Undiscovered Gems in Global Markets to Explore December 2025

As global markets navigate the complexities of shifting interest rates and economic indicators, small-cap stocks have shown resilience, particularly with the Russell 2000 Index outperforming larger indices amid recent Federal Reserve rate cuts. In this dynamic environment, identifying undervalued opportunities becomes crucial; a good stock often combines strong fundamentals with the potential to benefit from favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| ISE Chemicals | 1.29% | 16.36% | 32.61% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| Suzhou Sepax Technologies | 1.11% | 20.70% | 32.08% | ★★★★★★ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| MNtech | 69.81% | 10.24% | -13.03% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 45.75% | 3.45% | -2.64% | ★★★★★☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu HuaxicunLtd (SZSE:000936)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Huaxicun Co., Ltd. is involved in the research, development, production, and sale of polyester chemical fibers both domestically and internationally, with a market capitalization of CN¥7.26 billion.

Operations: The company's revenue primarily stems from the sale of polyester chemical fibers. It focuses on both domestic and international markets.

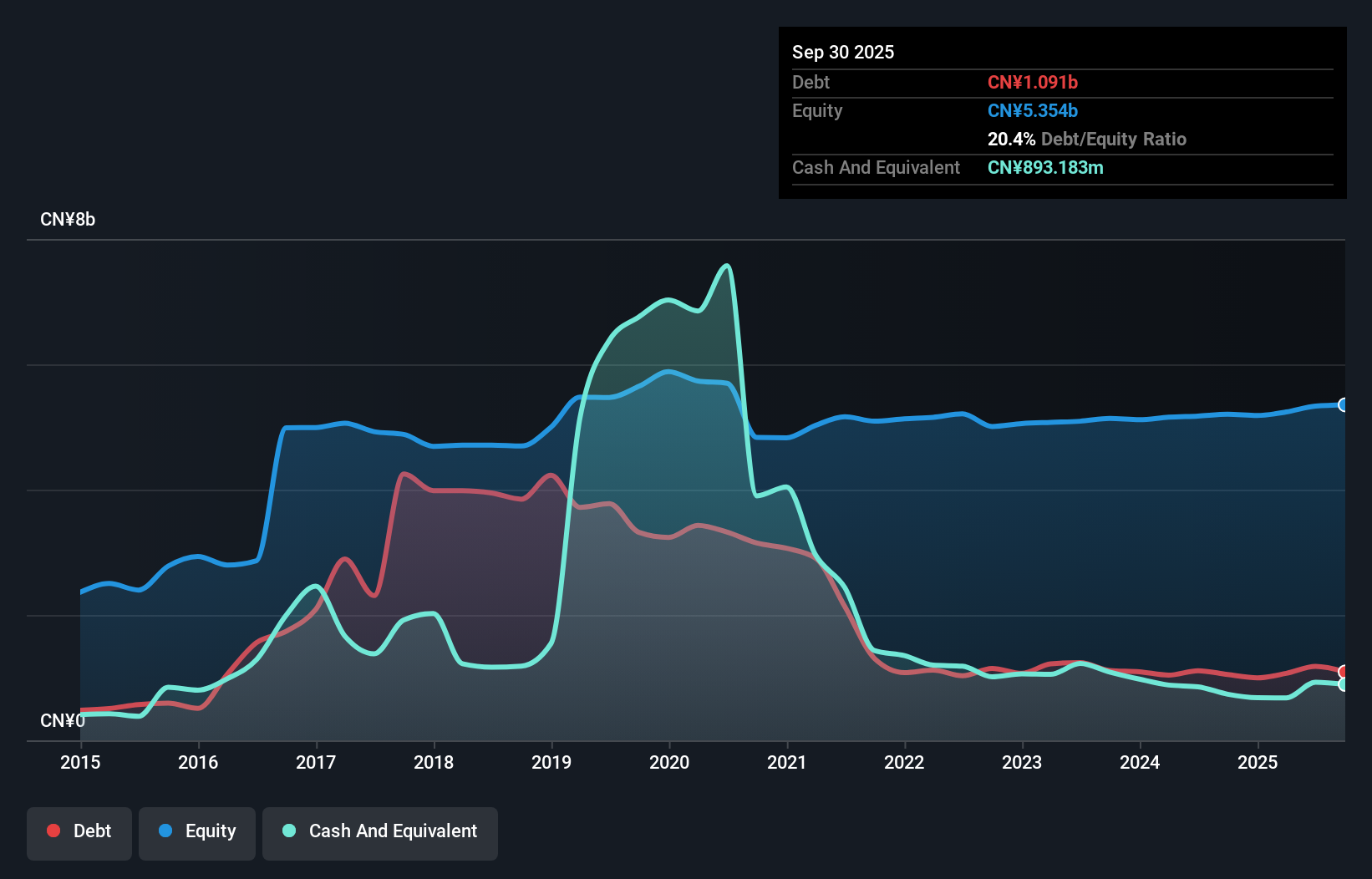

Jiangsu Huaxicun, a smaller player in the luxury industry, has shown impressive earnings growth of 149.9% over the past year, outpacing the industry's -1.2%. The company's price-to-earnings ratio stands at 23.8x, which is favorable compared to the broader CN market's 43.5x, suggesting potential value for investors. Over five years, its debt-to-equity ratio improved significantly from 65.1% to a more manageable 20.4%, indicating strong financial discipline. Recently reported sales for nine months reached CNY 2,533 million with net income rising to CNY 329 million from CNY 141 million previously, reflecting robust operational performance.

- Click here to discover the nuances of Jiangsu HuaxicunLtd with our detailed analytical health report.

Assess Jiangsu HuaxicunLtd's past performance with our detailed historical performance reports.

Kodensha (TSE:1948)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kodensha Co., Ltd. operates in the construction industry in Japan with a market capitalization of ¥39.83 billion.

Operations: Kodensha generates revenue primarily from electrical installation work and product sales, with the former contributing ¥32.70 billion and the latter ¥9.55 billion. The company's net profit margin shows a notable trend, reflecting its efficiency in converting revenue into actual profit.

