpacing the Food industry average of 4.8%. The company's debt-to-equity ratio has improved from 38.9% to 35%, indicating a solid financial footing, while its interest payments are well-covered by EBIT at 16.8 times coverage. Notably, Lotus's price-to-earnings ratio sits at an attractive 35.2x compared to the CN market's average of 43.5x, suggesting potential value for investors seeking opportunities in Asia’s emerging markets.

- Get an in-depth perspective on Lotus HoldingsLtd's performance by reading our health report here.

Understand Lotus HoldingsLtd's track record by examining our Past report.

Jiangsu Changbao SteeltubeLtd (SZSE:002478)

Simply Wall St Value Rating: ★★★★★☆

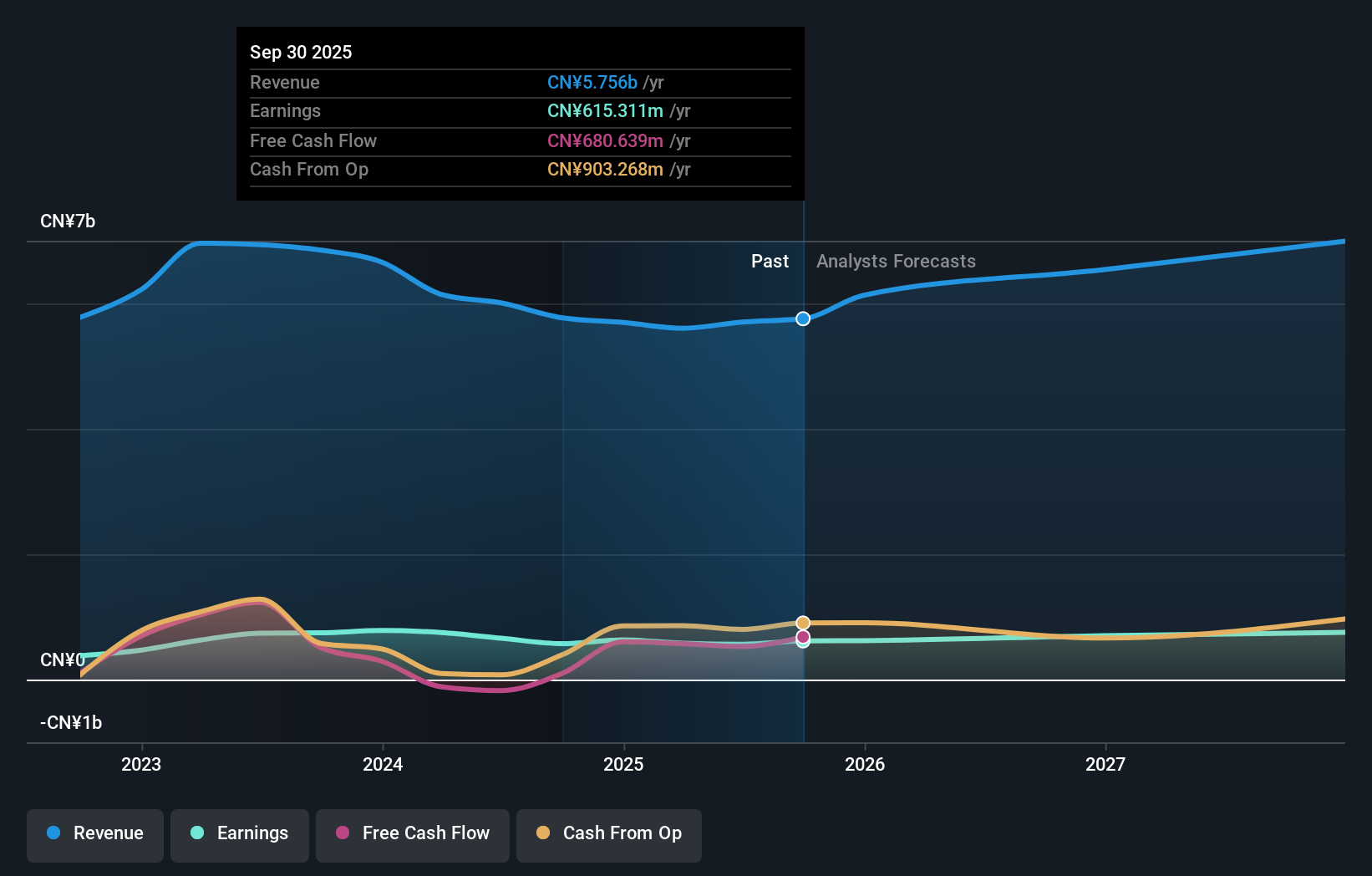

Overview: Jiangsu Changbao Steeltube Co., Ltd is engaged in the manufacturing and sale of steel tubes both within China and internationally, with a market capitalization of CN¥7.69 billion.

Operations: Jiangsu Changbao Steeltube generates revenue primarily from the production and sales of seamless steel pipes, amounting to CN¥5.76 billion.

Jiangsu Changbao Steeltube, a notable player in the steel industry, offers an intriguing investment case with its earnings growing 31% annually over the past five years. Despite a volatile share price recently, it trades at 71% below estimated fair value and maintains high-quality earnings. The company's debt to equity ratio has risen from 6.6% to 13%, yet it holds more cash than total debt, indicating strong financial health. Recent results for nine months ending September 2025 show sales of ¥4.28 billion and net income of ¥392 million, slightly down from last year's ¥411 million, reflecting market challenges but stable performance overall.

