Aperam (ENXTAM:APAM) Valuation Check After 316A Stainless Steel Breakthrough and Recent Share Price Strength

Aperam (ENXTAM:APAM) just rolled out its new patented 316A stainless steel grade, and that is what has traders leaning in. The stock’s recent climb raises a simple question: how much of this innovation is already priced in?

See our latest analysis for Aperam.

Investors seem to be warming up to that story, with a 90 day share price return of roughly 26 percent and a 1 year total shareholder return close to 39 percent, suggesting momentum is building rather than fading.

If this stainless steel breakthrough has you thinking bigger about industrial names, it is a good moment to explore auto manufacturers as potential next ideas on your radar.

Yet with the shares already outpacing the market and trading above analyst targets despite weak recent earnings, investors face a dilemma: is Aperam still undervalued on 316A’s potential, or is future growth already fully priced in?

Most Popular Narrative: 7.4% Overvalued

Compared with a narrative fair value of €31.68, Aperam’s last close at €34.04 implies investors are already paying up for the turnaround story.

The analysts have a consensus price target of €29.63 for Aperam based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €37.0, and the most bearish reporting a price target of just €25.0.

Want to see what powers this gap between fair value and today’s price? The narrative leans on rising margins, accelerating earnings, and a re rated profit multiple. Curious how those moving parts combine into that target?

Result: Fair Value of €31.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent European demand weakness and ongoing operational disruptions could easily derail margin recovery and challenge the upbeat narrative around 316A.

Find out about the key risks to this Aperam narrative.

Another Angle on Value

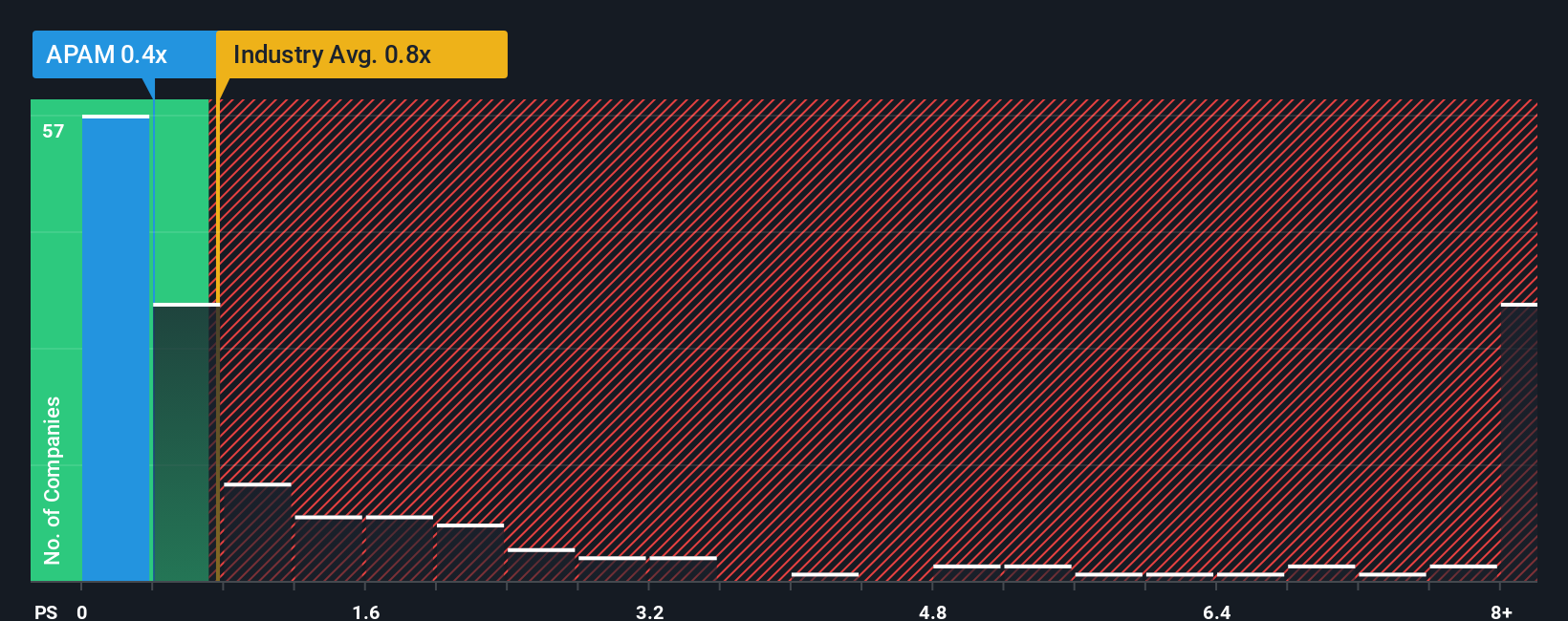

On raw sales, Aperam looks reasonably priced at 0.4 times revenue, in line with its own fair ratio and notably cheaper than both European metals peers and the wider industry at about 0.7 times. That narrower gap leaves less obvious upside, but also less margin for disappointment if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aperam Narrative

If this view does not fully line up with your own, or you would rather dig into the numbers yourself, you can build a fresh take in under three minutes, Do it your way.

A great starting point for your Aperam research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider scanning fresh opportunities from our screeners so you do not miss the next standout idea.

- Review these 3612 penny stocks with strong financials that combine small market capitalizations with improving fundamentals and potential for sentiment to re rate.

- Explore these 26 AI penny stocks positioned at the intersection of data, automation and scalable digital business models to increase your portfolio’s innovation exposure.

- Evaluate these 13 dividend stocks with yields > 3% that seek to balance yield levels with payout sustainability and consistent cash flow generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报