December 2025 European Stocks That May Be Trading Below Fair Value

As of December 2025, the European stock market has shown mixed performance, with indices like Germany's DAX seeing gains while others such as France's CAC 40 have experienced declines. Amidst potential rate hikes from the European Central Bank and economic resilience in the region, investors are keenly searching for stocks that might be trading below their fair value. Identifying undervalued stocks can offer opportunities for investors to capitalize on discrepancies between a company's market price and its intrinsic worth, particularly in a fluctuating economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN131.20 | PLN257.60 | 49.1% |

| Straumann Holding (SWX:STMN) | CHF95.28 | CHF187.83 | 49.3% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.35 | 49.9% |

| PVA TePla (XTRA:TPE) | €22.40 | €44.04 | 49.1% |

| Kitron (OB:KIT) | NOK68.00 | NOK134.76 | 49.5% |

| Inission (OM:INISS B) | SEK48.20 | SEK96.19 | 49.9% |

| Gentili Mosconi (BIT:GM) | €3.33 | €6.52 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.2% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.07 | 49.5% |

| Allcore (BIT:CORE) | €1.355 | €2.66 | 49% |

Underneath we present a selection of stocks filtered out by our screen.

Laboratorios Farmaceuticos Rovi (BME:ROVI)

Overview: Laboratorios Farmaceuticos Rovi, S.A. is a pharmaceutical company that manufactures, sells, and markets its products in Spain, the European Union, OECD countries, and internationally with a market cap of €3.18 billion.

Operations: Laboratorios Farmaceuticos Rovi generates its revenue primarily through the manufacturing, sales, and marketing of pharmaceutical products across Spain, the European Union, OECD countries, and other international markets.

