3 Penny Stocks With Market Caps Larger Than $100M To Watch

As the U.S. stock market navigates a landscape marked by fluctuating indices and tech sector pressures, investors are increasingly exploring diverse opportunities to balance their portfolios. Penny stocks, though often seen as relics of speculative past eras, continue to offer intriguing potential for those seeking value in smaller or newer companies. These stocks can provide a unique blend of affordability and growth potential when backed by strong financials, making them worth watching for long-term investment prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.79 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.09 | $186.41M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.26 | $548.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.24 | $1.35B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.75 | $178.24M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.54 | $589.37M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.8755 | $6.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.08 | $92.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

GrowGeneration (GRWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GrowGeneration Corp. operates retail hydroponic and organic gardening stores across the United States, with a market cap of approximately $117.29 million.

Operations: The company's revenue is derived from two main segments: Cultivation and Gardening, which generated $135.06 million, and Storage Solutions, contributing $26.30 million.

Market Cap: $117.29M

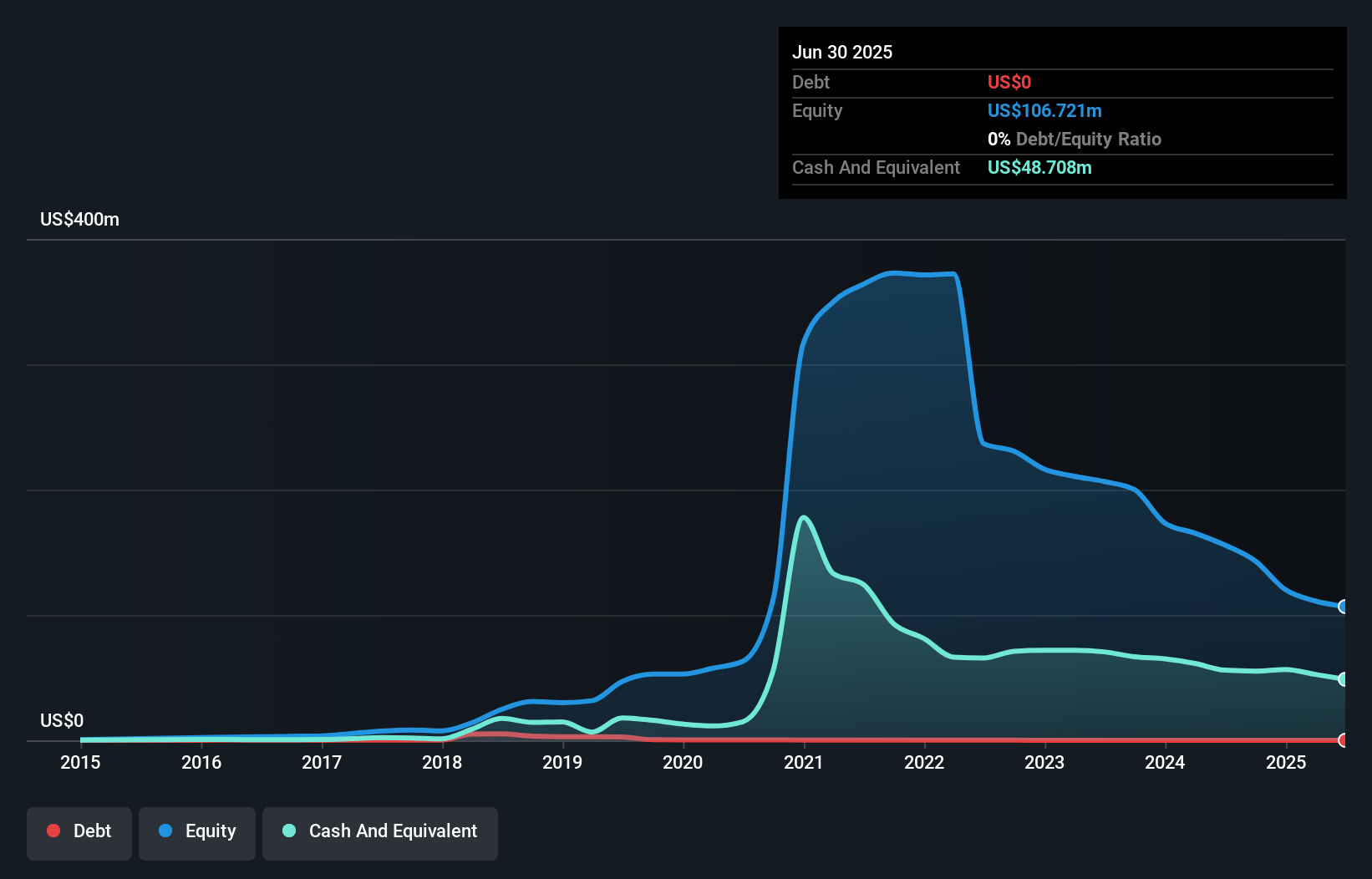

GrowGeneration Corp., with a market cap of US$117.29 million, operates in the hydroponic and organic gardening sector, showing resilience despite current unprofitability. Recent earnings indicate a net loss reduction from US$11.44 million to US$2.44 million year-over-year for Q3 2025, signaling potential progress in cost management and proprietary brand initiatives. The company is debt-free, with short-term assets significantly exceeding liabilities, providing financial stability amidst volatility typical of penny stocks. GrowGeneration's seasoned management and board bring experience to navigate challenges while showcasing innovative products like the Dialed In Under Canopy LED lights at industry events.

- Navigate through the intricacies of GrowGeneration with our comprehensive balance sheet health report here.

- Evaluate GrowGeneration's prospects by accessing our earnings growth report.

Village Farms International (VFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Village Farms International, Inc. is involved in the production, marketing, and distribution of greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes across North America with a market cap of $471.31 million.

Operations: The company's revenue is derived from its produce segment at $167.85 million, clean energy operations at $1.74 million, U.S. cannabis sales totaling $15.70 million, and Canadian cannabis activities generating $160.14 million, with a segment adjustment of $6.56 million.

