Exploring TREVI - Finanziaria Industriale And 2 Other Undiscovered Gems in Europe

In recent weeks, the European market has shown mixed performance, with indices like the STOXX Europe 600 ending slightly lower and major stock indexes displaying varied results. Amidst this backdrop of fluctuating economic indicators and potential shifts in monetary policy by the European Central Bank, investors are increasingly on the lookout for small-cap stocks that exhibit resilience and growth potential. In this context, identifying a promising stock involves looking for companies with strong fundamentals and unique market positions that can navigate these uncertain conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 5.42% | 70.25% | 79.14% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

TREVI - Finanziaria Industriale (BIT:TFIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TREVI - Finanziaria Industriale S.p.A. specializes in soil engineering and has a market capitalization of €217.66 million.

Operations: TREVI - Finanziaria Industriale S.p.A. generates revenue from its operations in the soil engineering sector. The company's financial performance includes a focus on managing costs and optimizing profit margins, with a notable net profit margin trend observed over recent periods.

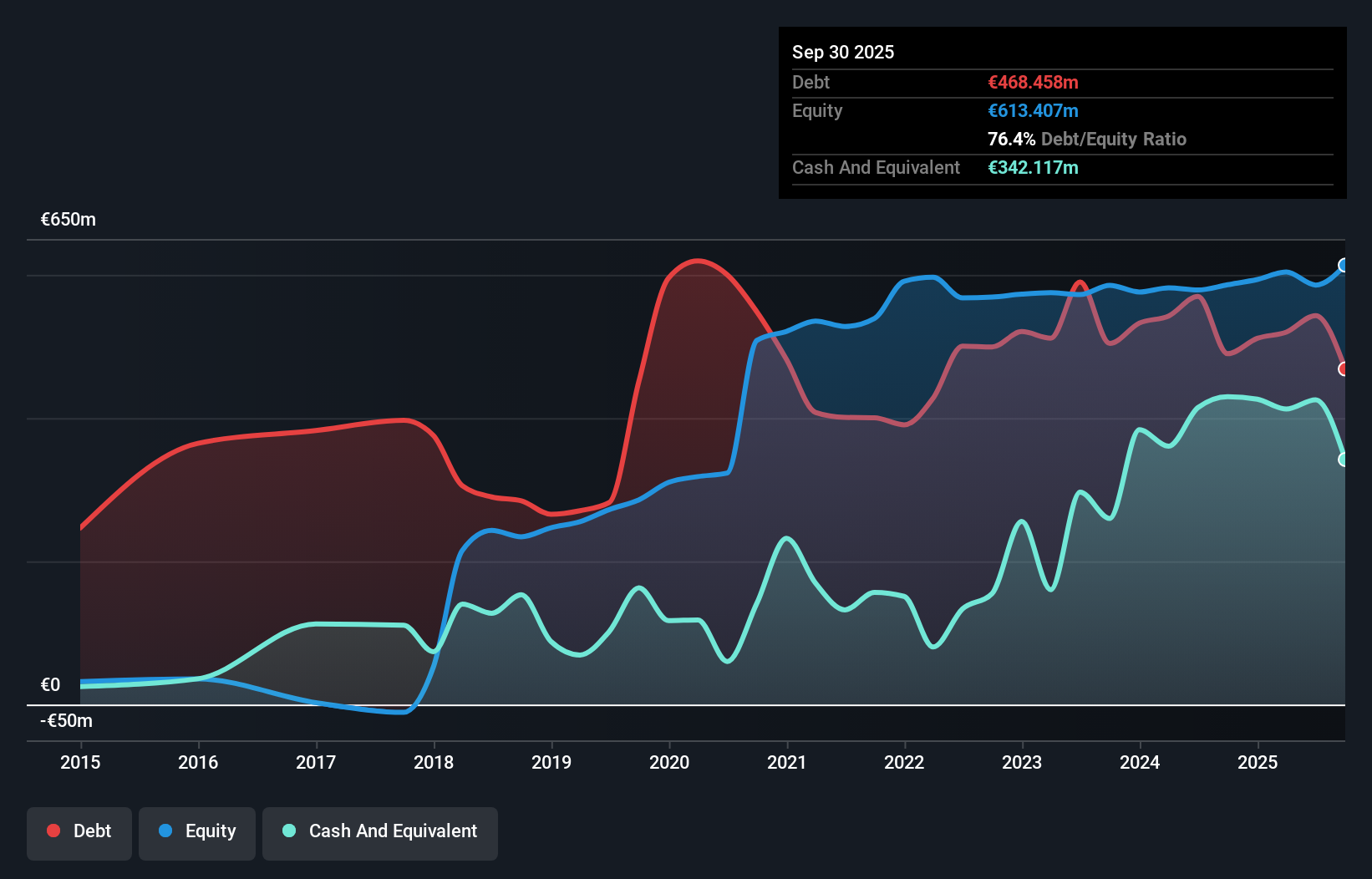

TREVI - Finanziaria Industriale, a notable player in the construction sector, has shown significant progress by becoming profitable this year. With its earnings forecasted to grow 32.8% annually, the company is on an upward trajectory. Despite this positive outlook, TREVI carries a high net debt to equity ratio of 136.9%, which may raise concerns about financial leverage. However, interest payments are well covered with an EBIT coverage of 4.4 times. The company's free cash flow turned positive recently at US$77 million as of June 2025, indicating improved operational efficiency and potential for future growth amidst industry challenges.

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★★★

Overview: Boozt AB (publ) operates as an online retailer offering a wide range of fashion, apparel, shoes, accessories, kids' items, home goods, sportswear, and beauty products with a market capitalization of approximately SEK6.57 billion.

