Rezolute (RZLT): Reassessing Valuation After sunRIZE Phase 3 Failure and Growing Legal Scrutiny

Rezolute (RZLT) is back in the spotlight after its Phase 3 sunRIZE trial for ersodetug in congenital hyperinsulinism missed both primary and key secondary endpoints, triggering sharp market fallout and legal scrutiny.

See our latest analysis for Rezolute.

The failed sunRIZE readout and subsequent legal overhang help explain why Rezolute’s 7 day share price return sits near minus 82 percent, while its 3 year total shareholder return is still positive. This suggests longer term holders are now reassessing whether any residual momentum remains.

If this kind of binary biotech risk is making you rethink concentration, it could be a useful moment to scout other healthcare stocks that spread exposure across more diversified pipelines.

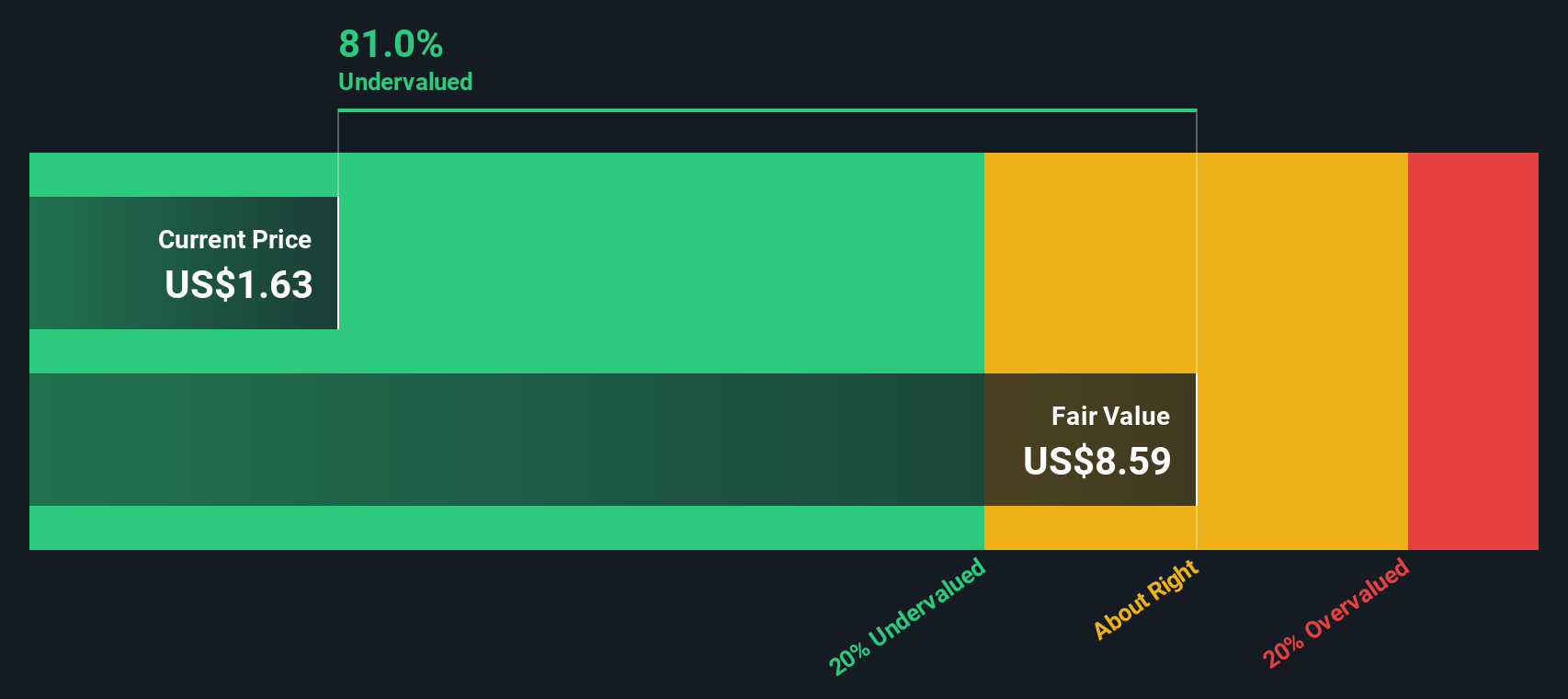

With the stock now near 1.8 and trading at a steep discount to even reduced analyst targets, investors face a stark question: is Rezolute deeply undervalued after sunRIZE, or is the market already discounting any future growth?

Price-to-Book of 1.1x: Is it justified?

Rezolute trades on a price to book ratio of roughly 1.1 times, which screens as undervalued against both peers and the wider US biotech space.

The price to book multiple compares the market value of the company to its net assets, a useful yardstick for early stage biotechs that lack meaningful revenue or profits. For Rezolute, this lens can highlight whether investors are paying a premium or discount for the balance sheet and pipeline potential relative to peers.

According to our data, Rezolute is considered good value on this measure, with its 1.1 times price to book sitting well below a peer average of 10.4 times. It also trades at a discount to the broader US biotech industry, where the average price to book is 2.7 times. This implies the market is assigning Rezolute a far lower valuation for each dollar of net assets than comparable companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 1.1x (UNDERVALUED)

However, significant clinical setbacks and continued cash burn without revenue mean that further dilution or disappointing trial updates could quickly erase the perceived undervaluation.

Find out about the key risks to this Rezolute narrative.

Another Lens on Value

Our DCF model paints an even more dramatic picture, suggesting Rezolute’s fair value is about 8.58 per share, roughly 79 percent above the current price. If both book value and cash flow point to deep undervaluation, is the market mispricing risk, or seeing something models cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rezolute for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rezolute Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in minutes: Do it your way.

A great starting point for your Rezolute research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Rezolute may be on your radar, but do not stop there, use the Simply Wall St Screener now to spot your next potential outperformer.

- Capture potential mispricings by targeting quality companies trading at compelling valuations through these 901 undervalued stocks based on cash flows, before the market fully catches on.

- Ride powerful digital disruption trends by focusing on innovators in blockchain and decentralized finance using these 80 cryptocurrency and blockchain stocks while these opportunities remain under-owned.

- Turn volatility into opportunity by filtering for robust balance sheets and momentum potential across these 3612 penny stocks with strong financials that might be off most investors’ radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报