OGE Energy (OGE): Evaluating Valuation After $345M Equity Raise and 19th Straight Annual Dividend Increase

OGE Energy (OGE) is back on income investors radar after pairing a fresh 345 million public equity offering with its 19th straight yearly dividend increase. This combination says a lot about management priorities.

See our latest analysis for OGE Energy.

At a share price of $43.05, OGE’s near term share price return has been a bit soft, but its multi year total shareholder returns suggest steady compounding rather than fading momentum. This latest equity raise and dividend hike reinforces that narrative.

If this blend of income and infrastructure investment has you thinking more broadly about utilities and defensives, it could be worth exploring other regulated healthcare stocks for comparison.

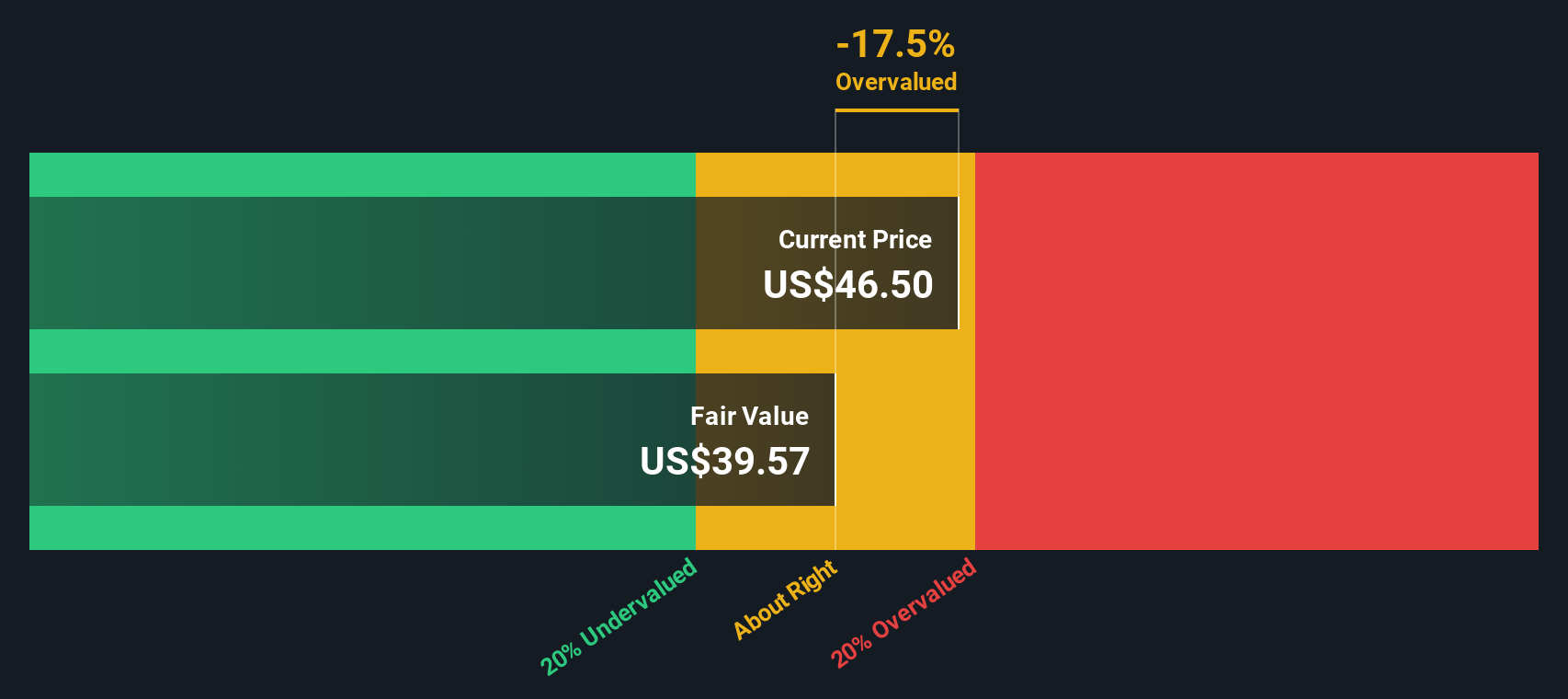

With shares trading at a modest discount to analyst targets but a premium to some valuation models, the key question is whether OGE is quietly undervalued for its steady growth or if the market is already pricing in its future upside.

Most Popular Narrative Narrative: 8.7% Undervalued

With OGE Energy last closing at 43.05 dollars against a narrative fair value of about 47.15 dollars, the current setup leans toward modest upside under consensus assumptions.

Ongoing and planned investments in generation capacity and transmission infrastructure, with legislative and regulatory support (e.g., CWIP and PISA mechanisms), enable accelerated asset deployment with minimized lag in rate recovery, supporting consistent future earnings and improved return on equity.

Curious how steady mid single digit growth, gently rising margins, and a richer future earnings multiple combine to justify that higher value? Want to see the exact roadmap behind those expectations?

Result: Fair Value of $47.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in industrial load and heavier reliance on gas fired projects could squeeze future margins if regulatory or economic conditions turn less supportive.

Find out about the key risks to this OGE Energy narrative.

Another Lens On Value

Our SWS DCF model points the other way and suggests fair value closer to 37.51 dollars versus today’s 43.05 dollars, making OGE look overvalued on cash flows even as earnings based narratives call it modestly undervalued. Which lens do you trust more for the next leg?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If you see the story differently or would rather rely on your own research, you can build a custom view in just minutes, Do it your way.

A great starting point for your OGE Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning targeted stock ideas on Simply Wall Street, so you are not relying on OGE alone.

- Capitalize on mispriced potential by reviewing these 908 undervalued stocks based on cash flows that may offer stronger upside than mature utilities.

- Ride powerful technology tailwinds by focusing on these 26 AI penny stocks positioned at the center of the AI transformation.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can complement the payout profile of OGE.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报