3 UK Dividend Stocks With Yields Up To 5.7%

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China and its impact on global demand. In such a volatile environment, dividend stocks can offer a measure of stability by providing regular income, making them an attractive option for investors seeking resilience amidst market fluctuations.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.07% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.45% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.43% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.75% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.83% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.19% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.28% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.09% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.79% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.73% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

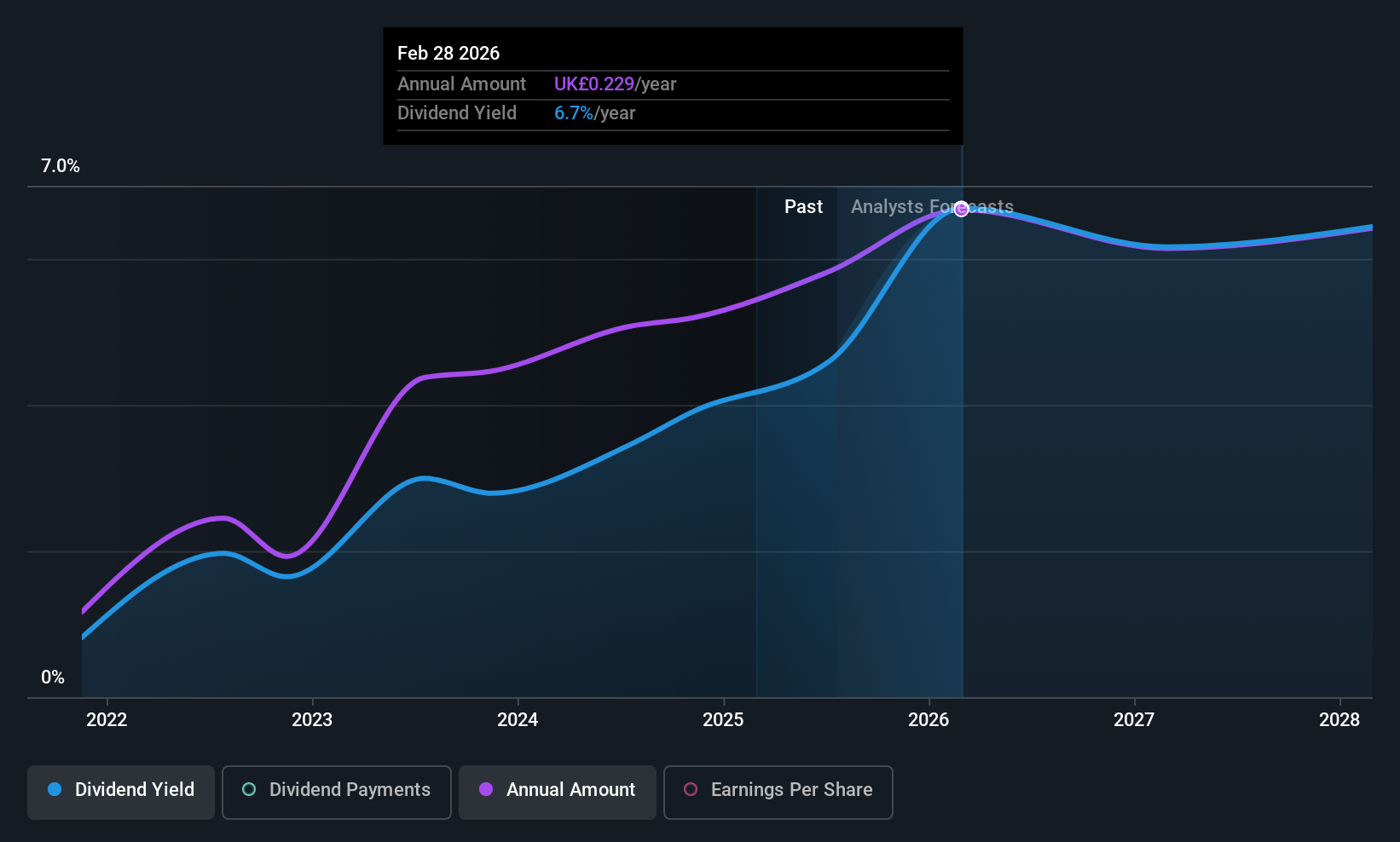

London Security (AIM:LSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries including the UK and has a market cap of £337.15 million.

Operations: London Security plc generates revenue of £226.71 million from the provision and maintenance of fire protection and security equipment across its operational regions in Europe.

Dividend Yield: 4.4%

London Security's dividend payments have grown over the past decade, but they have been volatile and unreliable, with recent decreases. The company maintains a low payout ratio of 24.8%, indicating dividends are well-covered by earnings. Despite a reasonable cash payout ratio of 74.4%, its dividend yield of 4.44% is below top-tier UK payers. Recent earnings showed sales growth to £116.92 million, though net income slightly declined to £8.69 million for the half year ending June 2025.

- Take a closer look at London Security's potential here in our dividend report.

