3 TSX Penny Stocks With Market Caps Under CA$100M To Consider

The Canadian equity market has recently reached new record highs, buoyed by positive signals from the Bank of Canada and the Federal Reserve regarding interest rates. In this context, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite being a somewhat outdated term. Focusing on those with robust financials and potential for growth can uncover hidden value, and we've identified three such penny stocks that may offer both stability and upside potential for investors looking to explore beyond the larger market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.46 | CA$261.8M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.27 | CA$128.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$50.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.08 | CA$156.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.04 | CA$31.52M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.02 | CA$191.15M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on the acquisition, exploration, and development of mineral properties in North America, with a market cap of CA$98.52 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to CA$1.19 million.

Market Cap: CA$98.52M

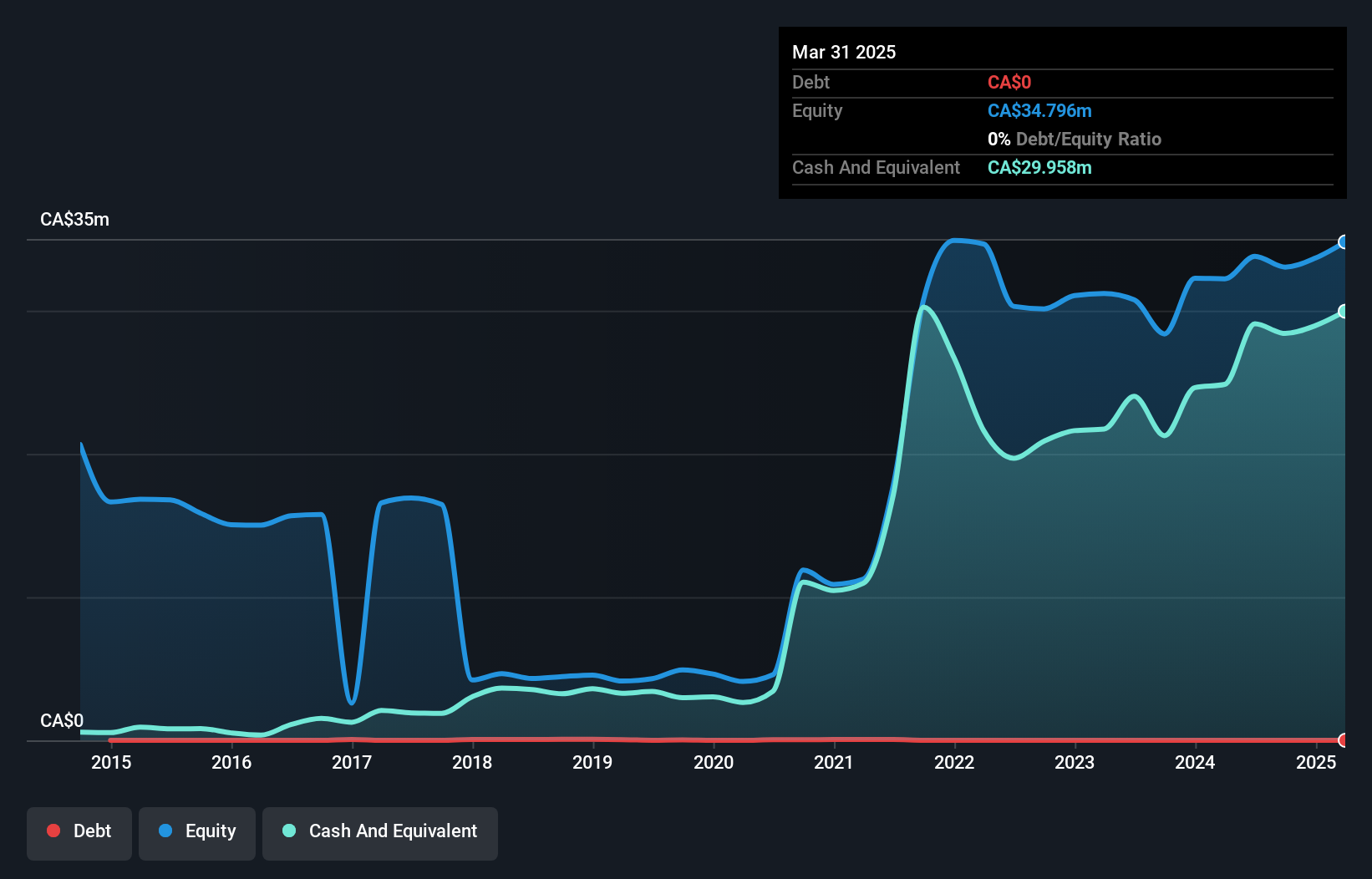

Globex Mining Enterprises, with a market cap of CA$98.52 million, remains pre-revenue with earnings primarily from non-cash sources. Recent assay results from the Rouyn-Merger property indicate promising gold mineralization, intersecting up to 12.60 g/t Au over 6.7 meters in one drill hole. The company has no debt and maintains a seasoned management team and board with extensive tenure, contributing to its stable operations despite limited revenue generation. Globex's strategic partnerships and ongoing exploration projects across North America position it for potential growth within the metals and mining sector amidst fluctuating industry dynamics.

