3 UK Penny Stocks With Market Caps Under £200M

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. Amid such market conditions, investors often seek opportunities in lesser-known areas like penny stocks, which are typically associated with smaller or newer companies. Although the term "penny stocks" might seem outdated, these investments can still offer value and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.13 | £473.8M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.255 | £326.76M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.85 | £12.83M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.61 | $354.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.45 | £175.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.78M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.485 | £41.8M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £157.65 million.

Operations: The company generates revenue of €92.3 million from providing software and data processing services.

Market Cap: £157.65M

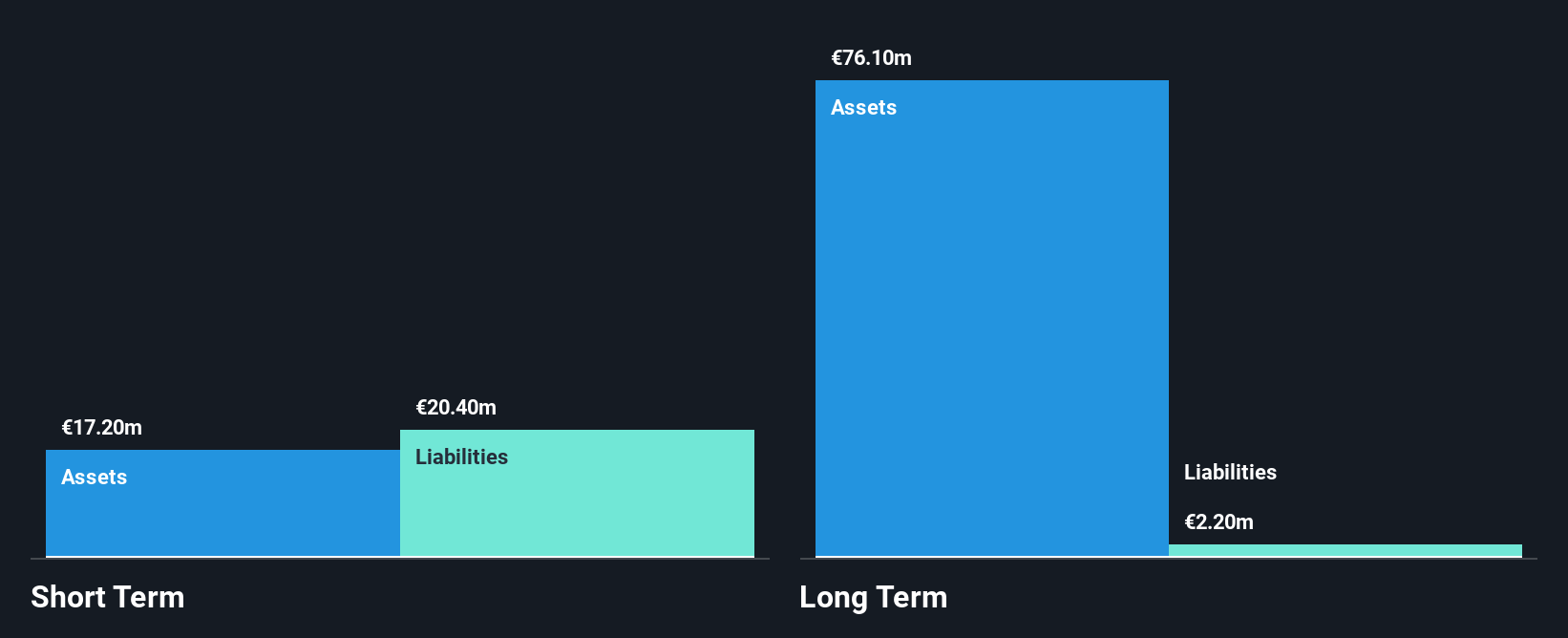

Hostelworld Group, with a market cap of £157.65 million, trades at 51.6% below its estimated fair value and has no debt, indicating financial stability. Despite this, the company faces challenges such as a decline in net profit margins from 16.1% to 8.3% and negative earnings growth over the past year (-49%). The board and management team are experienced, but recent leadership changes could impact strategic direction as Carl G. Shepherd steps in as Interim Chair following Ulrik Bengtsson's departure. Earnings are projected to grow annually by 32.27%, suggesting potential for future recovery amidst current volatility.

- Click to explore a detailed breakdown of our findings in Hostelworld Group's financial health report.

- Learn about Hostelworld Group's future growth trajectory here.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of approximately £159.06 million.

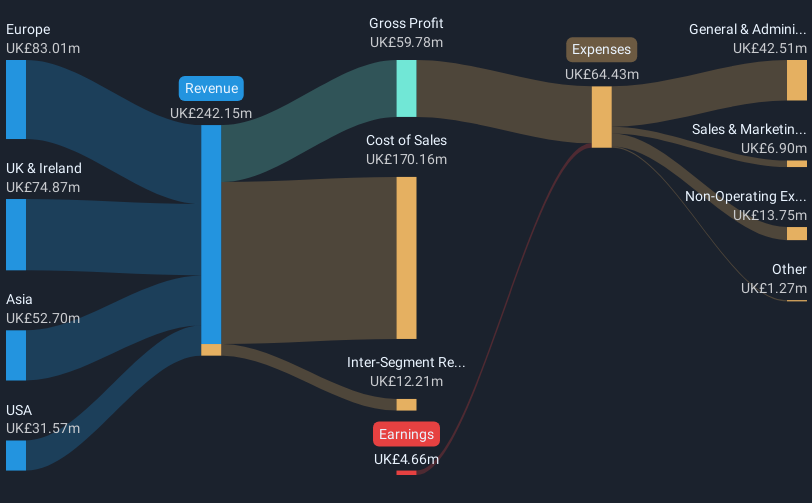

Operations: The company generates revenue of £151.89 million from its investment management operations.

