Morgan Stanley’s CUBI Coverage vs Insider Sales Could Be A Game Changer For Customers Bancorp

- Morgan Stanley recently initiated coverage of Customers Bancorp with an Equal Weight rating, citing the bank as a high-performing deposit transformation story with momentum expected into 2026 and beyond.

- A series of insider share sales, including Chief Accounting Officer Jessie John Deano Velasquez’s December 2025 transaction, contrasts with growing analyst attention and highlights how external confidence and internal share activity can sometimes move in different directions.

- With Morgan Stanley’s new coverage spotlighting deposit transformation, we’ll examine how this endorsement interacts with Customers Bancorp’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Customers Bancorp Investment Narrative Recap

To own Customers Bancorp, you need to believe its cubiX driven deposit model can keep attracting sticky, tech oriented clients while managing concentrated digital asset exposure and regulatory scrutiny. Morgan Stanley’s Equal Weight initiation and Velasquez’s share sale do not materially change the near term catalyst, which remains execution on deposit transformation, or the key risk around cubiX related deposit stability and potential earnings volatility if digital asset conditions or rules shift quickly.

Morgan Stanley’s coverage explicitly frames Customers as a “high performing deposit transformation story,” which ties directly into the cubiX growth catalyst that many investors are focused on. Set against this endorsement, the pattern of insider selling over the past year serves as a reminder that market optimism sits alongside real concentration and regulatory risks within the bank’s digital asset and stablecoin exposed deposit base.

Yet behind the optimism around cubiX and digital deposits, investors should still be aware of the concentration risk if...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's narrative projects $977.5 million revenue and $424.9 million earnings by 2028. This requires 17.9% yearly revenue growth and about a $293 million earnings increase from $131.6 million today.

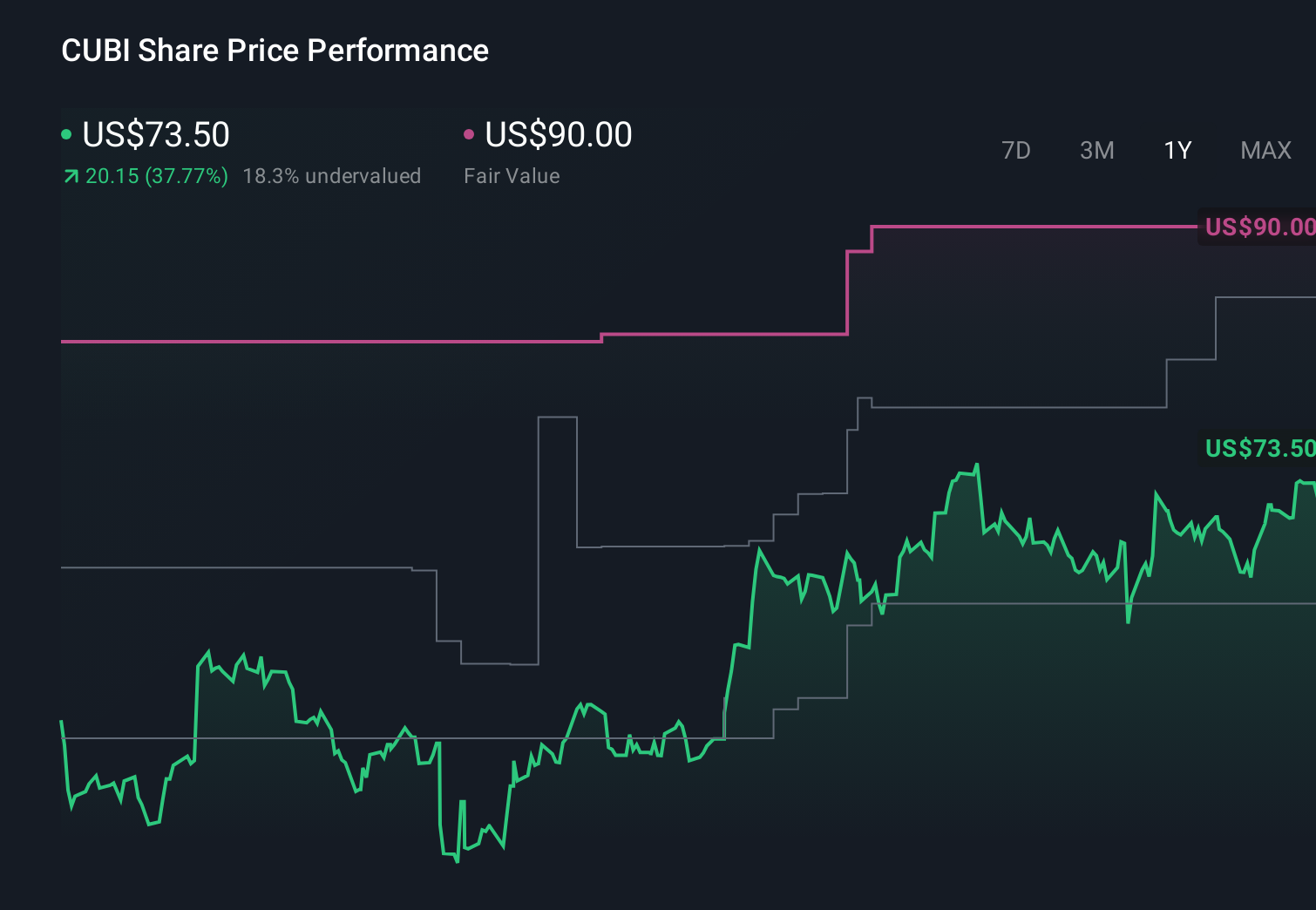

Uncover how Customers Bancorp's forecasts yield a $85.33 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$82 to US$159 per share, underscoring how far apart individual views can be. When you weigh that dispersion against the reliance on cubiX related deposits and evolving regulation, it becomes even more important to compare several independent viewpoints before deciding how Customers Bancorp fits into your portfolio.

Explore 3 other fair value estimates on Customers Bancorp - why the stock might be worth over 2x more than the current price!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报