Is Bonei Hatichon Civil Engineering & Infrastructures (TLV:BOTI) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Bonei Hatichon Civil Engineering & Infrastructures Ltd. (TLV:BOTI) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does Bonei Hatichon Civil Engineering & Infrastructures Carry?

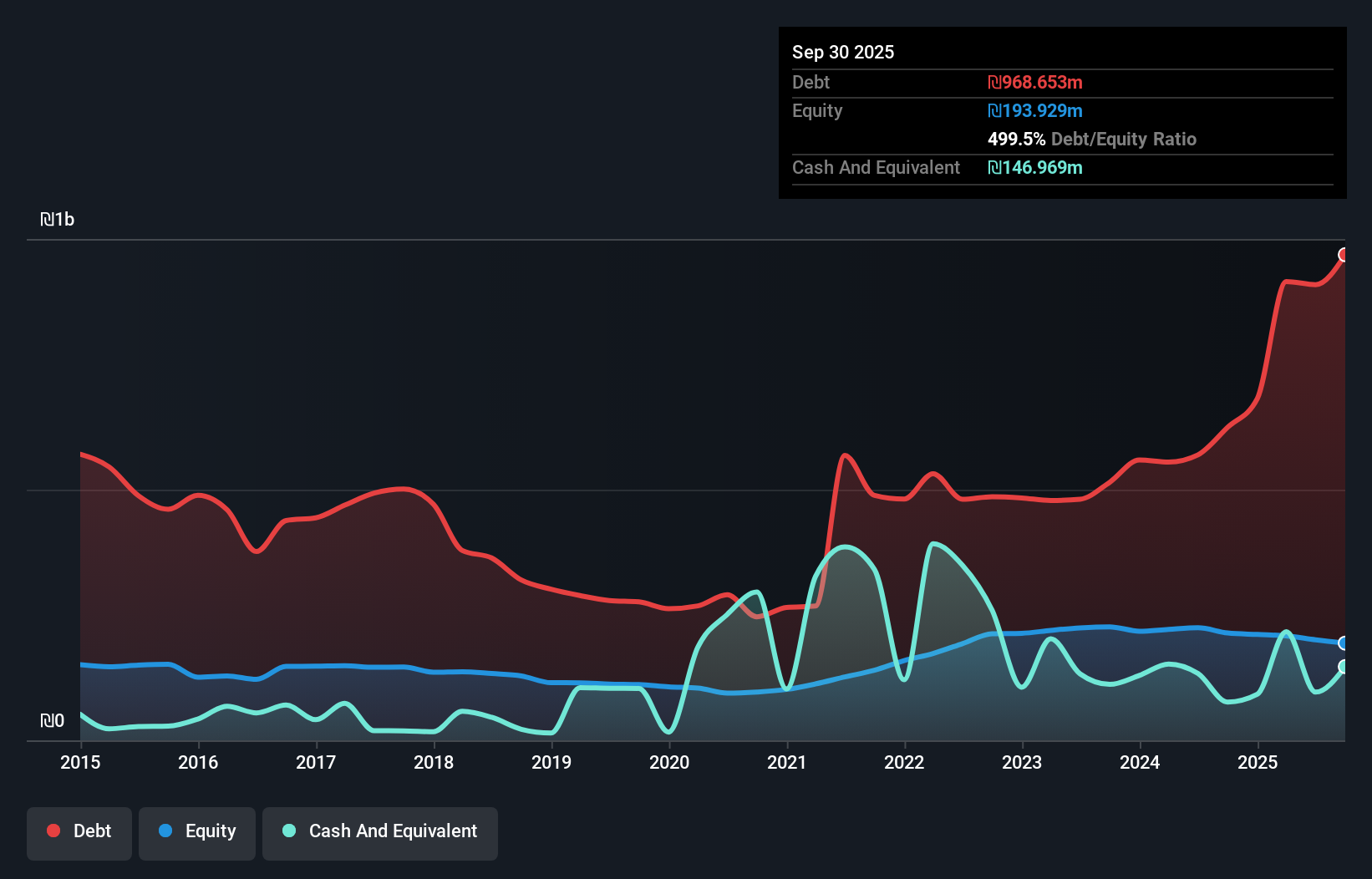

As you can see below, at the end of September 2025, Bonei Hatichon Civil Engineering & Infrastructures had ₪968.7m of debt, up from ₪624.3m a year ago. Click the image for more detail. However, because it has a cash reserve of ₪147.0m, its net debt is less, at about ₪821.7m.

How Strong Is Bonei Hatichon Civil Engineering & Infrastructures' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bonei Hatichon Civil Engineering & Infrastructures had liabilities of ₪1.36b due within 12 months and liabilities of ₪24.0m due beyond that. Offsetting these obligations, it had cash of ₪147.0m as well as receivables valued at ₪330.7m due within 12 months. So it has liabilities totalling ₪904.0m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₪568.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Bonei Hatichon Civil Engineering & Infrastructures would probably need a major re-capitalization if its creditors were to demand repayment.

See our latest analysis for Bonei Hatichon Civil Engineering & Infrastructures

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Bonei Hatichon Civil Engineering & Infrastructures shareholders face the double whammy of a high net debt to EBITDA ratio (24.3), and fairly weak interest coverage, since EBIT is just 0.63 times the interest expense. This means we'd consider it to have a heavy debt load. On a lighter note, we note that Bonei Hatichon Civil Engineering & Infrastructures grew its EBIT by 29% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Bonei Hatichon Civil Engineering & Infrastructures's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Bonei Hatichon Civil Engineering & Infrastructures burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Bonei Hatichon Civil Engineering & Infrastructures's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. After considering the datapoints discussed, we think Bonei Hatichon Civil Engineering & Infrastructures has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Bonei Hatichon Civil Engineering & Infrastructures that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报