3 ASX Growth Stocks With High Insider Ownership

As the Australian market shows signs of recovery with a potential year-end rally, investors are keenly observing growth stocks that may benefit from this positive momentum. In such an environment, companies with high insider ownership can often be appealing as they suggest confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.4% |

| Titomic (ASX:TTT) | 13.5% | 74.9% |

| Polymetals Resources (ASX:POL) | 32.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| Elsight (ASX:ELS) | 17.3% | 77% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.3% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's review some notable picks from our screened stocks.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★★

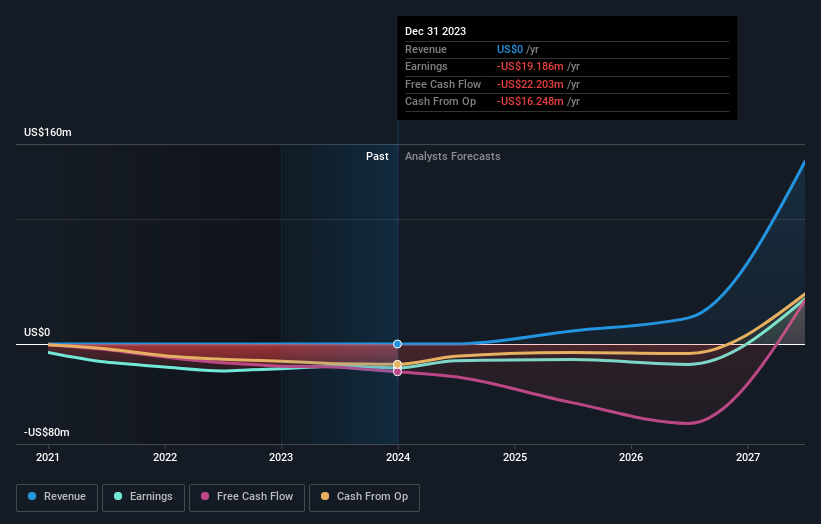

Overview: IperionX Limited focuses on the development of mineral properties in the United States and has a market capitalization of A$1.80 billion.

Operations: IperionX Limited does not currently report any revenue segments.

Insider Ownership: 16.9%

Return On Equity Forecast: 61% (2028 estimate)

IperionX exhibits strong growth potential with forecasted revenue growth of 56.9% annually, significantly outpacing the Australian market. Insiders have shown confidence by purchasing more shares recently, and no substantial insider selling has occurred in the past three months. Although currently generating less than US$1 million in revenue, IperionX is expected to become profitable within three years. The stock trades at a significant discount to its estimated fair value and was recently added to the S&P/ASX 200 Index.

- Unlock comprehensive insights into our analysis of IperionX stock in this growth report.

- The analysis detailed in our IperionX valuation report hints at an inflated share price compared to its estimated value.

Magnetic Resources (ASX:MAU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia, with a market cap of A$380.89 million.

Operations: The company's revenue segment is derived entirely from mineral exploration, amounting to A$0.01 million.

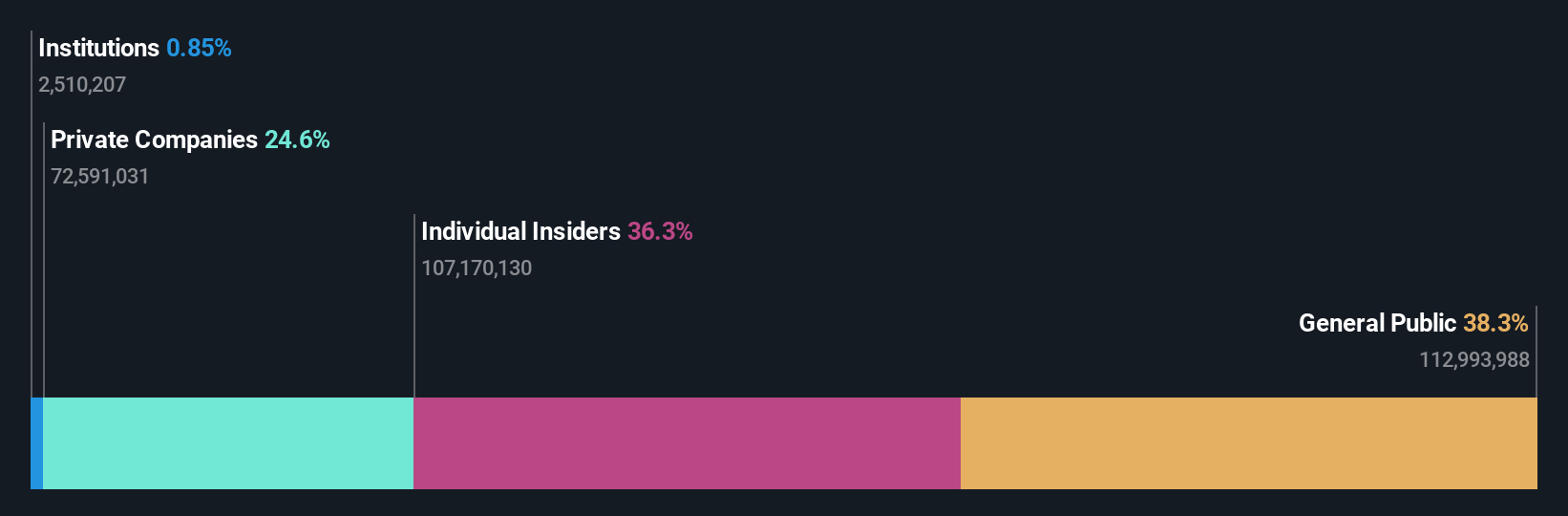

Insider Ownership: 36.4%

Return On Equity Forecast: 50% (2028 estimate)

Magnetic Resources has high insider ownership, contributing to its growth potential despite recent financial challenges. The company reported a net loss of A$14.22 million for the full year ended June 30, 2025, with revenue declining to A$0.20 million. However, it is forecasted to achieve profitability within three years and boasts an impressive expected return on equity of 50.1% by then. Recently added to the S&P/ASX Emerging Companies Index, Magnetic Resources remains a stock to watch for future performance improvements.

- Get an in-depth perspective on Magnetic Resources' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Magnetic Resources' current price could be inflated.

Meeka Metals (ASX:MEK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Meeka Metals Limited is involved in the exploration and development of gold properties in Western Australia, with a market cap of A$745.19 million.

Operations: The company's revenue segment includes exploration activities, generating A$0.33 million.

Insider Ownership: 11.9%

Return On Equity Forecast: 27% (2028 estimate)

Meeka Metals, with substantial insider ownership, is positioned for significant growth despite current financial setbacks. The company reported a net loss of A$4.24 million for the year ended June 30, 2025, but it is expected to achieve profitability within three years and has a high forecasted revenue growth rate of 43.7% annually. Recently added to the S&P Global BMI Index, Meeka Metals remains undervalued at 77.6% below its estimated fair value and anticipates strong future performance with a projected return on equity of 27.4%.

- Delve into the full analysis future growth report here for a deeper understanding of Meeka Metals.

- Insights from our recent valuation report point to the potential overvaluation of Meeka Metals shares in the market.

Next Steps

- Access the full spectrum of 111 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报