Reassessing HomeCo Daily Needs REIT (ASX:HDN) Valuation After Portfolio Uplift, Cap Rate Tightening and Debt Refinancing

HomeCo Daily Needs REIT (ASX:HDN) just rolled out a $219 million valuation uplift, cap rate tightening and a major debt refinancing, and then backed it up by reaffirming its FY26 distribution and earnings guidance.

See our latest analysis for HomeCo Daily Needs REIT.

Those portfolio gains and the latest distribution announcement come after a solid rebound, with the unit price now at A$1.37 and an 18.1 percent year to date share price return. The 1 year total shareholder return of 27.6 percent suggests momentum in the story is still building.

If you like how HDN is steadily compounding returns but want to see what else is quietly gaining traction, now is a good time to explore fast growing stocks with high insider ownership.

With HDN trading just below broker targets but already boasting double digit returns and fresh valuation gains, the key question now is whether the units still offer upside or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 4.7% Undervalued

With HomeCo Daily Needs REIT last closing at A$1.37 against a narrative fair value of about A$1.44, the focus shifts to how long term earnings and margins might underpin that modest upside.

The $650 million medium term development pipeline leveraging underutilized land and tenant led expansion provides embedded organic growth opportunities as new projects are completed at attractive yields (minimum 7% targeted), leading to portfolio revaluations, increased rental income, and net asset value uplift.

Robust asset management intensity, including tenant remixing, sustained leasing spreads (recently double digit on renewals), and high annual rent escalations (87% of leases with fixed increases averaging 3.5%), is expected to outpace cost inflation and drive margin expansion and earnings per share growth.

Curious how falling future margins, flatlined earnings and a higher profit multiple can still justify upside from here? The narrative connects those moving parts in one detailed valuation roadmap. Want to see which assumptions do the heavy lifting in that A$1.44 fair value?

Result: Fair Value of $1.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained e commerce growth or renewed pressure from powerful anchor tenants could cap leasing spreads and undermine the modest upside implied by today’s valuation.

Find out about the key risks to this HomeCo Daily Needs REIT narrative.

Another View: Earnings Multiple Sends a Different Signal

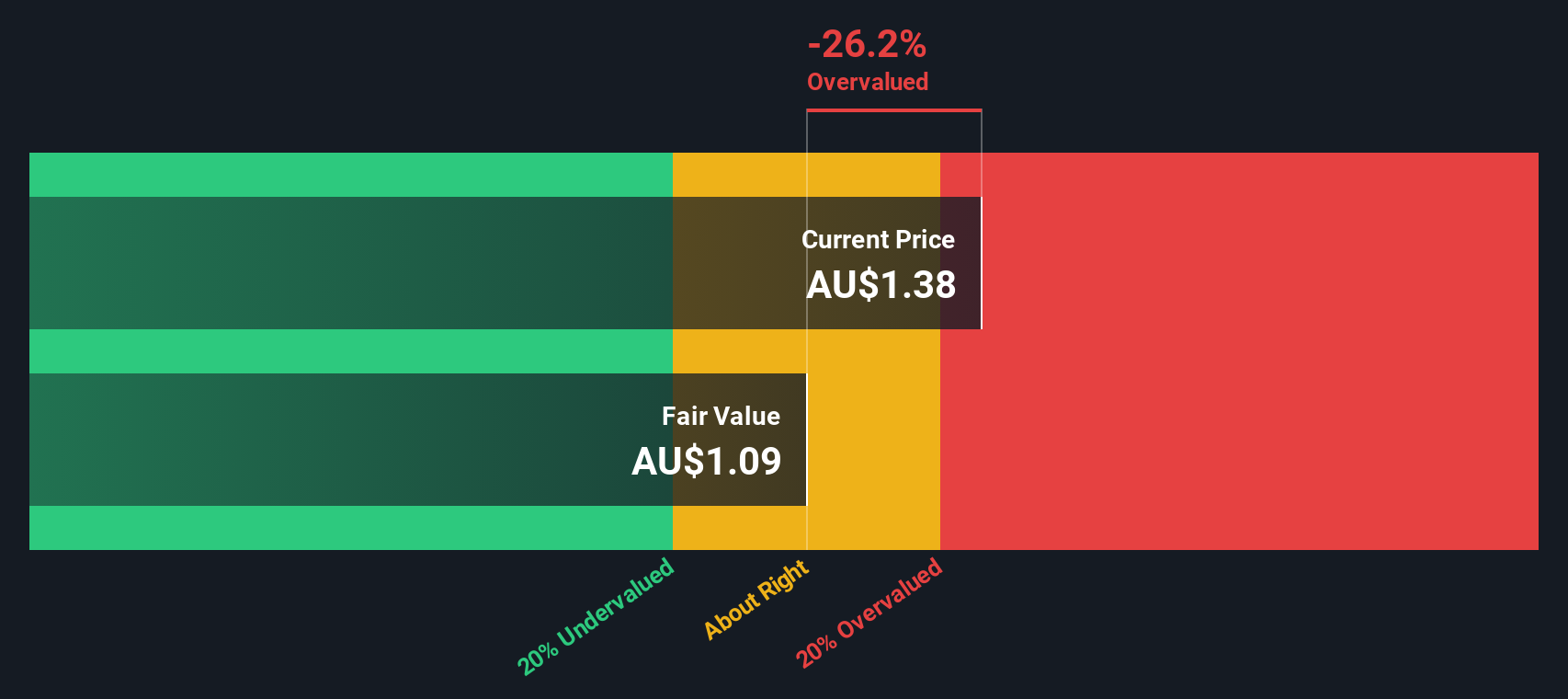

Analysts see modest upside to A$1.44, but our earnings based lens is more cautious. HDN trades on 11.4x earnings versus a fair ratio of 17.7x and a 15.5x industry average. However, our model pegs fair value nearer A$1.15, suggesting downside if sentiment or rates turn.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HomeCo Daily Needs REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HomeCo Daily Needs REIT Narrative

If you think the numbers tell a different story or simply want to dive into the assumptions yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your HomeCo Daily Needs REIT research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move again, lock in your next opportunities with focused screeners on Simply Wall St, built to surface high conviction ideas in minutes.

- Secure potential income streams by targeting companies with solid cash payouts using these 13 dividend stocks with yields > 3%.

- Ride structural shifts in medicine and diagnostics by filtering for innovators powered by algorithms and data with these 30 healthcare AI stocks.

- Position early in digital finance trends by zeroing in on platforms and infrastructure providers through these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报