Is Emerson Electric Still Attractive After Automation Pivot and 87.4% Five Year Surge?

- If you are wondering whether Emerson Electric at around $136 a share is still a smart buy or if the easy money has already been made, this breakdown is for you.

- The stock has slipped about 0.5% over the last week, but is still up 7.1% over the past month, 11.8% year to date, and 87.4% over five years, a pattern that hints at both staying power and shifting expectations.

- Recently, Emerson has been in the spotlight for its strategic pivot toward higher growth automation and industrial software, supported by a series of portfolio moves and acquisitions that aim to sharpen its focus. Those moves have helped reshape how investors think about its long term growth and risk profile, and they form the backdrop for the latest price action.

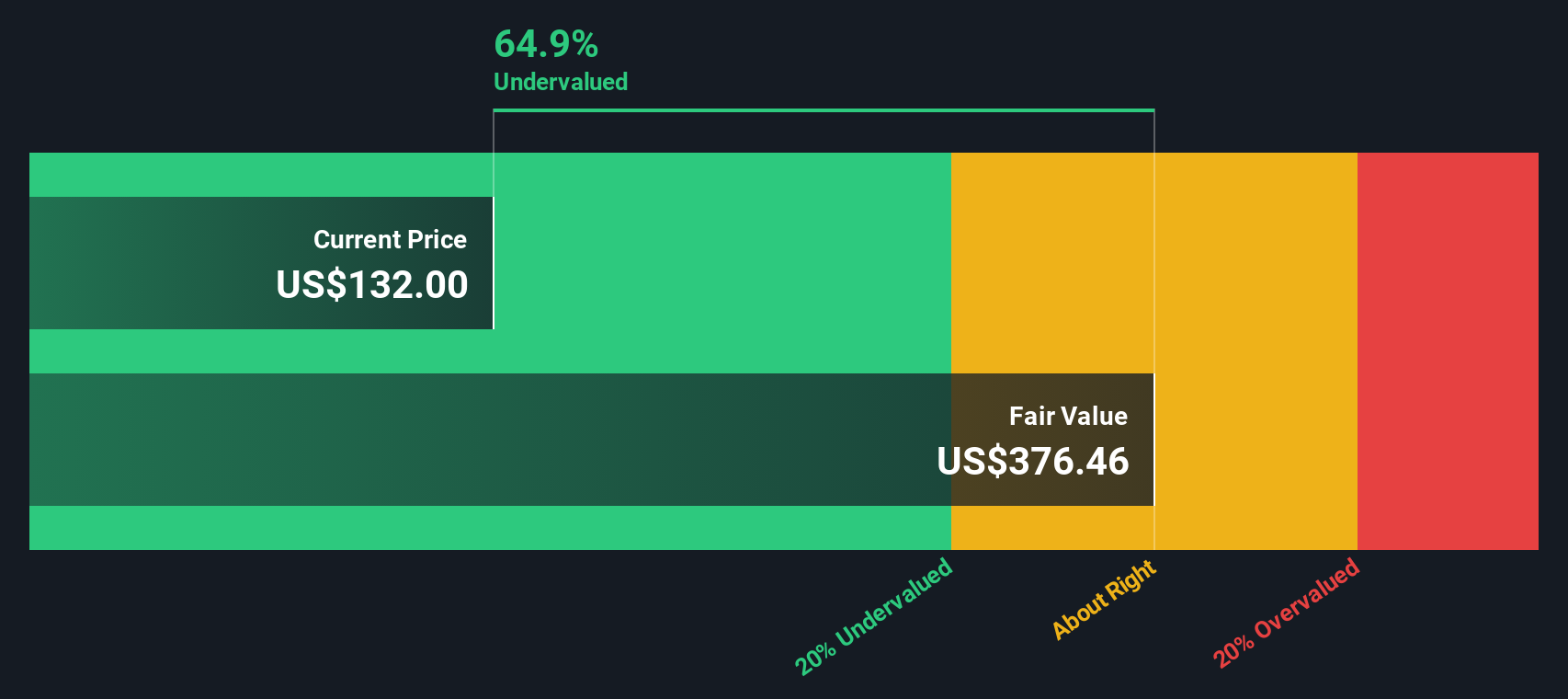

- Right now, Emerson scores a 3/6 valuation check score, suggesting the market might be only half convinced it is undervalued. We will walk through what that means across different valuation methods, then finish with a more complete way to think about its true worth.

Find out why Emerson Electric's 6.7% return over the last year is lagging behind its peers.

Approach 1: Emerson Electric Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to their value in $ today.

For Emerson Electric, the latest twelve month free cash flow is about $2.7 Billion. Analysts and model projections see this rising steadily, with free cash flow expected to reach roughly $7.1 Billion by 2029 and continuing to grow into the next decade. The 2 Stage Free Cash Flow to Equity model used here blends analyst estimates for the next several years with longer term extrapolations by Simply Wall St to build a 10 year cash flow outlook.

