How Long-Term Take-or-Pay Deals And U.S. Expansion At Gibson Energy (TSX:GEI) Has Changed Its Investment Story

- In December 2025, Gibson Energy Inc. renewed a 20-year take-or-pay refined products services agreement and added a 10-year extension to a terminal storage take-or-pay contract covering 800,000 barrels at its Edmonton Terminal, while also approving a new infrastructure project in Texas to support U.S. growth.

- These long-dated, take-or-pay commitments with senior integrated oil sands customers highlight the Edmonton Terminal’s role as critical midstream infrastructure and reinforce Gibson’s push to diversify its earnings base through additional U.S. assets.

- We’ll now examine how the renewed 20-year take-or-pay agreement could influence Gibson Energy’s investment narrative and future cash flow visibility.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gibson Energy Investment Narrative Recap

To own Gibson Energy, you need to be comfortable with a fee-based midstream model that leans heavily on long-term contracts, dividend income and exposure to North American crude flows. The renewed 20-year take-or-pay deal and 10-year storage extension modestly improve short term cash flow visibility, but they do not change the core near term catalyst, which remains volume and recontracting progress at key terminals, or the key risk of structural pressure on oil demand and asset utilization.

The March 2025 Duvernay partnership with Baytex, which adds committed volumes and new liquids infrastructure tied into the Edmonton Terminal, fits neatly alongside the latest contract renewals. Together, these agreements point to a growing base of long-dated, take-or-pay commitments at Edmonton that may matter for investors watching Gibson’s ability to keep its fee-based infrastructure network well utilized, particularly as it layers in new U.S. projects and manages marketing segment volatility.

But investors still need to be aware of how faster-than-expected energy transition could alter long term oil sands throughput and...

Read the full narrative on Gibson Energy (it's free!)

Gibson Energy's narrative projects CA$9.3 billion revenue and CA$301.2 million earnings by 2028. This requires a 4.8% yearly revenue decline and an earnings increase of about CA$142 million from CA$159.0 million today.

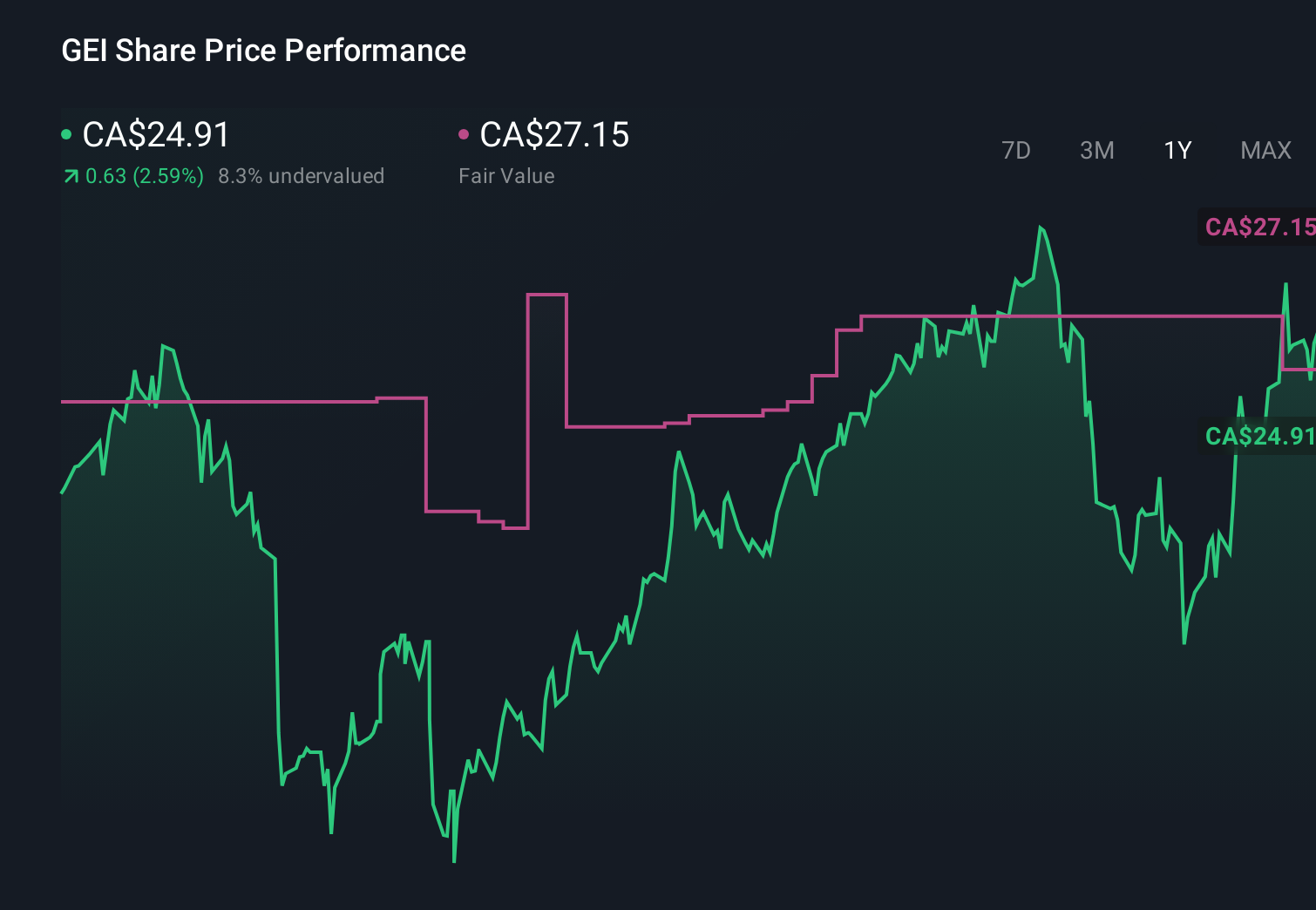

Uncover how Gibson Energy's forecasts yield a CA$25.62 fair value, in line with its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide CA$13.23 to CA$59.22 per share, underlining how differently individual investors view Gibson’s prospects. Against this backdrop of diverse opinions, the Edmonton Terminal’s long-dated take-or-pay contracts remain central to the company’s ability to support earnings growth and dividend payments as crude demand and export patterns evolve.

Explore 3 other fair value estimates on Gibson Energy - why the stock might be worth 49% less than the current price!

Build Your Own Gibson Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gibson Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gibson Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gibson Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报