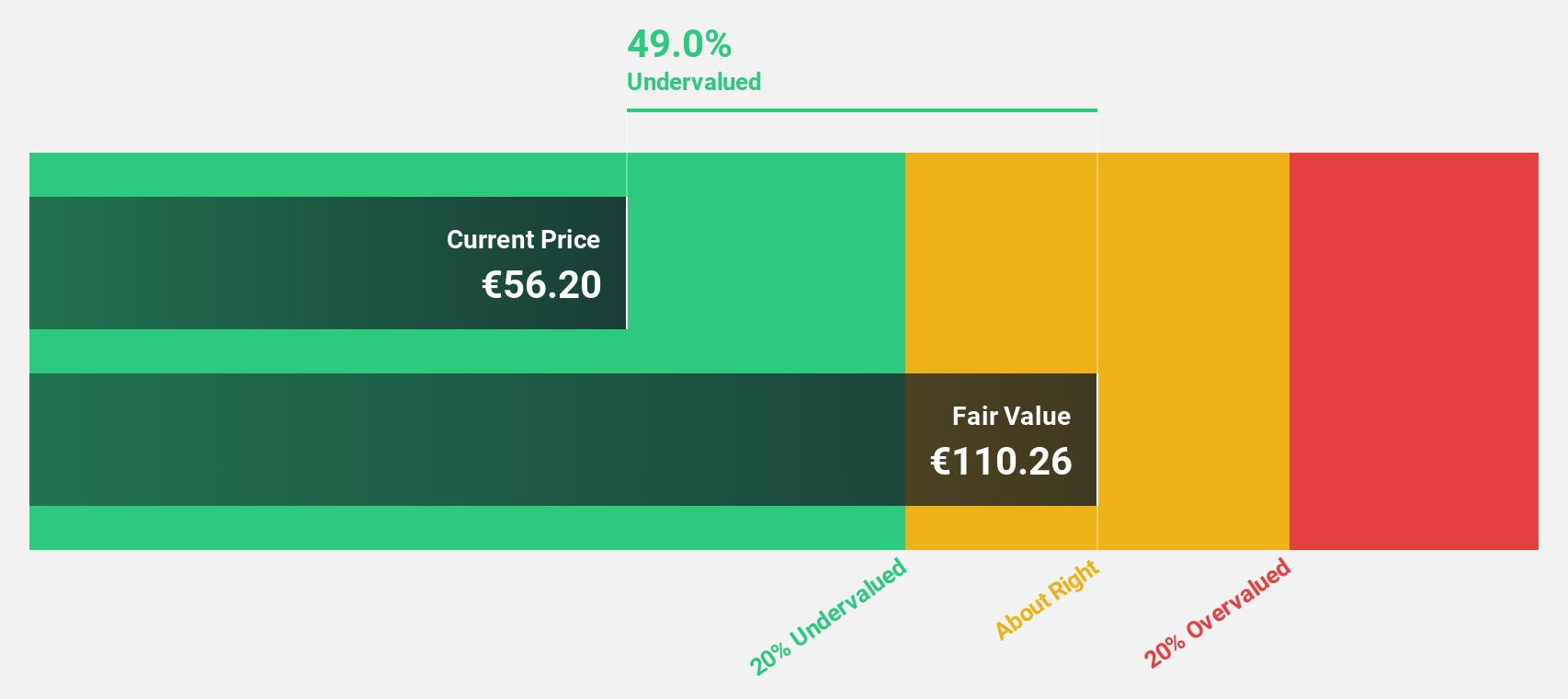

Estimated Discount To Fair Value: 37.9%

Laboratorios Farmaceuticos Rovi is trading at €62.25, significantly below its estimated fair value of €100.24, suggesting it may be undervalued based on cash flows. Despite a recent decline in sales to €525.06 million and net income to €97.77 million for the nine months ending September 2025, earnings are expected to grow substantially over the next three years at 21.3% annually, surpassing the Spanish market average growth rate of 7%.

- Our earnings growth report unveils the potential for significant increases in Laboratorios Farmaceuticos Rovi's future results.

- Get an in-depth perspective on Laboratorios Farmaceuticos Rovi's balance sheet by reading our health report here.

Apotea (OM:APOTEA)

Overview: Apotea AB (publ) operates an online pharmacy in Sweden with a market capitalization of approximately SEK9.19 billion.

Operations: The company's revenue is primarily derived from its online retail operations, which generated SEK7.09 billion.

