Fukuoka REIT (TSE:8968): Valuation Check After the Newly Announced Semi-Annual Dividend Cut

Fukuoka REIT (TSE:8968) just told investors it will pay a semi annual dividend of JPY 4,000 per share in May 2026, a reduction that immediately puts cash flow sustainability in focus.

See our latest analysis for Fukuoka REIT.

The cut comes after a strong run, with the share price up about 26.7% year to date and a robust 38.5% total shareholder return over 12 months, suggesting momentum is still positive even as income expectations reset.

If this dividend tweak has you reassessing your income plays, it could be a good moment to explore fast growing stocks with high insider ownership as a way to discover other compelling opportunities.

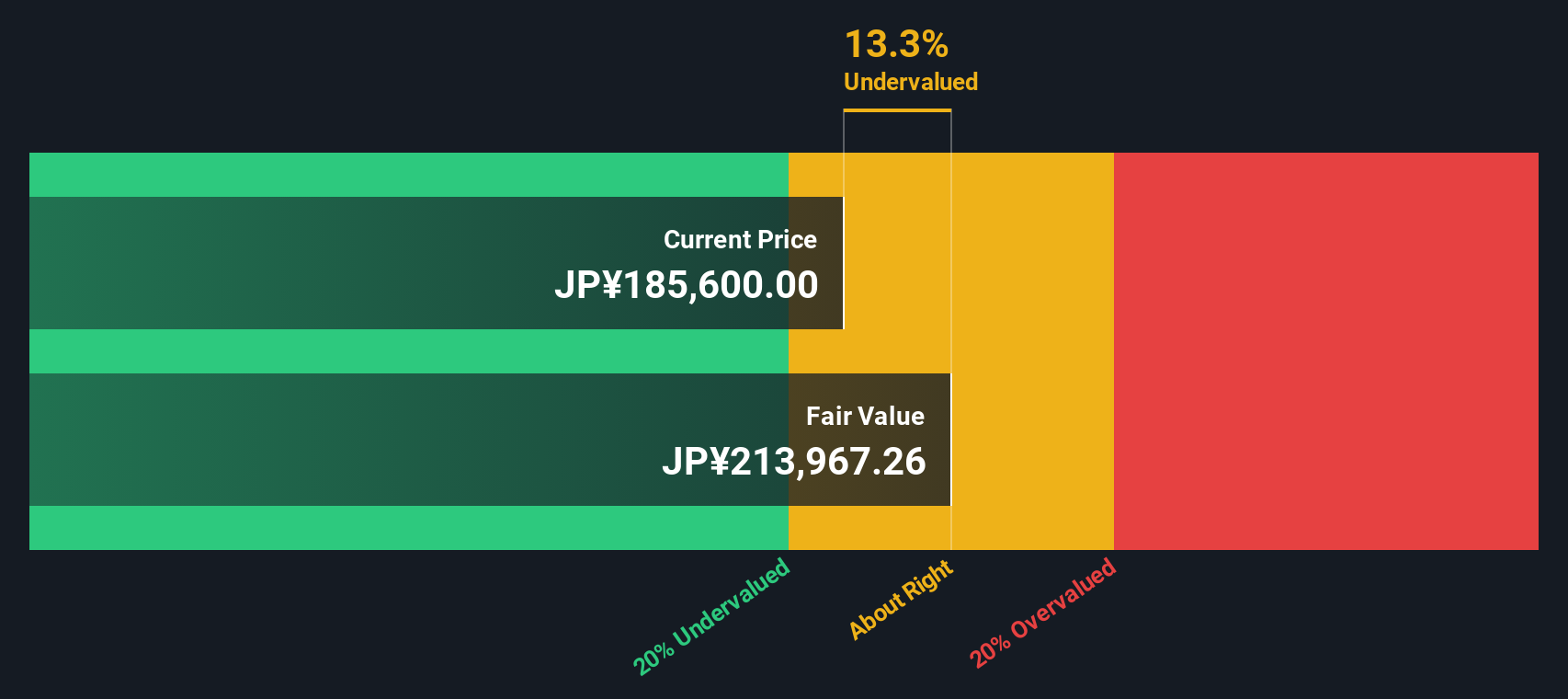

With units still trading close to analyst targets but at a noticeable discount to estimated intrinsic value, the key question now is whether Fukuoka REIT is a mispriced regional gem or whether the market already anticipates its future growth.

Price-to-Earnings of 20.2x: Is it justified?

On a price-to-earnings ratio of 20.2x, Fukuoka REIT looks inexpensive versus its own fair P E of 23.3x and its last close of ¥186,300.

The price to earnings multiple compares today’s unit price with annual earnings per unit. This is a key gauge for income focused investors in REITs.

For Fukuoka REIT, the market appears to be assigning a lower earnings multiple than our fair ratio suggests, even though the units also trade at about a 13.2 percent discount to our SWS DCF fair value estimate of roughly ¥214,541.

Against peers, the picture is more nuanced. The trust screens cheap versus the peer average P E of 25.1x, yet still looks expensive next to the broader Asian retail REITs group, where the average multiple is closer to 15.1x.

Explore the SWS fair ratio for Fukuoka REIT

Result: Price-to-Earnings of 20.2x (UNDERVALUED)

However, softer net income trends and any setback in Kyushu’s regional real estate demand could quickly challenge today’s seemingly attractive valuation.

Find out about the key risks to this Fukuoka REIT narrative.

Another View: Valuation Gaps Cut Both Ways

Our SWS DCF model also points to upside, with Fukuoka REIT trading about 13.2 percent below its estimated fair value of roughly ¥214,541. If both earnings based multiples and cash flow estimates flag value, is the market simply cautious about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fukuoka REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fukuoka REIT Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a personalised view in just minutes. Do it your way.

A great starting point for your Fukuoka REIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing move?

Smart investors do not stop at one opportunity; they scan the market for stand out ideas that others overlook, so you should too using the Simply Wall Street Screener.

- Capture potential high growth stories early by reviewing these 3613 penny stocks with strong financials that already show stronger fundamentals than most tiny caps ever achieve.

- Position yourself at the forefront of innovation by tapping into these 26 AI penny stocks that link real revenue growth to artificial intelligence tailwinds.

- Lock in value focused opportunities by targeting these 908 undervalued stocks based on cash flows that our models flag as mispriced based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报