Nittetsu Mining (TSE:1515)

Simply Wall St Value Rating: ★★★★★☆

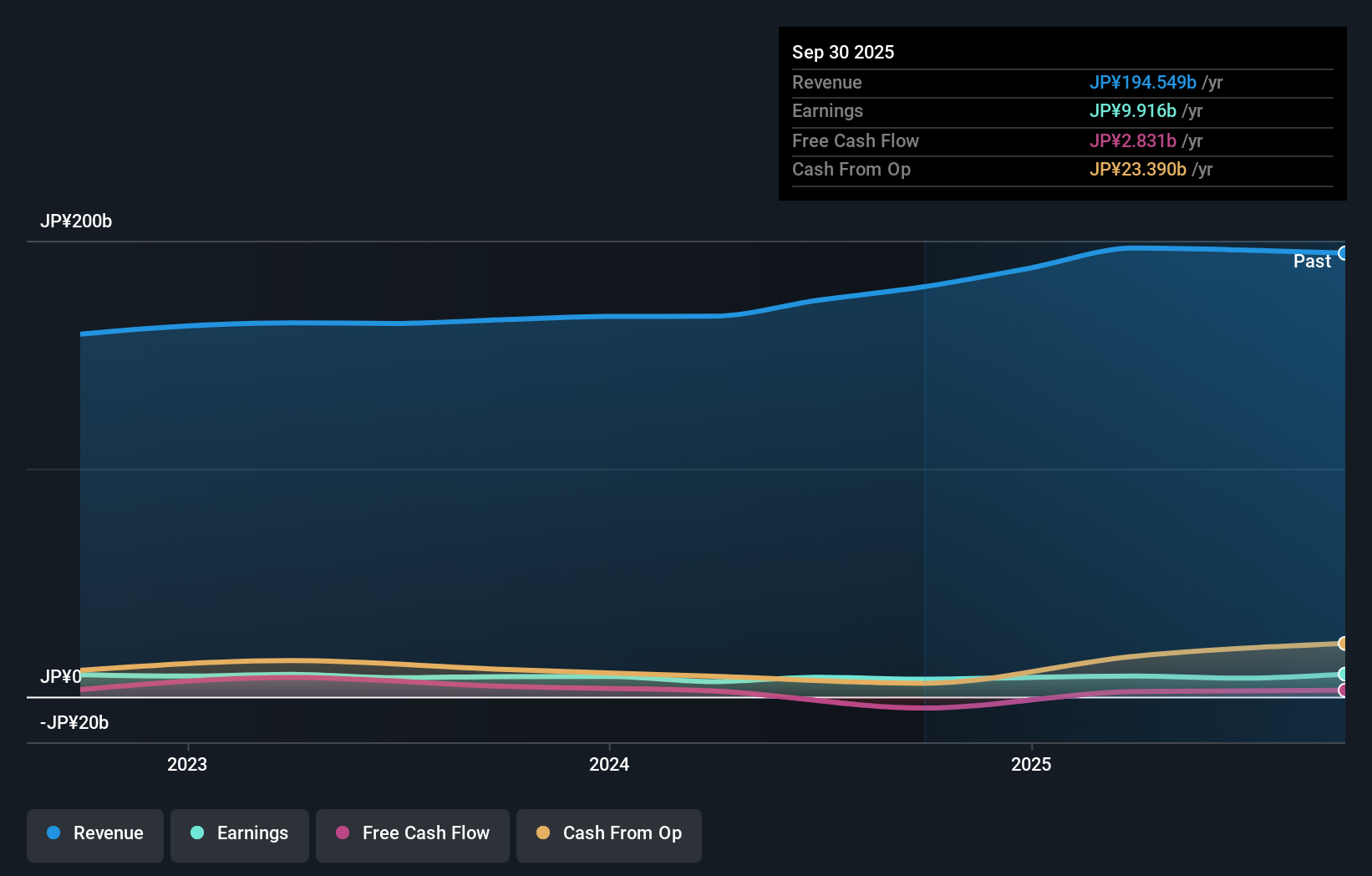

Overview: Nittetsu Mining Co., Ltd. is involved in mining operations both domestically and internationally, with a market capitalization of approximately ¥171.06 billion.

Operations: Nittetsu Mining generates revenue primarily from its Metal segment, contributing ¥107.92 billion, followed by the Ore segment at ¥66.22 billion. The Machinery and Environment division adds ¥16.37 billion to the revenue stream, while the Real Estate and Renewable Resource Energy segments contribute smaller portions of ¥4.76 billion and ¥1.83 billion respectively.

Nittetsu Mining, a nimble player in the mining sector, recently raised its earnings guidance for fiscal 2026 due to favorable copper prices and a weaker yen. The company forecasts net sales of JPY 196 billion and operating profit of JPY 13.9 billion, up from previous estimates. With earnings growth at 29% over the past year, Nittetsu outpaces the industry average of -8%. Despite a volatile share price recently, it trades at an attractive valuation—75% below estimated fair value. Additionally, Nittetsu's strategic joint venture with Camino Minerals aims to scale up copper production at Puquios mine using advanced leaching technologies.

- Click here and access our complete health analysis report to understand the dynamics of Nittetsu Mining.

Evaluate Nittetsu Mining's historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 2500 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报