Market Cap: $471.31M

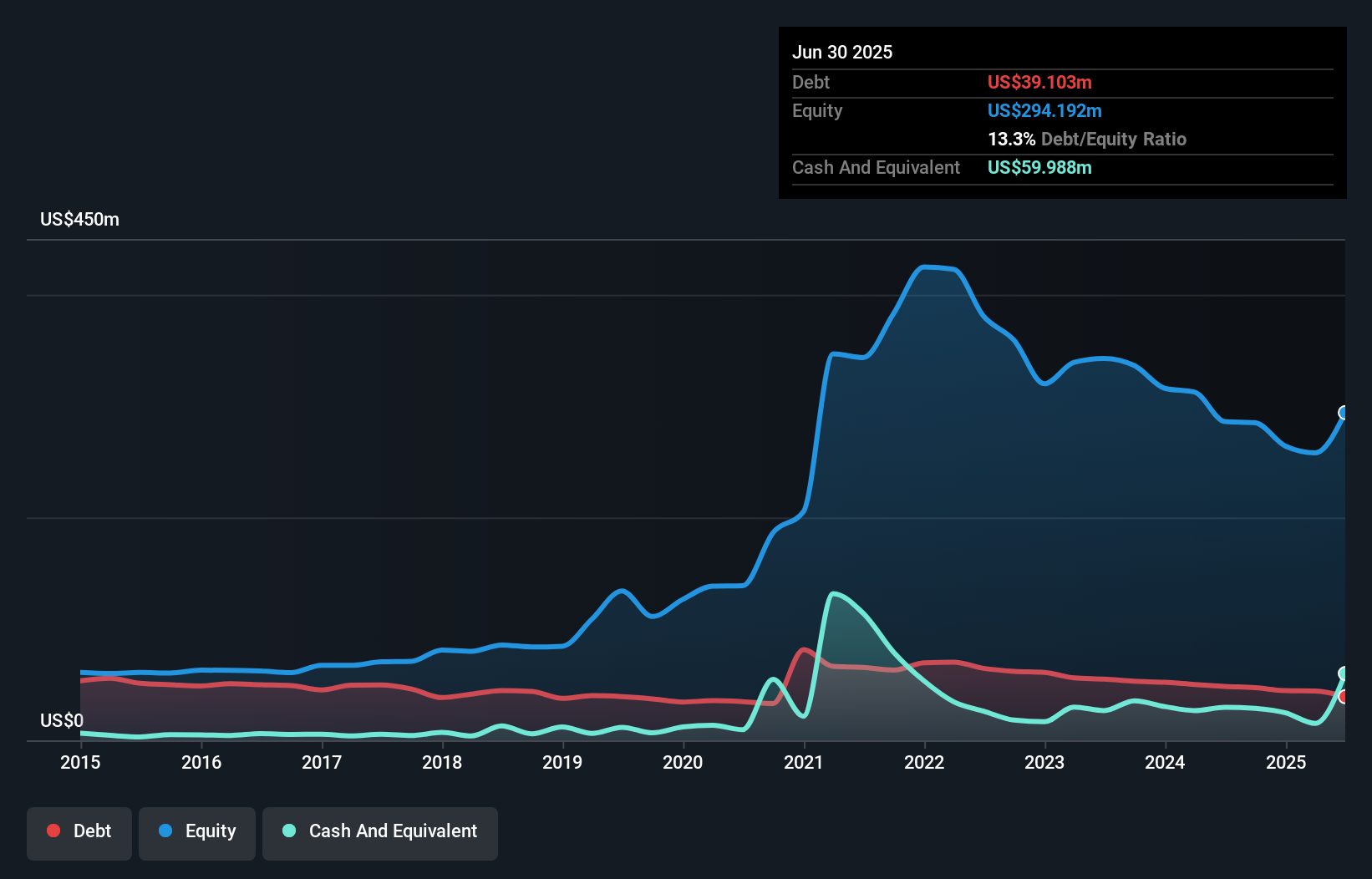

Village Farms International, with a market cap of $471.31 million, has transitioned to profitability, reporting Q3 2025 net income of $10.22 million compared to a prior loss. The company maintains more cash than debt and its short-term assets exceed liabilities, indicating financial stability uncommon in penny stocks. Recent developments include the launch of Promenade's vape product in Quebec's regulated cannabis market, potentially driving growth given Quebec's significant share of national cannabis sales. Despite high volatility and low return on equity at 1.7%, Village Farms' strategic innovations and new leadership aim to bolster its competitive position.

- Get an in-depth perspective on Village Farms International's performance by reading our balance sheet health report here.

- Explore Village Farms International's analyst forecasts in our growth report.

eHealth (EHTH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: eHealth, Inc. operates a health insurance marketplace offering consumer engagement, education, and enrollment solutions in the United States with a market cap of $138.44 million.

Operations: The company generates revenue primarily from its Medicare segment, which accounts for $517.44 million, and its Employer and Individual segment, contributing $25.51 million.

