Is It Too Late to Consider Bank OZK After Strong Multi Year Share Price Gains?

- If you are wondering whether Bank OZK is still attractively priced today or if the easiest gains are already behind it, this overview can help unpack what the market might be overlooking.

- The stock has quietly climbed about 3.0% over the last week and 10.4% over the last month, and is up 11.1% year to date. Those gains add to longer-term increases of 38.7% over three years and 92.6% over five years.

- Recent market attention has focused on Bank OZK’s strategic positioning in commercial real estate lending and its conservative balance sheet. Some investors view this as a relative advantage as credit conditions evolve. At the same time, broader sector concerns about regional banks and funding costs have kept sentiment mixed, creating a tug of war between optimism about growth and caution about risk.

- Within that backdrop, Bank OZK scores a strong 5/6 on our valuation checks. This suggests the market may not be fully reflecting its fundamentals. Below, we walk through what that means using multiple valuation approaches before finishing with a more robust way to think about its overall worth.

Find out why Bank OZK's 8.2% return over the last year is lagging behind its peers.

Approach 1: Bank OZK Excess Returns Analysis

The Excess Returns model estimates what Bank OZK is worth by comparing the returns it can earn on shareholders capital with the return investors demand. When a bank consistently earns more on its equity than its cost of equity, the difference, or excess return, builds intrinsic value over time.

For Bank OZK, book value is about $51.09 per share, with a stable earnings power estimate of $6.79 per share, based on weighted future Return on Equity forecasts from nine analysts. Against a cost of equity of $3.98 per share, this implies excess returns of roughly $2.81 per share each year on an average ROE of 11.87%. Analysts also see book value compounding toward a stable level of $57.20 per share, again supported by estimates from nine analysts.

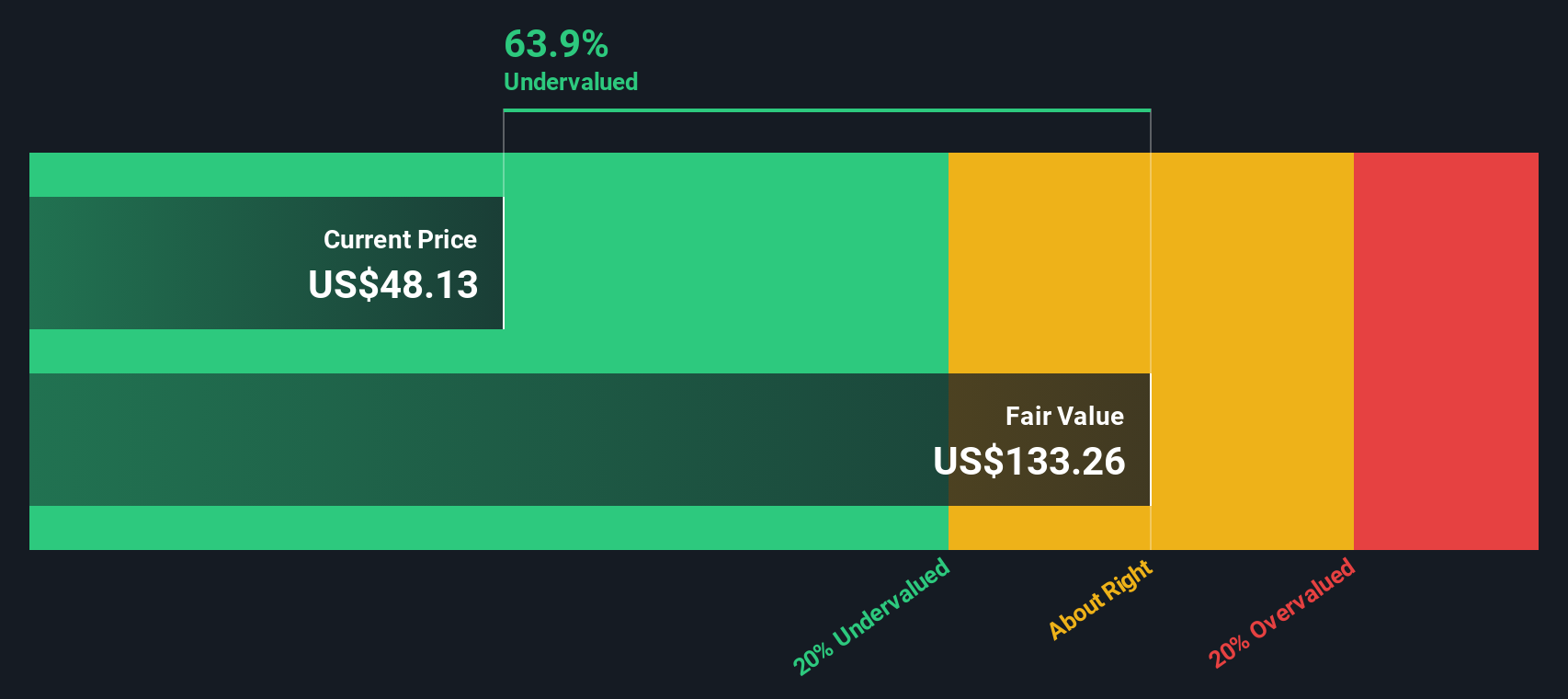

Feeding these inputs into the Excess Returns framework results in an intrinsic value estimate of roughly $133.26 per share, implying the stock is about 63.5% undervalued relative to its current market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank OZK is undervalued by 63.5%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Bank OZK Price vs Earnings