- Dive into the specifics of Globex Mining Enterprises here with our thorough balance sheet health report.

- Understand Globex Mining Enterprises' track record by examining our performance history report.

Orbit Garant Drilling (TSX:OGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Orbit Garant Drilling Inc. offers mineral drilling services across Canada, the United States, Central and South America, and West Africa with a market cap of CA$53.82 million.

Operations: The company's revenue is derived from two main segments: Drilling International, which generates CA$53 million, and Drilling Canada (encompassing Surface Drilling, Underground Drilling, and Manufacturing Canada), contributing CA$134.4 million.

Market Cap: CA$53.82M

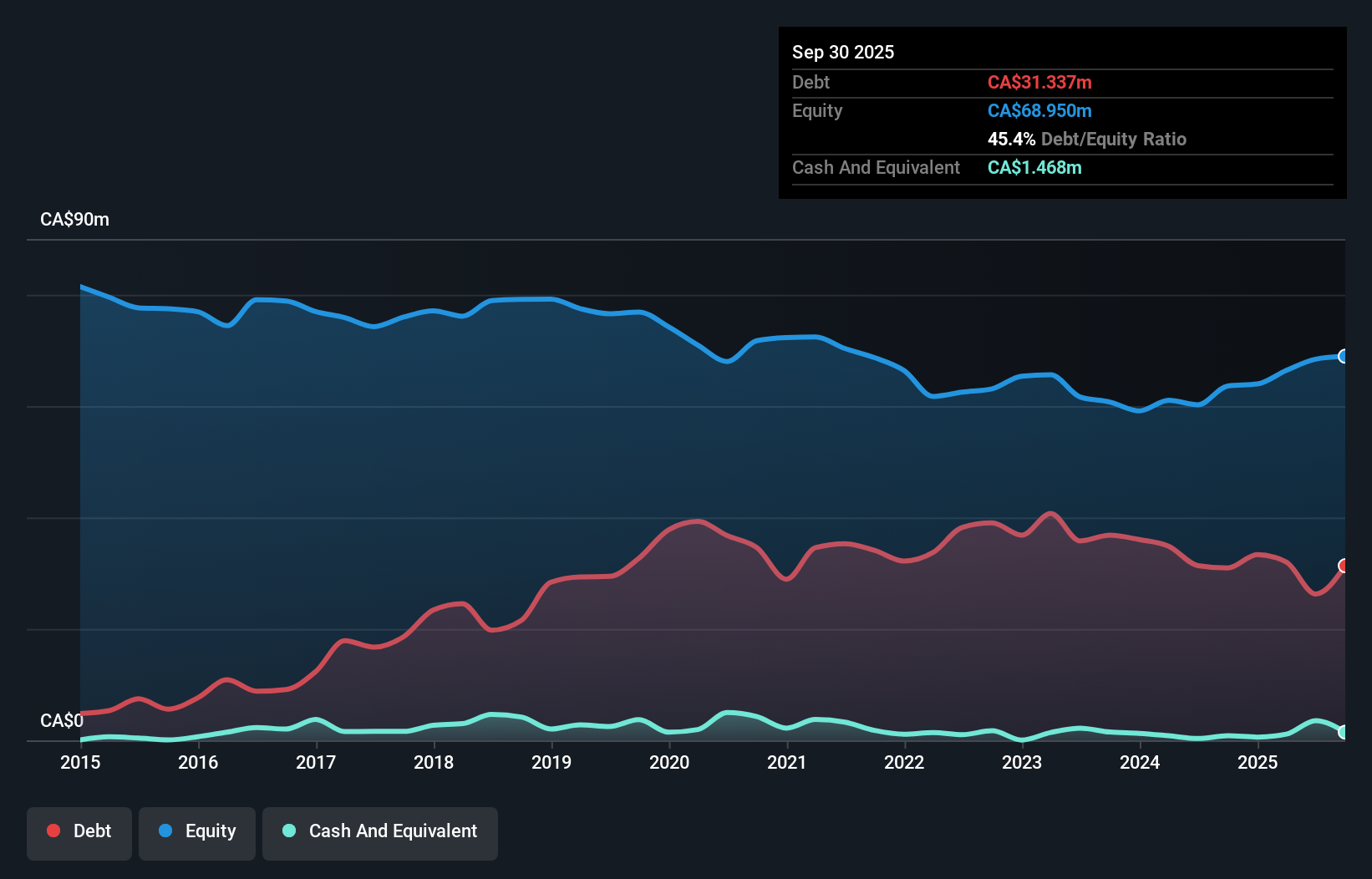

Orbit Garant Drilling, with a market cap of CA$53.82 million, operates in mineral drilling services across multiple regions. The company reported first-quarter sales of CA$46.67 million, slightly down from the previous year, while net income dropped significantly to CA$0.349 million from CA$2.91 million. Despite this decline, Orbit Garant's earnings have grown substantially over the past year and its profit margins improved to 2.7%. The company's debt is well managed with operating cash flow covering 39.4% of its debt and EBIT covering interest payments by 5.6 times, though it carries a high net debt to equity ratio of 43.3%.