Market Cap: $138.44M

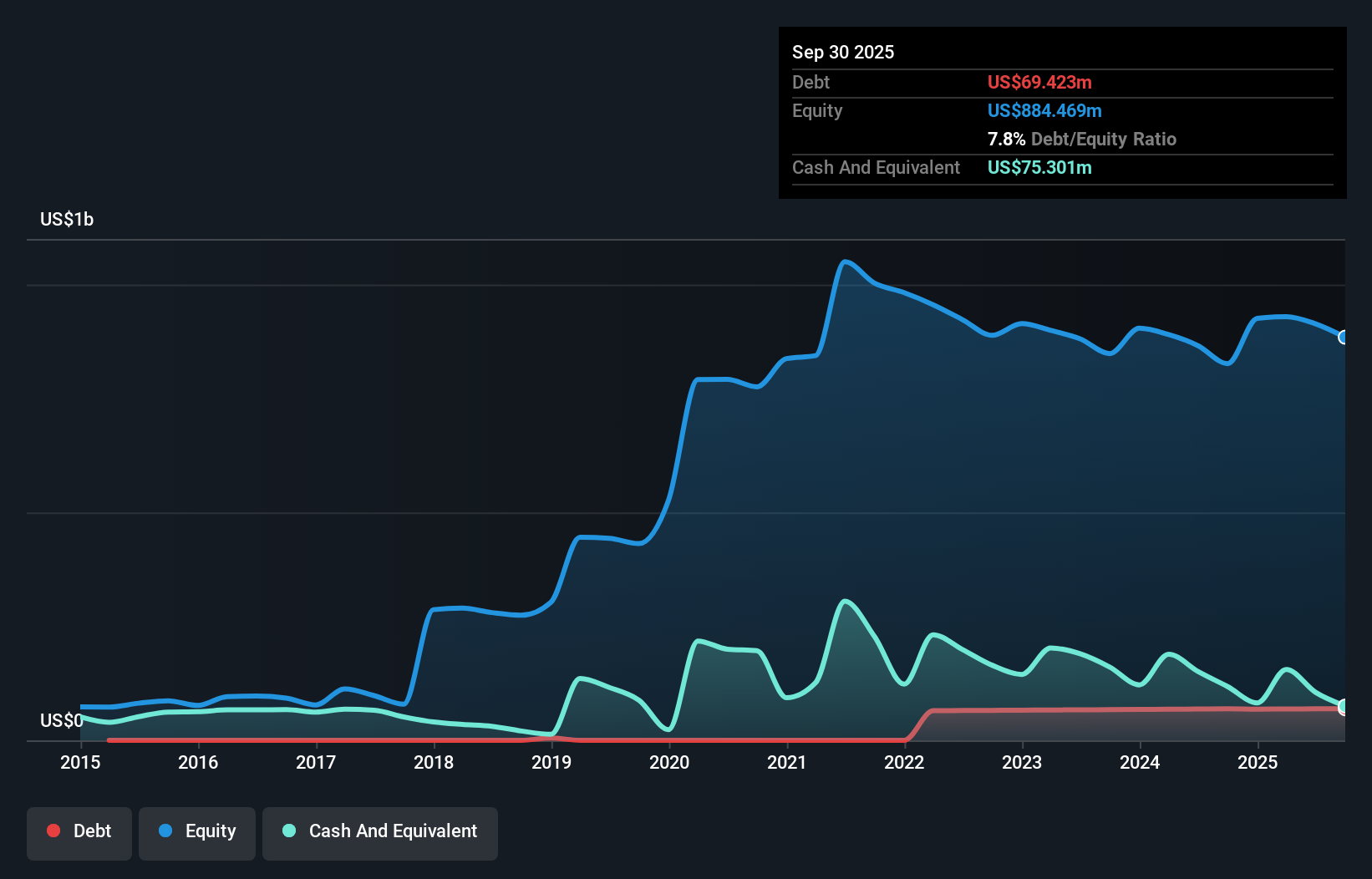

eHealth, Inc., with a market cap of US$138.44 million, has shown financial resilience uncommon in the penny stock category by becoming profitable this year and maintaining more cash than total debt. Despite a low return on equity of 5.7%, its short-term assets significantly exceed both short- and long-term liabilities, providing a stable financial footing. The company recently raised its earnings guidance for 2025 and continues to leverage AI technology through Alice, enhancing customer service efficiency in the Medicare segment. However, high volatility persists and operating cash flow remains negative, indicating ongoing challenges in managing debt coverage effectively.

- Click here to discover the nuances of eHealth with our detailed analytical financial health report.

- Learn about eHealth's future growth trajectory here.

Key Takeaways

- Discover the full array of 343 US Penny Stocks right here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报