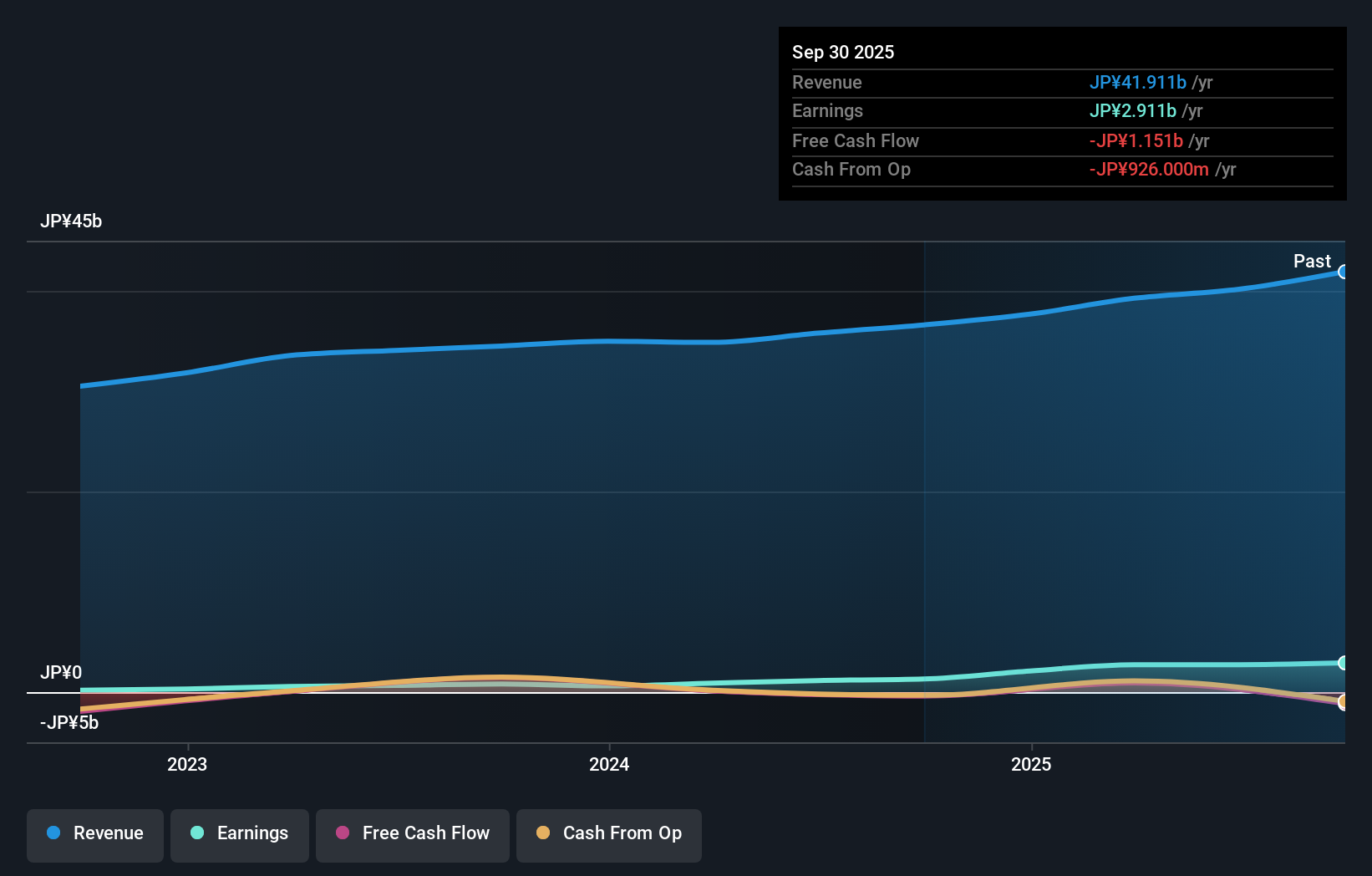

Kodensha, a small player in the construction sector, has exhibited impressive earnings growth of 121.9% over the past year, outpacing the industry average of 34.9%. Despite its highly volatile share price in recent months, Kodensha's financial health seems solid with more cash than total debt and a reduced debt-to-equity ratio from 3.9% to 2.2% over five years. However, free cash flow remains negative which could be a point of concern for potential investors looking at its long-term sustainability and operational efficiency within the market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Kodensha.

Review our historical performance report to gain insights into Kodensha's's past performance.

Hyakugo Bank (TSE:8368)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Hyakugo Bank, Ltd. offers a range of financial services to both individual and corporate clients in Japan and has a market capitalization of ¥265 billion.

Operations: Hyakugo Bank generates revenue primarily through interest income from loans and investments, as well as fees from various financial services. The bank's cost structure includes interest expenses on deposits and borrowings, alongside operational costs. Notably, the net profit margin has shown fluctuations over recent periods.