- Our valuation report unveils the possibility London Security's shares may be trading at a premium.

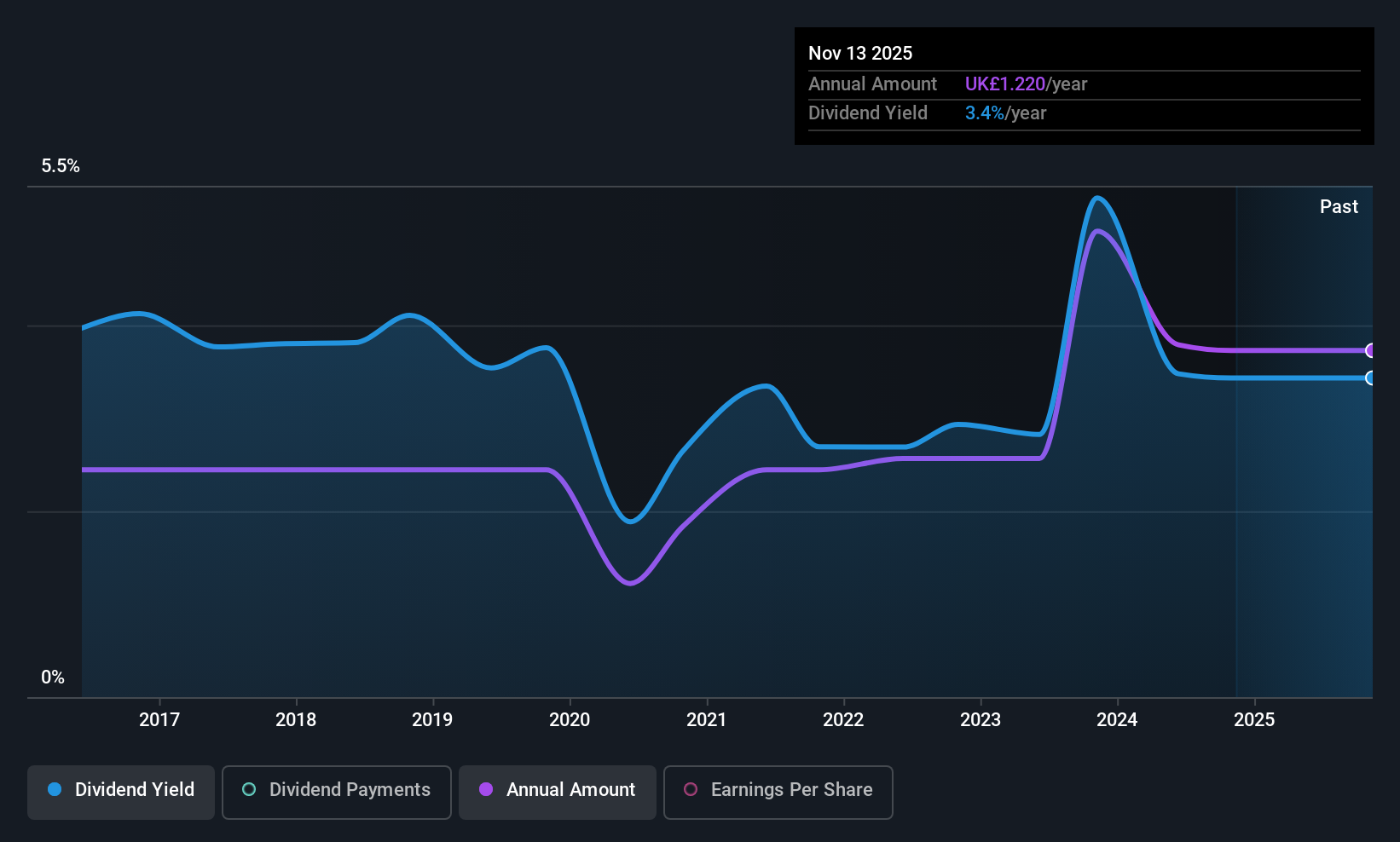

Bytes Technology Group (LSE:BYIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bytes Technology Group plc provides software, security, AI, and cloud services across the United Kingdom, Europe, and internationally with a market cap of £821.01 million.

Operations: Bytes Technology Group plc generates revenue from its IT Solutions Provider segment amounting to £219.74 million.

Dividend Yield: 5.8%

Bytes Technology Group has a relatively short dividend history of four years, with payments showing volatility. Despite this, the company maintains a solid earnings payout ratio of 45.6%, indicating dividends are well-covered by profits. The recent interim dividend increased to 3.2 pence per share, totaling £7.6 million, reflecting cautious growth amid earnings stability challenges as net income slightly decreased to £29.03 million for H1 FY26 compared to the previous year’s period.

- Unlock comprehensive insights into our analysis of Bytes Technology Group stock in this dividend report.

- The valuation report we've compiled suggests that Bytes Technology Group's current price could be quite moderate.