When those projected cash flows are discounted back, the model arrives at an intrinsic value of about $228.10 per share. Compared with the current share price around $136, the DCF implies the stock is roughly 40.1% undervalued. This suggests the market is not fully pricing in Emerson’s long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Emerson Electric is undervalued by 40.1%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

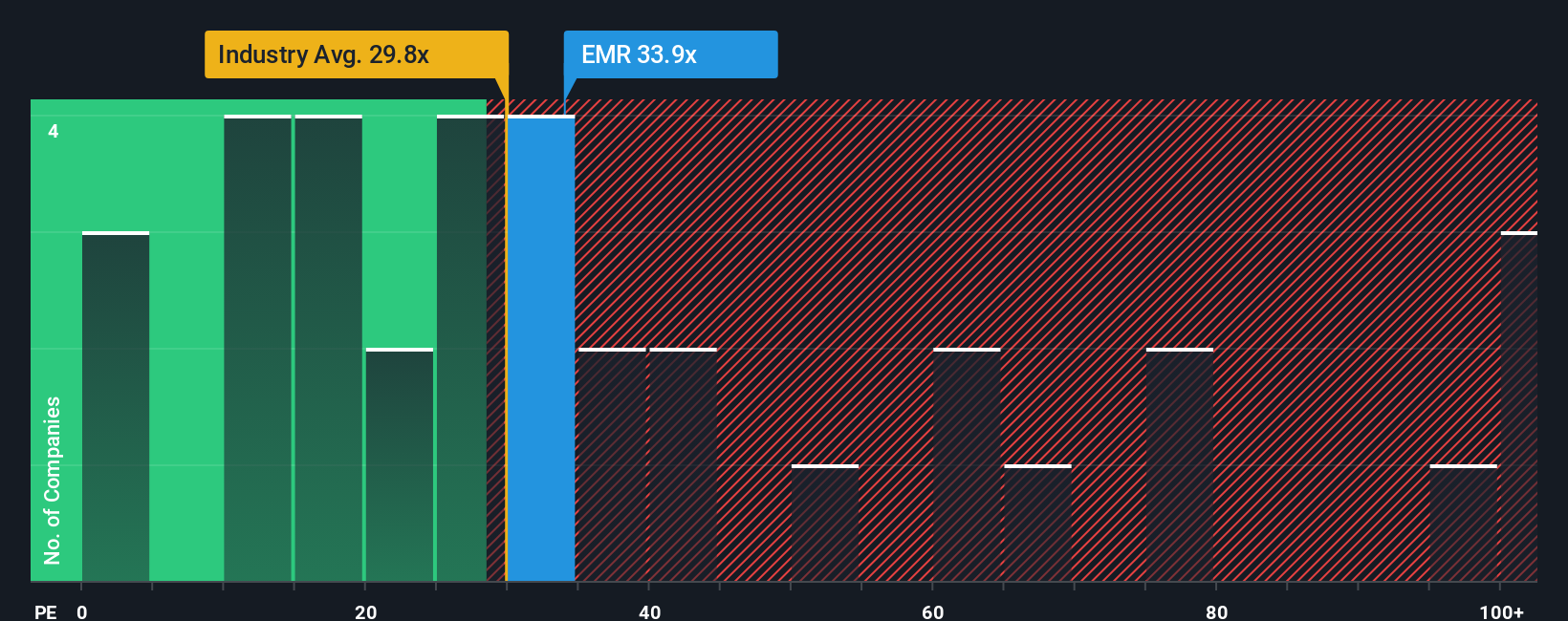

Approach 2: Emerson Electric Price vs Earnings

For a profitable company like Emerson Electric, the price to earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profits. In general, faster growth and lower risk justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

Emerson currently trades on a PE of about 33.6x. That sits modestly above the Electrical industry average of roughly 31.6x, but below the broader peer group average near 44.1x. This suggests investors are willing to pay a premium to the sector, yet not a technology-like growth multiple. To refine this view, Simply Wall St calculates a proprietary Fair Ratio of 31.9x. This reflects what Emerson’s PE should be after factoring in its earnings growth outlook, profitability, risk profile, industry positioning, and market cap.

This Fair Ratio offers a more tailored benchmark than simple peer or industry comparisons because it aligns the multiple with Emerson’s specific fundamentals rather than one-size-fits-all averages. With the current PE only slightly above the 31.9x Fair Ratio, the stock screens as roughly fairly valued on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Emerson Electric Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Emerson Electric’s future with a concrete forecast and a Fair Value you can compare to today’s price.

A Narrative is your story behind the numbers, where you spell out what you believe about Emerson’s future revenue, earnings and margins, and link that story directly to a financial model and a Fair Value estimate.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy and accessible, allowing you to see how your assumptions translate into a Fair Value, and then decide whether the current price suggests a buy, hold, or sell.

Because Narratives update dynamically as new news, earnings, or guidance arrives, your Fair Value view stays in sync with reality instead of going stale.

For example, one investor might build a bullish Emerson Narrative that assumes margins rise toward 16% with strong automation demand and a Fair Value closer to $185. In contrast, a more cautious investor, worried about cyclicality and integration risks, might see only modest growth and a Fair Value nearer $111. Narratives lets you transparently compare and refine both perspectives.

Do you think there's more to the story for Emerson Electric? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报