Analyst Upgrades and Pearce Deal Might Change The Case For Investing In CBRE Group (CBRE)

- Earlier this week, CBRE Group gained fresh attention as Keefe, Bruyette & Woods and Barclays upgraded their ratings, citing the company’s diversified real estate services platform, contractual revenue mix, and ongoing technology and acquisition-driven expansion.

- These endorsements come on the heels of CBRE’s continued push into higher-growth, resilient service lines and recent M&A, including the approximately US$1.20 billion purchase of Pearce Services, LLC to broaden its global capabilities.

- We’ll now examine how this wave of analyst upgrades, highlighting CBRE’s diversified and resilient revenue base, reframes the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CBRE Group Investment Narrative Recap

To own CBRE, you need to believe in its shift toward resilient, services-led and contractual revenues that can offset cycles in transactional real estate activity. The latest analyst upgrades reinforce this narrative rather than changing it, while the key short term swing factor remains how quickly capital markets and leasing volumes recover. The biggest near term risk still lies in macro uncertainty and interest rate volatility, which can delay deals and pressure margins even for a diversified operator.

The announced US$1.20 billion acquisition of Pearce Services looks most relevant here, because it directly expands CBRE’s higher-growth, more recurring service offerings that analysts are highlighting. That deal, alongside the company’s ongoing technology investments, underpins the current catalyst of revenue mix improvement and more stable earnings, but it also raises the stakes if capital markets or broader economic conditions slow and constrain returns on new investments.

Yet even as CBRE leans further into resilient revenues, investors should be aware that its exposure to interest rate swings and recession risk could still...

Read the full narrative on CBRE Group (it's free!)

CBRE Group's narrative projects $50.0 billion revenue and $2.3 billion earnings by 2028. This requires 9.5% yearly revenue growth and about a $1.2 billion earnings increase from $1.1 billion today.

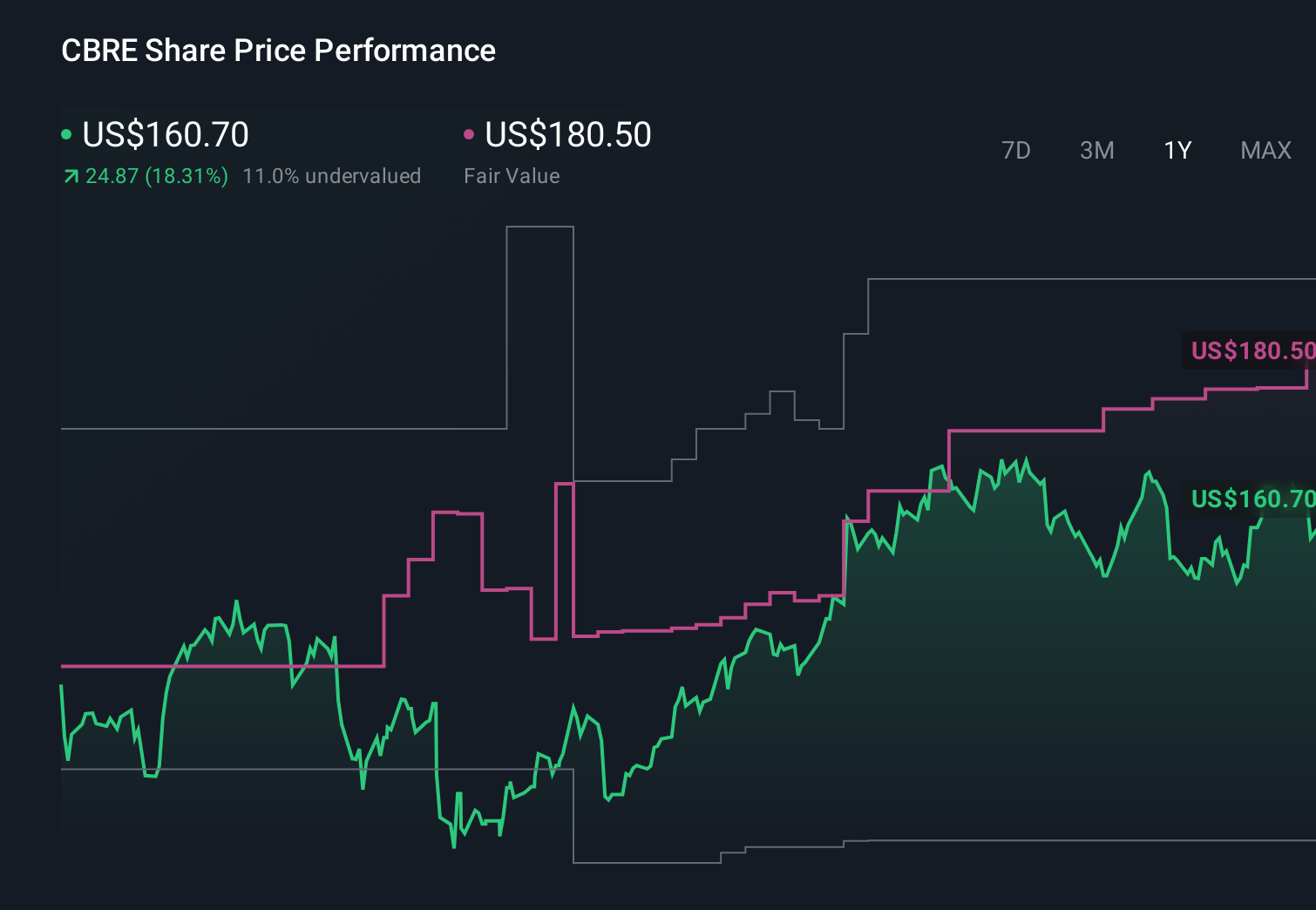

Uncover how CBRE Group's forecasts yield a $180.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$144.82 to US$218.54, showing how differently individual investors view CBRE’s future. Against this, CBRE’s push into more contractual, resilient service lines could matter a lot for how those expectations play out over time.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth 9% less than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报