Does nVent Electric’s (NVT) AI-Focused Liquid Cooling Pivot Quietly Redefine Its Core Investment Story?

- nVent Electric was recently recognized as one of the “10 Data Center Cooling Companies to Invest In,” as management, at the past 2025 Goldman Sachs Industrials and Materials Conference, outlined plans to reposition the business around modular cooling and power solutions for AI-driven data centers.

- This shift toward becoming a focused data center infrastructure provider, with an emphasis on liquid cooling technologies, signals a meaningful evolution in how nVent aims to participate in AI-related demand across global computing infrastructure.

- Next, we’ll examine how nVent’s intensified push into liquid cooling for AI data centers could reshape its investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

nVent Electric Investment Narrative Recap

To own nVent today, you need to believe its pivot toward AI data center infrastructure can translate a record backlog into durable earnings while justifying a premium valuation. The recent recognition among “10 Data Center Cooling Companies to Invest In” reinforces its AI exposure but does not fundamentally change the near term catalyst, which is execution on liquid cooling growth, nor the key risk around a potential slowdown in AI data center capital spending.

The most relevant recent update is nVent’s November launch of modular liquid cooling solutions, including enhanced coolant distribution units, updated racks and a new services program. This rollout, alongside collaboration with Siemens and participation in Project Deschutes, directly supports the company’s push into AI focused data center infrastructure and ties closely to investors’ focus on whether new products can sustain order momentum and help offset the risks of sector cyclicality and higher capital intensity.

But while the AI data center story is compelling, investors should be aware that...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.5 billion revenue and $651.5 million earnings by 2028.

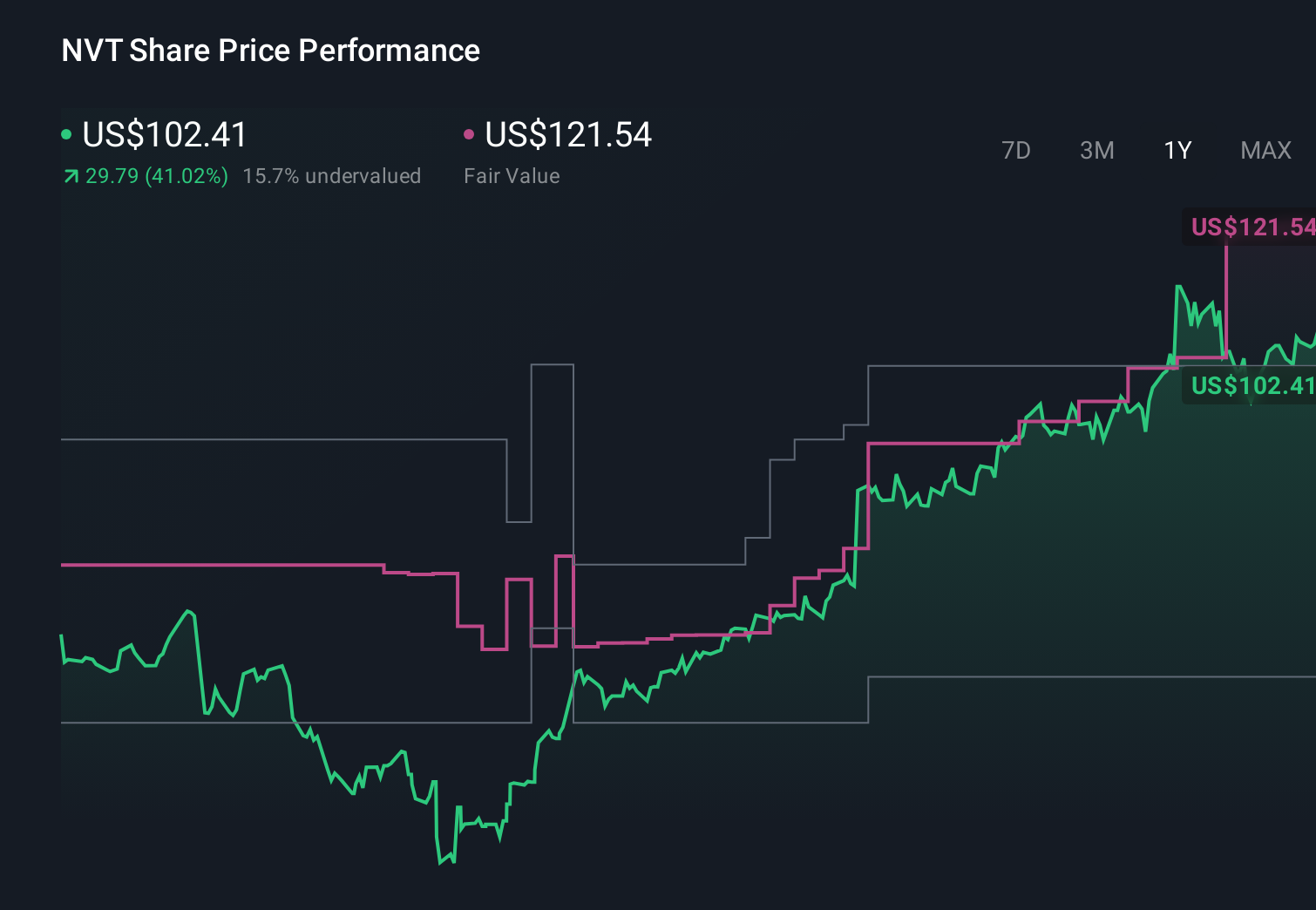

Uncover how nVent Electric's forecasts yield a $121.54 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for nVent span roughly US$81 to US$122 per share, underlining how far apart individual views can be. As you weigh that range, remember that nVent’s growing reliance on AI data center spending also increases its exposure to any future pullback in that investment cycle, so it can be useful to compare several of these perspectives before forming your own view.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth 20% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报