Operations: Boozt generates revenue primarily through its online platforms, Boozt.com and Booztlet.com, with sales figures of SEK6.57 billion and SEK1.69 billion, respectively.

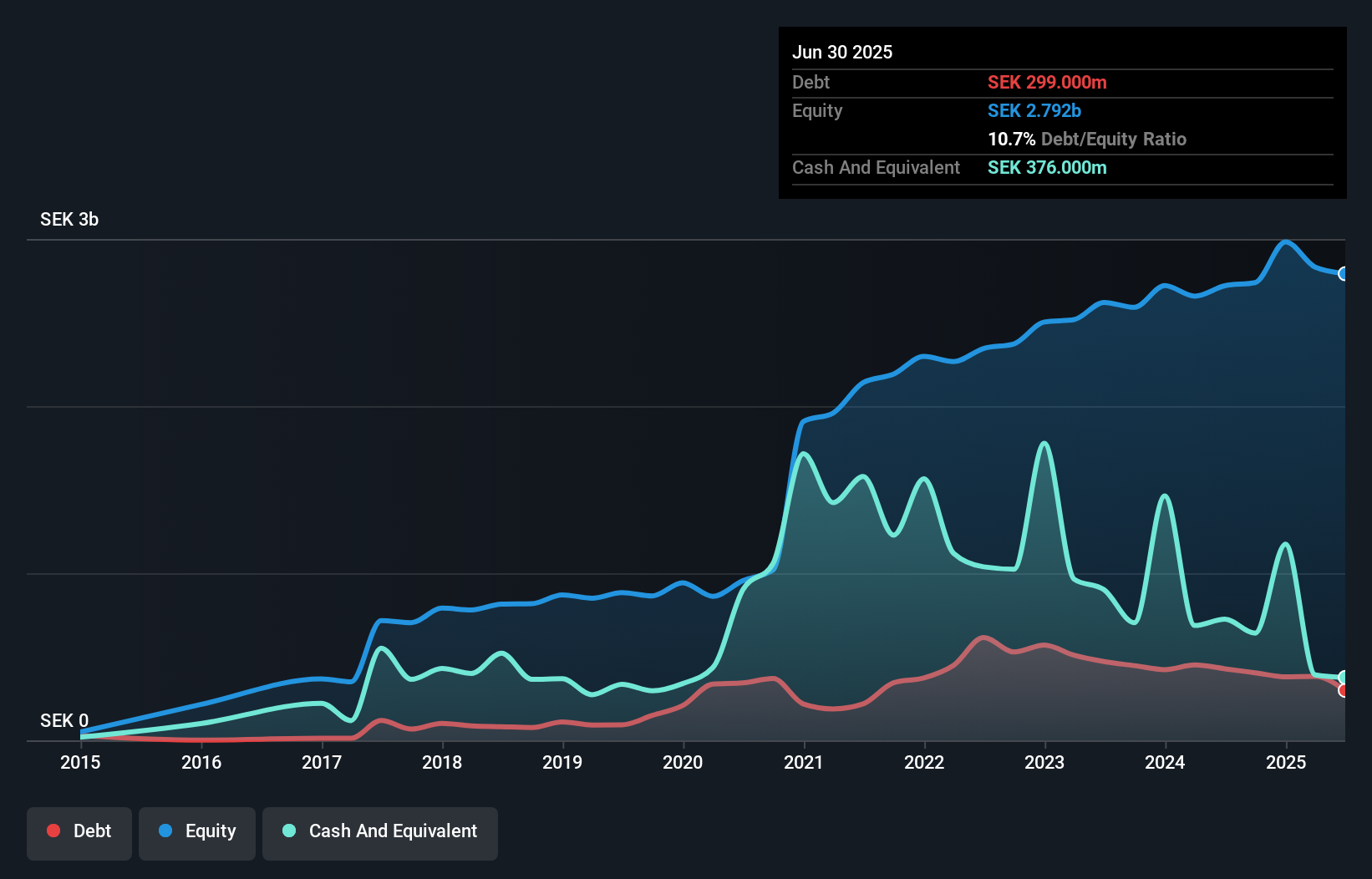

Boozt, a notable player in the European e-commerce space, has shown impressive earnings growth of 69.9% over the past year, outpacing its industry peers. The company's price-to-earnings ratio of 17.7x is attractive compared to the Swedish market average of 22.1x, suggesting it trades at a good relative value. Boozt's interest payments are comfortably covered by EBIT with a coverage ratio of 24.1x, indicating solid financial health. However, recent insider selling and reliance on discount strategies could pose challenges despite strong cash flow and share buybacks totaling SEK 235 million this year enhancing investor confidence in its strategic direction.

Instone Real Estate Group (XTRA:INS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Instone Real Estate Group SE, along with its subsidiaries, focuses on developing residential real estate properties in Germany and has a market capitalization of approximately €348.31 million.

Operations: Instone generates revenue primarily from the development of housing projects, amounting to €393.46 million.

Instone Real Estate Group, a notable player in the German residential property market, has shown impressive earnings growth of 253.8% over the past year, outpacing industry averages. Despite a dip in revenue from €388.79 million to €312.74 million for the nine months ending September 2025, net income rose to €42.41 million from €23.57 million previously reported, highlighting robust profitability amidst market challenges. The company is strategically positioned with a low loan-to-cost ratio of 12% and plans to acquire land with a gross development value (GDV) of around €2 billion by 2026, indicating strong future growth potential through strategic acquisitions and joint ventures across major metropolitan areas in Germany.

Seize The Opportunity

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 310 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报