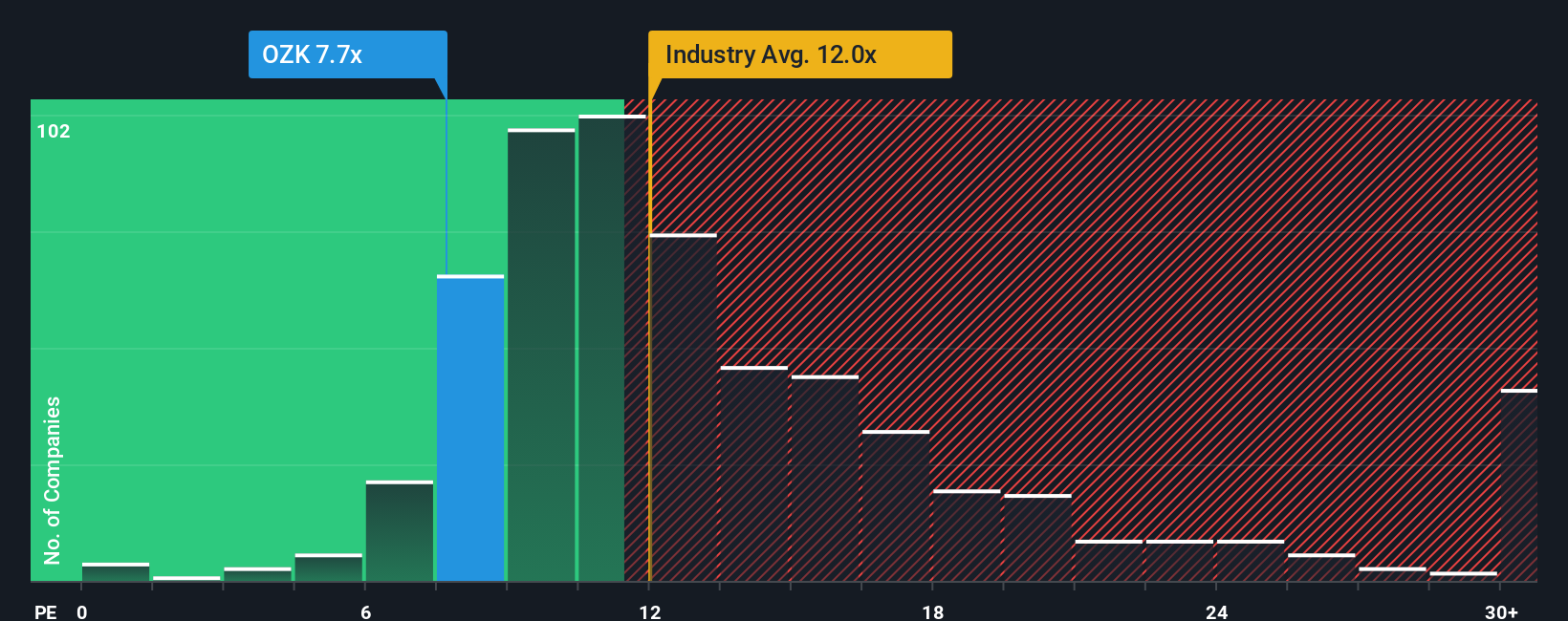

For profitable companies like Bank OZK, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It naturally ties valuation to profitability, which makes it especially relevant for established, consistently earning banks.

What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower risk usually justify a higher multiple, while slower growth or greater uncertainty should pull the multiple down.

Bank OZK currently trades on a PE of about 7.8x, which is well below both the US Banks industry average of roughly 11.9x and a broader peer average of about 16.7x. Simply Wall St’s Fair Ratio, our proprietary estimate of what PE the market should reasonably pay given Bank OZK’s growth profile, profitability, size and risk, comes out at around 11.2x. This is more informative than a simple peer or industry comparison because it adjusts for the company’s specific fundamentals rather than assuming all banks deserve the same multiple. Against that 11.2x Fair Ratio, the current 7.8x PE suggests the shares still look undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank OZK Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Bank OZK to the numbers by linking your view of its future revenue, earnings, margins and fair value to a clear financial forecast. Narratives on Simply Wall St, which you can explore on the Community page used by millions of investors, connect three pieces for you: the business story you believe, the forecast that flows from that story, and the fair value that those forecasts imply. Once you have a Narrative, you can quickly see whether Bank OZK looks like a buy or a sell by comparing your Fair Value to today’s market price, and that view is updated automatically as fresh news or earnings data comes in. For example, one Bank OZK Narrative might lean bullish, focusing on Sun Belt growth, CIB expansion and a higher future PE closer to the most optimistic analyst target of about $67 per share, while a more cautious Narrative could emphasize commercial real estate risk and slower diversification that anchors fair value nearer the most conservative target of around $42, and Narratives make both perspectives explicit, comparable and easy to refine over time.

Do you think there's more to the story for Bank OZK? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报