Market Cap: £159.06M

Liontrust Asset Management, with a market cap of £159.06 million, presents a mixed picture for investors. The company trades at 37.5% below its estimated fair value and is debt-free, enhancing its financial resilience. However, it has experienced negative earnings growth (-13.2%) over the past year and reduced sales (£69.14 million) compared to the previous period (£87.04 million). Despite seasoned management and high-quality earnings, challenges persist with a dividend cut from 22 pence to 7 pence per share and declining net income (£4.7 million from £8.74 million). Recent share buyback initiatives may signal confidence in long-term prospects amidst current volatility.

- Get an in-depth perspective on Liontrust Asset Management's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Liontrust Asset Management's future.

Trifast (LSE:TRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trifast plc, with a market cap of £101.23 million, designs, engineers, manufactures, and supplies industrial fasteners and category C components across the United Kingdom, Ireland, Europe, North America, and Asia.

Operations: The company's revenue from Industrial Fasteners and Category 'C' Components amounts to £215.42 million.

Market Cap: £101.23M

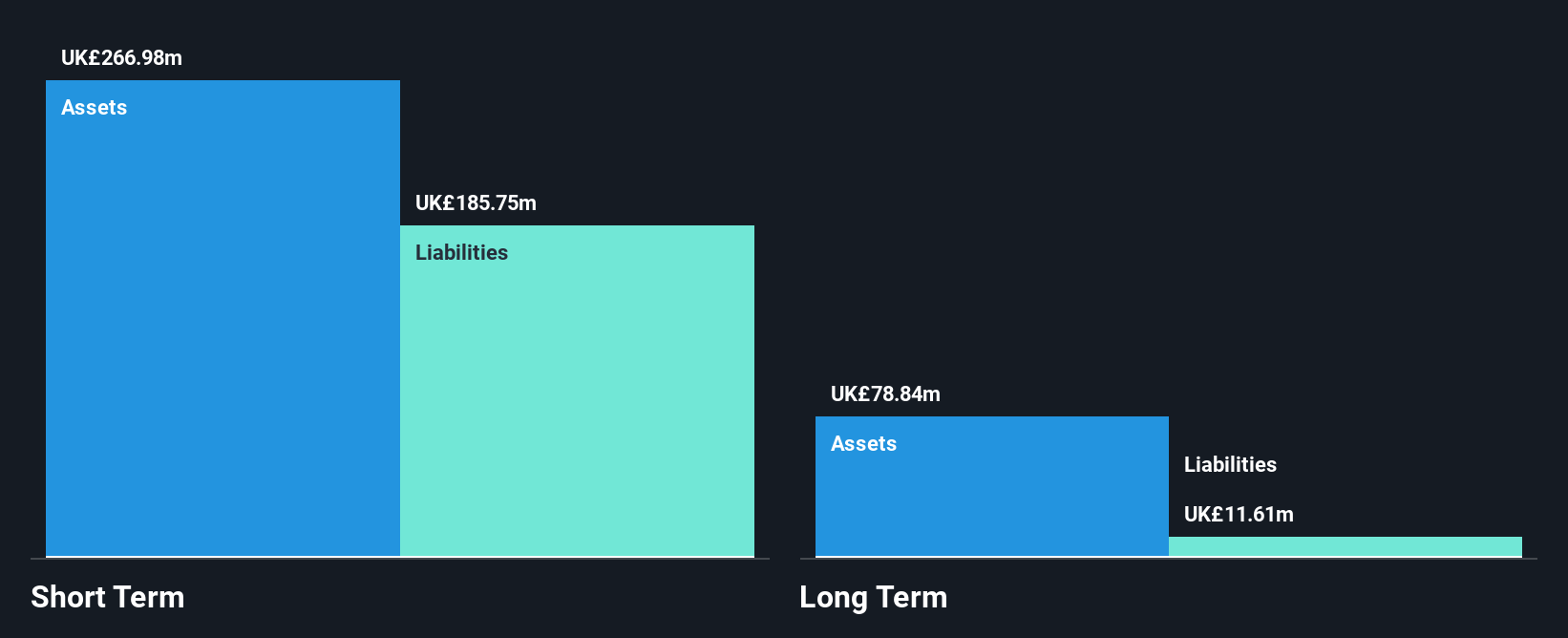

Trifast plc, with a market cap of £101.23 million, offers a nuanced investment case. The company reported half-year sales of £105.85 million, slightly down from the previous year, yet net income rose to £1.46 million. Despite low return on equity (0.9%) and a dividend not fully covered by earnings, Trifast's short-term assets (£155.8M) comfortably exceed both its short-term and long-term liabilities (£40.8M and £68.5M respectively). The firm has become profitable recently but faces challenges such as increased debt levels over five years and significant one-off losses impacting financial results.

- Dive into the specifics of Trifast here with our thorough balance sheet health report.

- Gain insights into Trifast's future direction by reviewing our growth report.

Taking Advantage

- Gain an insight into the universe of 306 UK Penny Stocks by clicking here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报