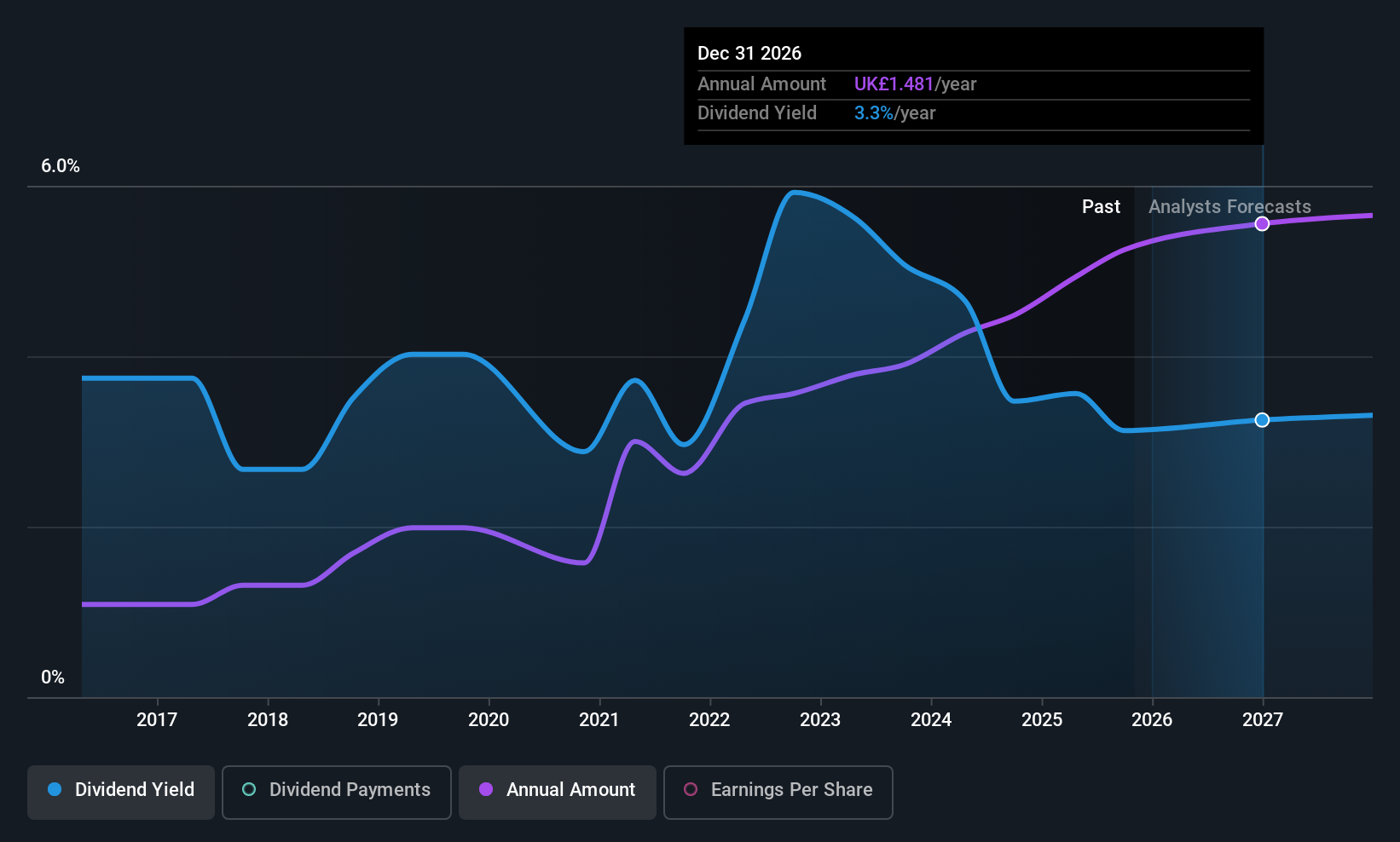

Morgan Sindall Group (LSE:MGNS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market cap of £2.16 billion.

Operations: Morgan Sindall Group plc generates revenue through its segments: Fit Out (£1.51 billion), Construction (£1.05 billion), Infrastructure (£999.30 million), Property Services (£224.30 million), Partnership Housing (£885.40 million), and Mixed Use Partnerships (£57.30 million).

Dividend Yield: 3%

Morgan Sindall Group's dividend payments are supported by a solid earnings payout ratio of 43.1% and a cash payout ratio of 50.5%, indicating sustainability through profits and cash flows. However, the dividend yield of 3.03% is below the UK market's top tier, and historical volatility raises reliability concerns despite recent growth in earnings by £22 million to £118 million. The price-to-earnings ratio at 14.2x suggests it is valued attractively compared to the broader UK market average of 15.9x.

- Delve into the full analysis dividend report here for a deeper understanding of Morgan Sindall Group.

- According our valuation report, there's an indication that Morgan Sindall Group's share price might be on the expensive side.

Turning Ideas Into Actions

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 47 more companies for you to explore.Click here to unveil our expertly curated list of 50 Top UK Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报