- Click here to discover the nuances of Orbit Garant Drilling with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Orbit Garant Drilling's track record.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries globally with a market cap of CA$49.86 million.

Operations: EnWave Corporation does not report specific revenue segments.

Market Cap: CA$49.86M

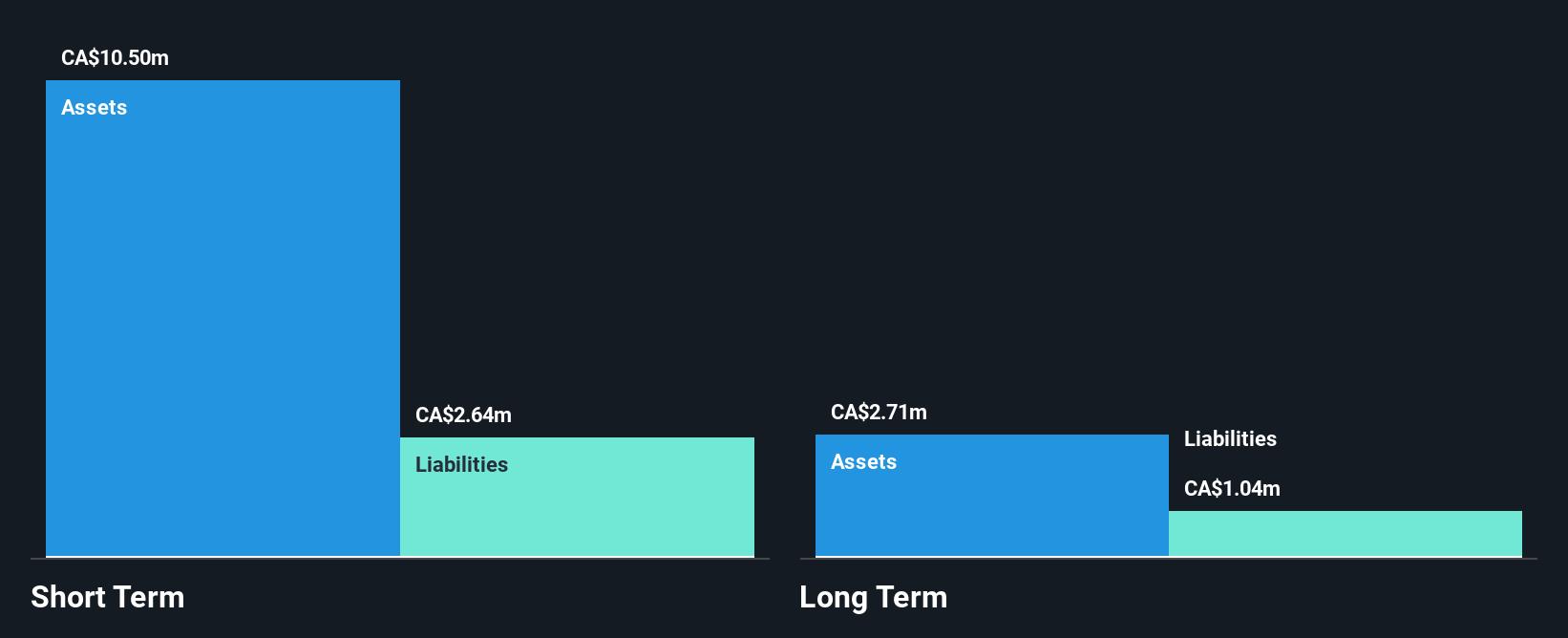

EnWave Corporation, with a market cap of CA$49.86 million, reported annual sales of CA$13.83 million, up from CA$8.18 million the previous year, while reducing its net loss to CA$0.418 million from CA$2.4 million. The company has secured several royalty-bearing commercial licenses globally in the food and cannabis sectors, enhancing its revenue potential despite current unprofitability and negative return on equity (-22.21%). EnWave's seasoned management and board contribute to strategic growth initiatives like recent agreements in New Zealand and Brazil for its patented dehydration technology, supported by a strong cash position exceeding total liabilities significantly.

- Navigate through the intricacies of EnWave with our comprehensive balance sheet health report here.

- Gain insights into EnWave's future direction by reviewing our growth report.

Summing It All Up

- Navigate through the entire inventory of 390 TSX Penny Stocks here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报