Assessing DENSO (TSE:6902)’s Valuation After Recent Short-Term Share Price Strength

DENSO (TSE:6902) has quietly outperformed the broader auto parts space over the past week, and that short term strength comes against a mixed backdrop of modest 1 month gains but flat performance over the past 3 months.

See our latest analysis for DENSO.

Zooming out, DENSO’s recent 7 day share price return sits against a year to date share price decline, even as its multi year total shareholder return remains firmly positive. This hints that long term momentum is intact while near term sentiment recalibrates.

If DENSO’s move has you watching the auto space more closely, this could be a good moment to explore other opportunities among auto manufacturers.

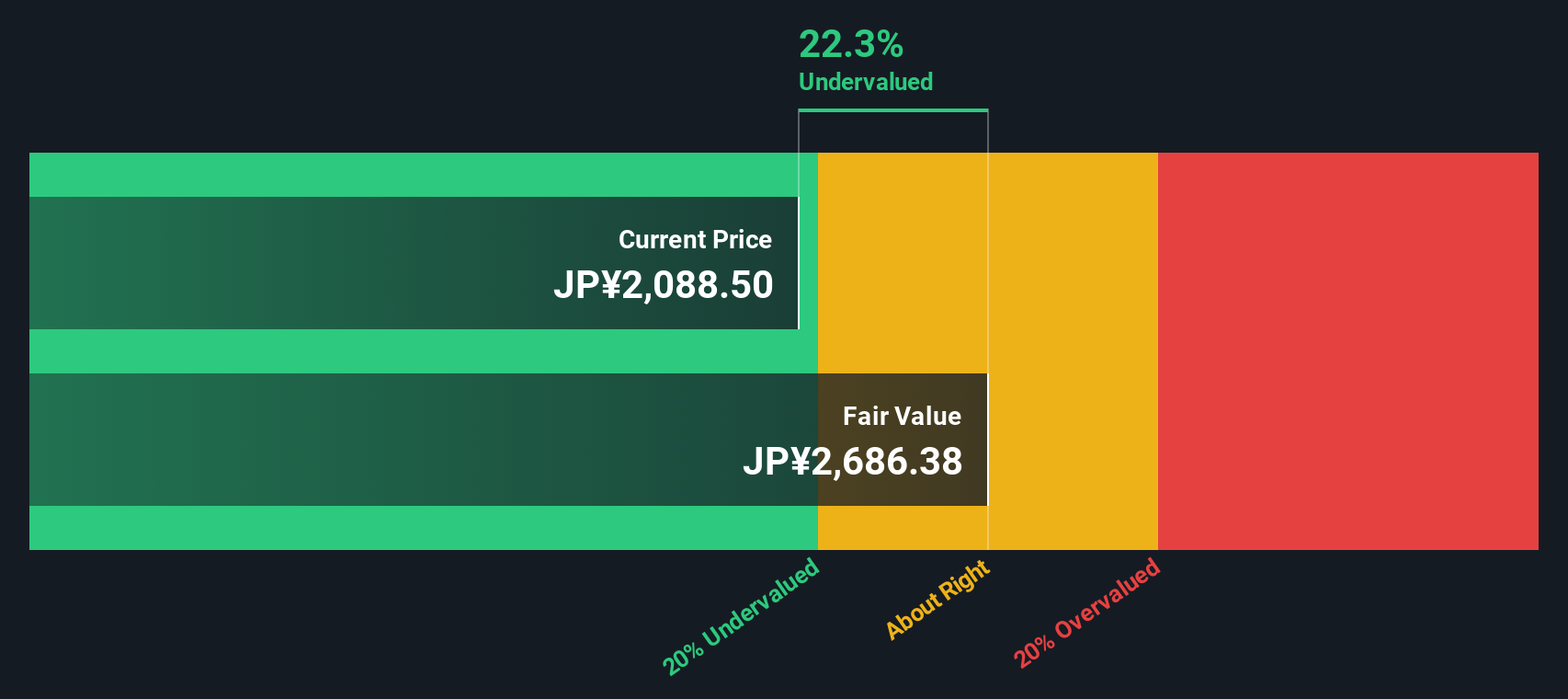

With shares still trading at a discount to analyst targets and intrinsic value estimates despite steady revenue and profit growth, investors now face a key question: is this a buying opportunity, or is future growth already priced in?

Price-to-Earnings of 15.9x: Is it justified?

At a last close of ¥2125.5, DENSO trades on a 15.9x price to earnings multiple, roughly in line with peers but richer than the wider auto components space.

The price to earnings ratio compares what investors are paying today for each unit of current earnings, which is particularly important for a mature, profitable supplier like DENSO. It helps frame whether the market is demanding a premium for its quality and growth profile, or discounting it relative to other options in the sector.

On one hand, DENSO screens as good value versus a peer average multiple of 16.1x, suggesting investors are not overpaying relative to similar Japanese names. On the other hand, its 15.9x multiple is above the 9.9x average for the broader JP Auto Components industry and modestly above an estimated fair price to earnings ratio of 15.7x, implying limited room for multiple expansion if sentiment softens.

Explore the SWS fair ratio for DENSO

Result: Price-to-Earnings of 15.9x (ABOUT RIGHT)

However, sustained weakness in auto production or slower adoption of electrified powertrains could pressure DENSO’s growth expectations and limit any re rating in the near term.

Find out about the key risks to this DENSO narrative.

Another View: DCF Points to Deeper Value

While the earnings multiple suggests DENSO is roughly fairly priced, our DCF model tells a different story, indicating the shares trade around 27% below an estimated fair value of ¥2903.53. If the cash flows play out as expected, is the market overlooking a longer term opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DENSO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DENSO Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your DENSO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the next opportunity runs without you, use the Simply Wall Street Screener to uncover stocks that match your strategy and keep your portfolio working harder.

- Capitalize on powerful long term compounding by targeting these 13 dividend stocks with yields > 3% that can keep paying you while markets move around.

- Ride structural growth in digital infrastructure by focusing on these 80 cryptocurrency and blockchain stocks shaping the future of payments and decentralized networks.

- Seize early stage innovation potential with these 26 AI penny stocks positioned at the intersection of automation, data, and next generation software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报