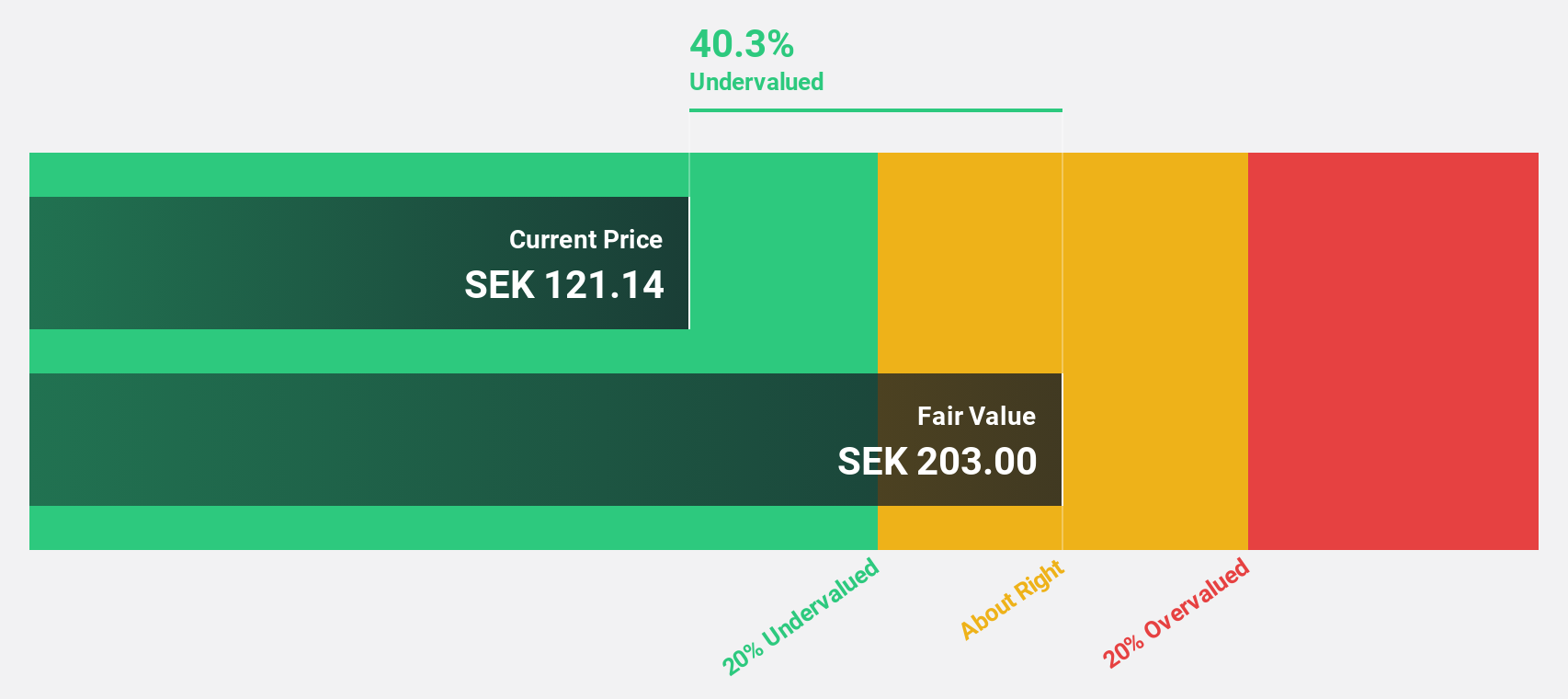

Estimated Discount To Fair Value: 24.7%

Apotea AB, trading at SEK 88.34, is priced below its fair value estimate of SEK 117.39, reflecting potential undervaluation based on cash flows. The company reported a year-over-year increase in Q3 revenue to SEK 1,773.4 million and net income to SEK 69.6 million. Earnings are projected to grow annually by 17.7%, outpacing the Swedish market's average growth rate of 13.5%, though not significantly high compared to some benchmarks.

- Our comprehensive growth report raises the possibility that Apotea is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Apotea's balance sheet health report.

JOST Werke (XTRA:JST)

Overview: JOST Werke SE manufactures and supplies safety-critical systems for the commercial vehicle industry across Germany, Europe, North America, Asia, the Pacific, and Africa with a market cap of €806.09 million.

Operations: JOST Werke SE generates revenue from manufacturing and supplying safety-critical systems for the commercial vehicle sector, with operations spanning Germany, Europe, North America, Asia, the Pacific, and Africa.

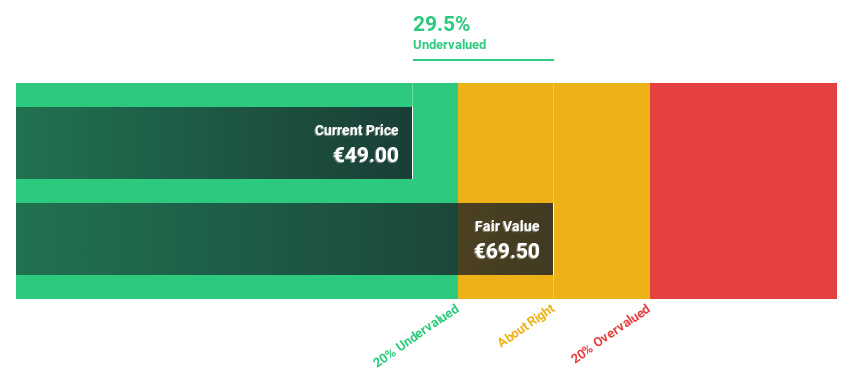

Estimated Discount To Fair Value: 18.2%

JOST Werke SE, trading at €54.1, is undervalued with a fair value estimate of €66.16. Despite high debt levels and unstable dividends, its earnings are forecast to grow significantly at 47.1% annually over the next three years, surpassing the German market average of 17%. Recent Q3 results showed increased sales to €383.15 million but decreased net income to €1.89 million year-over-year, impacted by large one-off items affecting financial outcomes.

- The growth report we've compiled suggests that JOST Werke's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of JOST Werke stock in this financial health report.

Taking Advantage

- Click this link to deep-dive into the 192 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报