Empire State Realty Trust (ESRT): Valuation Check After $500m Buyback, Dividend Affirmation and Scholastic Building Deal

Empire State Realty Trust (ESRT) just rolled out a $500 million share repurchase plan alongside a steady fourth quarter dividend, while also moving to buy the Scholastic Building in SoHo. That combination deserves a closer look.

See our latest analysis for Empire State Realty Trust.

These moves come after a tough stretch, with a 90 day share price return of negative 10.9 percent and a one year total shareholder return of negative 37.2 percent. However, ESRT’s opportunistic buyback and SoHo expansion suggest management sees long term upside even from today’s 6.94 dollar share price.

If this kind of contrarian real estate bet has your attention, it might be a good time to see what else is compelling in the market and explore fast growing stocks with high insider ownership

With shares still down sharply over the past year but trading at a sizable discount to analyst targets and intrinsic value estimates, is Empire State Realty Trust a contrarian buy, or is the market already discounting all future growth?

Most Popular Narrative Narrative: 18.8% Undervalued

With a fair value estimate of 8.55 dollars versus a 6.94 dollar last close, the most followed narrative sees meaningful upside still on the table.

Ongoing portfolio modernization and demonstrated leadership in sustainability and energy efficiency strengthens ESRT's competitive position, enabling premium rents, attracting high-quality tenants, and supporting net margin expansion as tenants increasingly seek sustainable space and as operating costs are optimized.

Curious how modest revenue growth, thinner margins, and a surprisingly rich future earnings multiple can still justify upside from here? The full narrative unpacks the tension between slowing profits, rising share count, and a valuation framework more often reserved for fast growing sectors. Want to see which assumptions make that upside case hang together?

Result: Fair Value of $8.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on execution, with Observatory tourism softness and rising operating expenses both capable of squeezing margins and undermining the bullish thesis.

Find out about the key risks to this Empire State Realty Trust narrative.

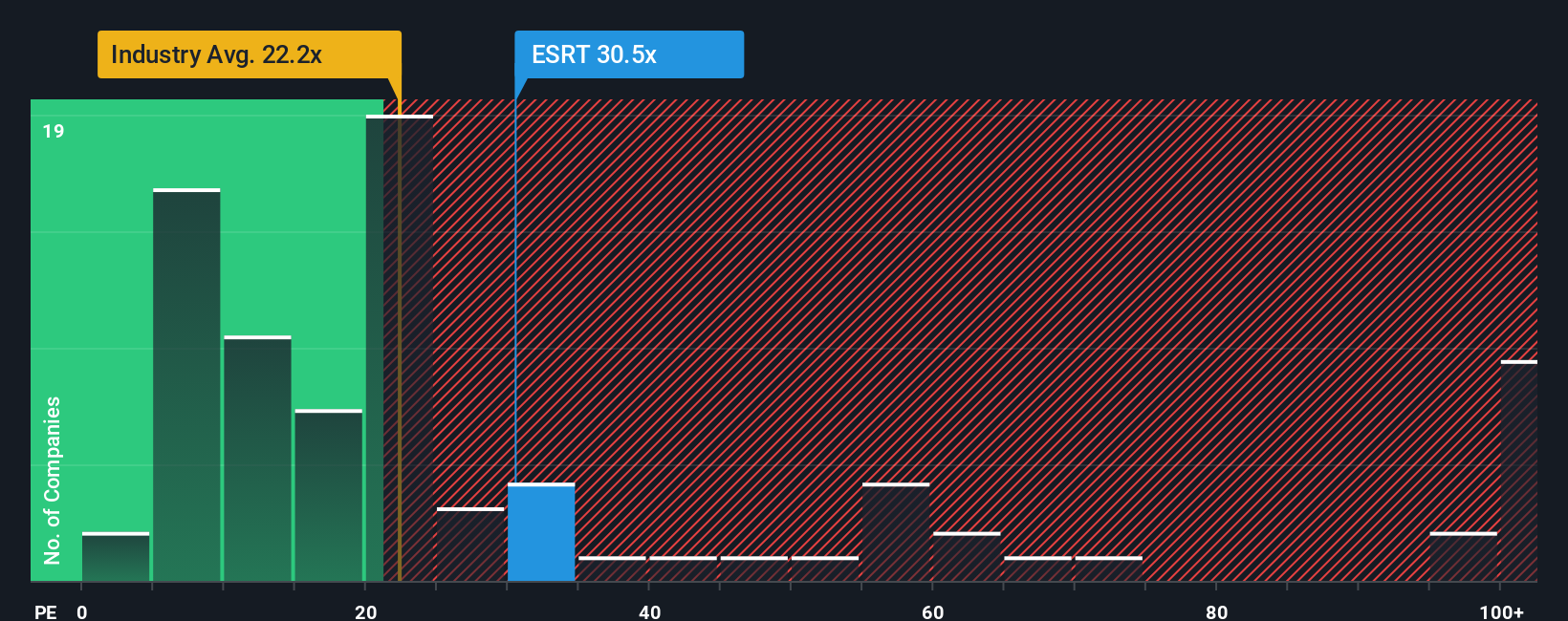

Another View: Market Ratios Flash a Caution Signal

While our fair value points to upside, ESRT’s 33.9 times earnings looks steep beside the Office REITs industry at 22.3 times and a fair ratio of 26.6 times. That gap suggests less margin for error if earnings disappoint. Are investors overpaying for safety and brand?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Empire State Realty Trust Narrative

If you see things differently, or just enjoy digging into the numbers yourself, you can build a tailored view in minutes with Do it your way

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction investment ideas?

Before you move on, make sure you are not leaving potential winners on the table. Use the Simply Wall Street Screener to explore potential next steps.

- Explore early stage momentum by researching these 3612 penny stocks with strong financials that combine low share prices with relatively strong fundamentals.

- Focus on structural growth by reviewing these 30 healthcare AI stocks that are involved in how medicine is delivered, analyzed, and personalized.

- Review consistent cashflow potential by examining these 13 dividend stocks with yields > 3% that aim to provide investors with ongoing income and the potential benefits of long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报