Ventas (VTR) Valuation Check After Strong Q3 and Accelerated Senior Housing Expansion

Ventas (VTR) just backed up its strong third quarter with another shareholder friendly move, affirming a quarterly dividend of $0.48 per share that keeps its income story firmly on track.

See our latest analysis for Ventas.

That dividend decision fits into a strong run for Ventas, with the stock now at $77.86 after a solid year to date share price return of 34.33 percent and an impressive 3 year total shareholder return of 94.07 percent. This suggests that momentum is still building.

If this kind of defensive income plus growth story appeals to you, it could be worth exploring healthcare real estate peers and broader healthcare stocks as potential next ideas.

With double digit revenue growth, upbeat analyst targets and a rich three year run already in the bag, the real question now is simple: is Ventas still undervalued or is future growth already priced in?

Most Popular Narrative Narrative: 8.1% Undervalued

Compared with the last close at 77.86 dollars, the most popular narrative pegs Ventas' fair value a little higher, hinting at more upside if its long term plan lands as modeled.

Ongoing active portfolio management such as converting underperforming triple net assets to SHOP, strategic acquisitions focused on high performing newer assets in strong demographic markets, and expanding relationships with best in class operators creates a runway for outsized top line revenue and FFO per share growth.

Want to see how this expansion playbook could turn rent checks into faster earnings growth? The narrative leans on accelerating revenues, higher margins, and a potentially richer future profit multiple. Curious which assumptions really carry the valuation, and how bold they get over the next few years? Tap through to unpack the full story.

Result: Fair Value of $84.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and execution risks in senior housing operations could derail margin expansion and challenge the upbeat long term valuation case.

Find out about the key risks to this Ventas narrative.

Another View: Market Ratios Flash a Caution Sign

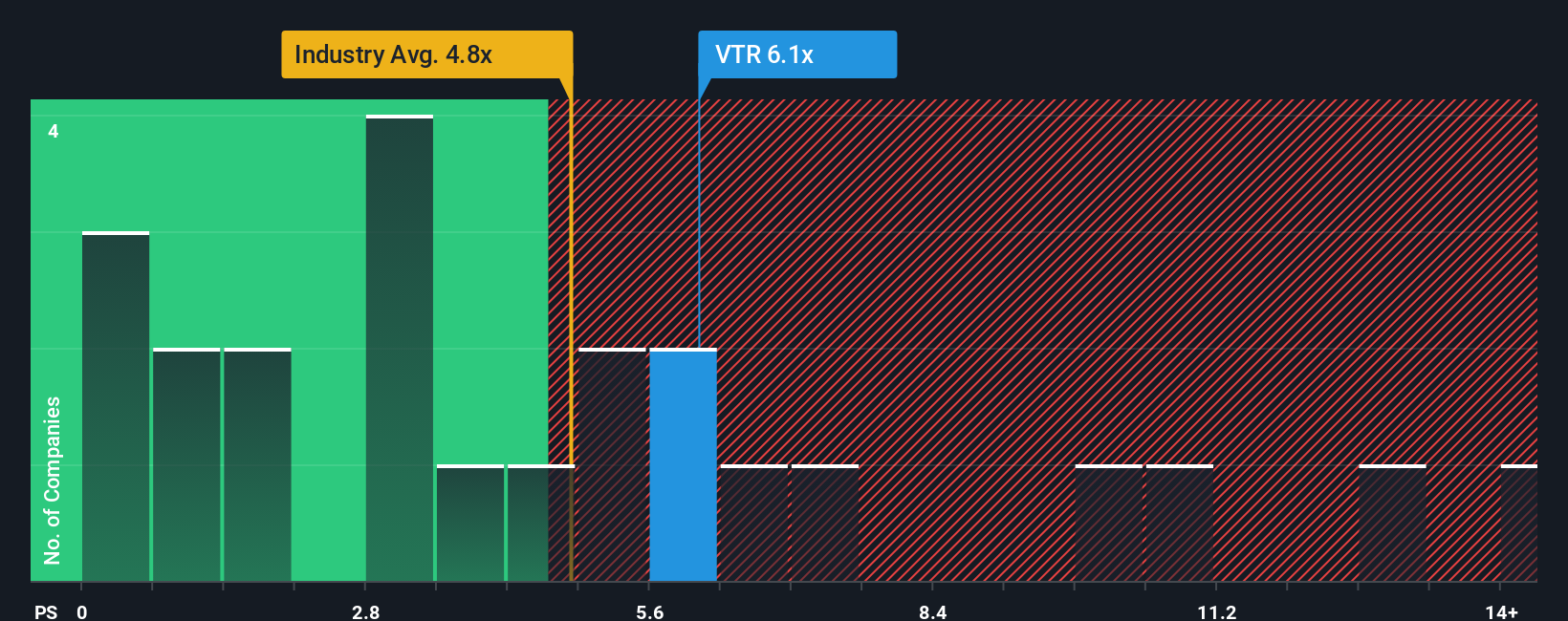

While our DCF model sees Ventas as meaningfully undervalued, the market’s own yardstick tells a tougher story. Its price to sales ratio sits at 6.6 times versus a fair ratio of 5.8 times and 4.6 times for the broader North American Health Care REITs group. Is the optimism already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ventas Narrative

If you see things differently or prefer to dive into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop sharpening their watchlist, so before momentum shifts away from you, use our screeners to uncover fresh, data backed opportunities today.

- Capture potential mispricings early by targeting companies trading below intrinsic value through these 901 undervalued stocks based on cash flows, before the wider market catches on.

- Ride structural growth in automation, data, and intelligent software by zeroing in on these 26 AI penny stocks shaping the next wave of innovation.

- Strengthen your income stream by focusing on reliable payers with these 13 dividend stocks with yields > 3% that may support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报