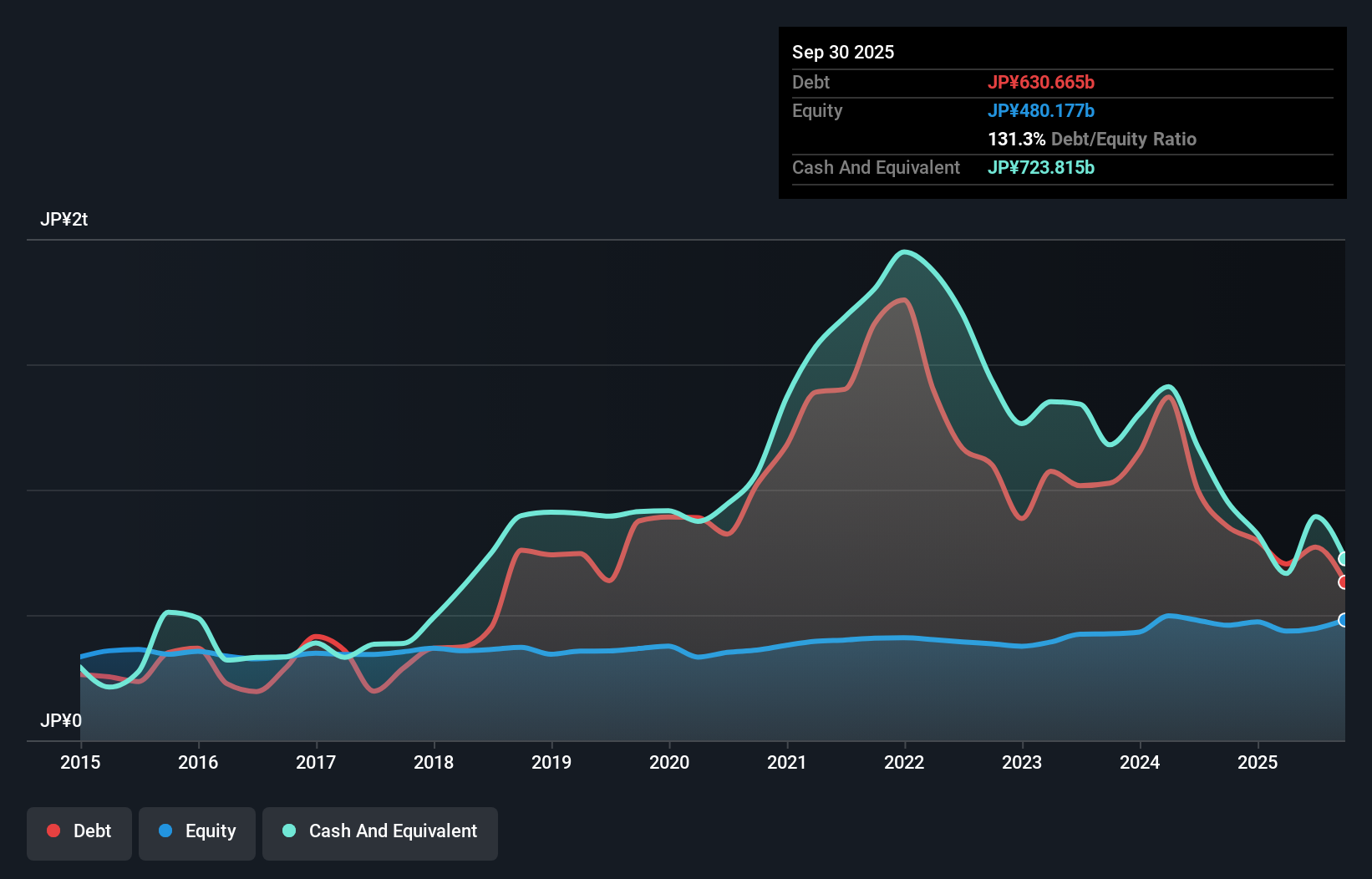

Hyakugo Bank, a smaller player in the financial sector, showcases a robust performance with earnings growth of 25.6%, outpacing the industry average of 25.5%. Total assets stand at ¥7,557.9 billion, with deposits reaching ¥6,270.4 billion and loans at ¥5,068 billion. The bank's price-to-earnings ratio is attractive at 13.9x compared to the broader JP market's 14.2x. However, it faces challenges with an insufficient allowance for bad loans set at 1.4% of total loans and free cash flow remains negative recently impacting its liquidity position despite high-quality past earnings contributing positively to its standing in the market.

- Delve into the full analysis health report here for a deeper understanding of Hyakugo Bank.

Evaluate Hyakugo Bank's historical performance by accessing our past performance report.

Summing It All Up

- Explore the 3001 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报